- Solana processes far more daily transactions than Ethereum L1 and L2 combined, driven by ultra-low fees.

- Massive usage doesn’t translate into equally massive protocol revenue, highlighting a value-capture gap.

- Whale deposits into exchanges and realized losses add sell pressure as SOL trades in a fragile zone.

Solana’s story right now isn’t really about price. It’s about sheer usage.

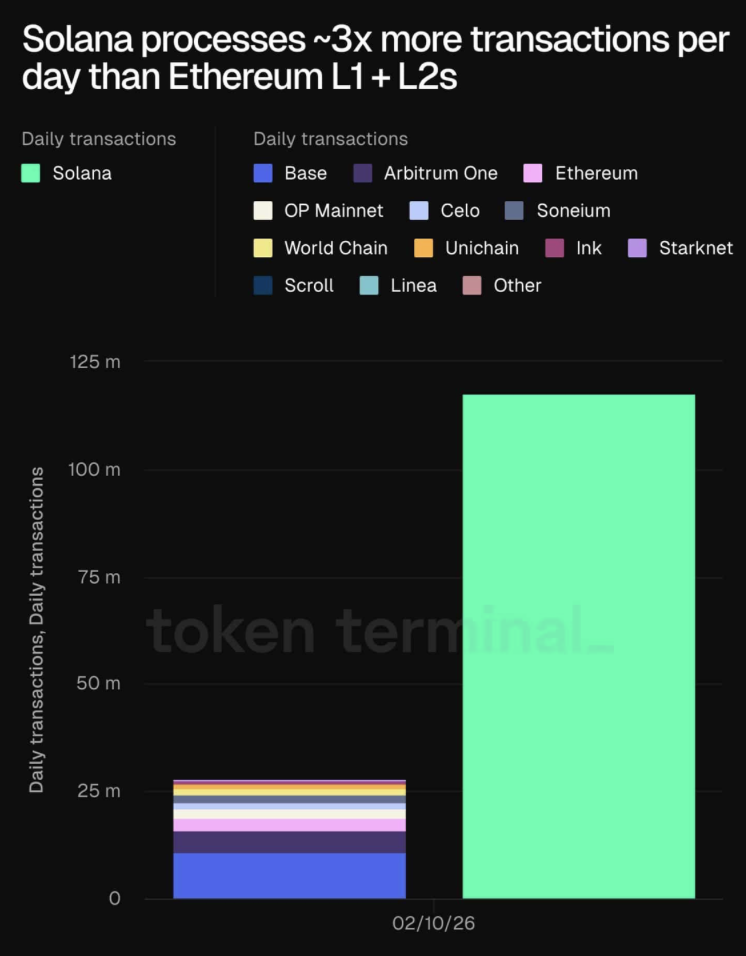

While traders keep debating where SOL is heading next, the network itself is doing something pretty wild: it’s processing more daily transactions than almost everything else in crypto put together. According to TokenTerminal data, Solana is handling roughly three times more daily transactions than Ethereum’s Layer 1 plus all of its Layer 2 networks combined. That’s not a small lead. That’s Solana basically planting a flag and saying, “this is what high-throughput looks like.”

Solana Is Winning on Raw Throughput, Not Hype

The numbers explain why the Solana narrative keeps surviving, even through drawdowns.

Solana is sitting around 285 million daily transactions, with reported throughput around 3,300 transactions per second. That’s the kind of scale Ethereum still can’t touch on L1. And it’s made possible by the same two things Solana has always leaned on: fast execution and ultra-low fees.

That structure naturally attracts activity. You can trade, swap, mint, and move funds around without thinking too hard about cost. As a result, user engagement has climbed too, with around 2.6 million active addresses. That level of participation keeps Solana attractive for DeFi trading, payment-style use cases, and anything high-frequency where speed matters.

But the catch is that not all transactions are equal. A chunk of Solana’s volume comes from vote transactions, which inflate totals. Real “user TPS” is lower than the headline number. And the network still has reliability questions, with success rates often hovering around 40–50% in congested periods, partly because of bot activity.

So yes, Solana leads on throughput. But the network still has to prove it can keep that speed while staying consistent, because reliability is what turns a fast chain into a long-term settlement layer.

Solana’s Usage Doesn’t Fully Convert Into Value

Here’s where the story gets more complicated.

Even though Solana dominates in transactions, it doesn’t capture value the way you might expect. The chain processes around 86 million non-vote transactions per day, yet only generates roughly $622,000 in chain fees. That’s a weird gap if you’re thinking in traditional network-effect terms.

Compare that to Tron. Tron reportedly generates around $948,000 daily in fees, despite far lower overall activity, because stablecoin transfers drive steadier fee generation. Solana’s fees are almost too cheap. Transactions averaging around $0.003–$0.007 make it incredibly scalable, but they also suppress how much value the base protocol captures.

In other words, Solana is built for volume, not toll collection.

The value, instead, shifts upward into the application layer. Solana records about $7.57 million in total fees paid, including roughly $6.66 million from apps. That’s where the real economic activity is showing up.

Ethereum, though, still dominates in monetization. It generates around $18 million in total fees and $11.7 million in app revenue, and it captures more protocol-level value through burns and MEV. That structural difference matters, because it highlights the core tradeoff: Solana can execute more, but Ethereum extracts more.

Solana is winning the speed race. Ethereum is winning the value capture race. That’s the cleanest way to frame it.

Whale Activity Is Adding a New Layer of Pressure

Even with execution dominance, economic weaknesses can still translate into volatility. And right now, whale behavior is not exactly calming anyone down.

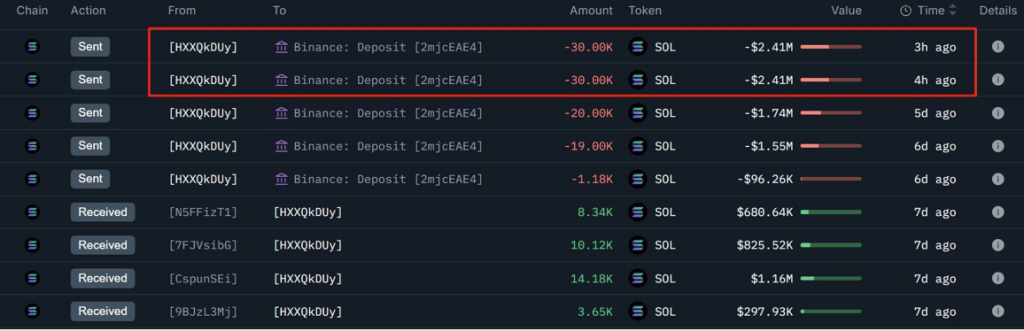

One wallet recently deposited 60,000 SOL (worth roughly $4.42 million) into Binance through staged transfers. Two deposits of 30,000 SOL alone totaled about $4.82 million within hours. Before that, smaller tranches — 20,000 SOL, 19,900 SOL, and 1,180 SOL — pushed cumulative exchange inflows above 100,000 SOL.

This matters because the deposits followed an earlier withdrawal of 111,945 SOL, originally valued around $17.16 million, which had been allocated for staking. The return flow realized roughly $9.78 million, locking in a loss of about $7.38 million, or around 43%.

That kind of slow, phased depositing pattern is often done to reduce slippage during liquidation. It doesn’t automatically mean a full sell-off is happening, but it does suggest the wallet is de-risking.

And when whales are willing to realize losses at that scale, it tends to reinforce defensive sentiment in the market, especially while SOL is still trading near post-drawdown ranges.

Final Thoughts

Solana’s dominance is real, but it’s also messy.

On one hand, the chain is processing mind-blowing transaction volume and pulling in millions of active users. That kind of throughput accelerates ecosystem adoption, boosts liquidity velocity, and keeps Solana positioned as the “execution layer” narrative leader.

On the other hand, the network still has reliability friction, and the economics aren’t as clean as the transaction counts suggest. Fees are so low that protocol value capture lags behind chains like Ethereum, and even Tron shows stronger monetization in certain categories.

Solana is proving it can move fast. The next phase is proving it can do it reliably, and profitably, without breaking when demand spikes.