- Bitcoin is rising despite spot volumes sitting near year-long lows.

- Thin liquidity exaggerates price moves but also reveals real positioning.

- Institutions appear to be preparing ahead of liquidity returning, not waiting for it.

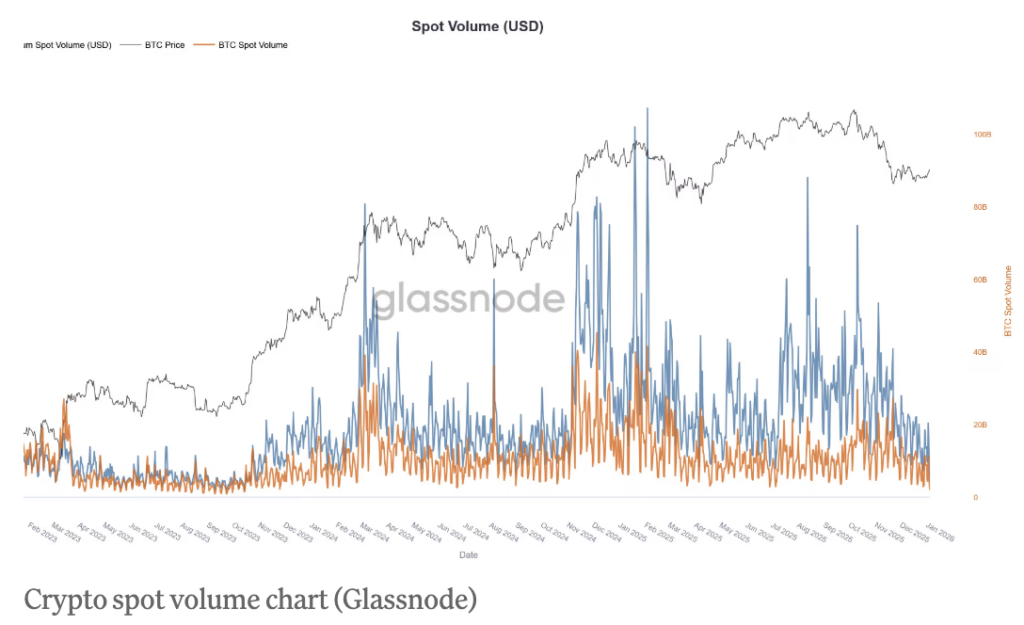

Bitcoin pushing toward the $94,000 level looks strong at first glance, but the structure underneath tells a more complicated story. Spot trading volumes across Bitcoin and most altcoins are sitting near their lowest levels since late 2023, according to Glassnode. In a textbook market, price strength is confirmed by expanding volume. That confirmation simply isn’t there right now. This rally is happening in shallow water, where liquidity is scarce and every step matters.

Thin Liquidity Changes How Price Moves

After the massive $19 billion liquidation event in October, market depth never fully recovered. Order books stayed thin, and many market makers reduced exposure instead of stepping back in. In that kind of environment, relatively modest flows can push price far more than usual. Moves get exaggerated on both sides. That fragility is real, but it also exposes something important — weak hands can’t move size here without paying a steep cost.

Why Low Volume Isn’t Automatically Bearish

This is where surface-level analysis often falls apart. Institutions don’t wait for perfect conditions or clean charts. They position when liquidity is uncomfortable and participation feels thin. Spot ETF inflows picking up, combined with firms like Morgan Stanley filing for a Bitcoin trust, suggest large players aren’t paralyzed by low volume. They’re preparing ahead of the moment when depth returns and attention follows price.

Volatility Is the Price of Positioning

Thin books make price action feel unstable, but that instability cuts both ways. With little standing in the order book, even moderate demand can move the market sharply. That’s often how aggressive upside moves form — not through euphoria, but through absence of resistance. When liquidity is limited, the path of least resistance can change quickly.

What This Fragility Really Means

Yes, this rally looks fragile, because it is. Low spot volume and shallow depth mean Bitcoin can snap in either direction. But fragility doesn’t equal lack of conviction. More often, it signals quiet positioning before broader participation returns. When liquidity finally improves, price discovery may get uncomfortable again — just not necessarily in the direction most expect.