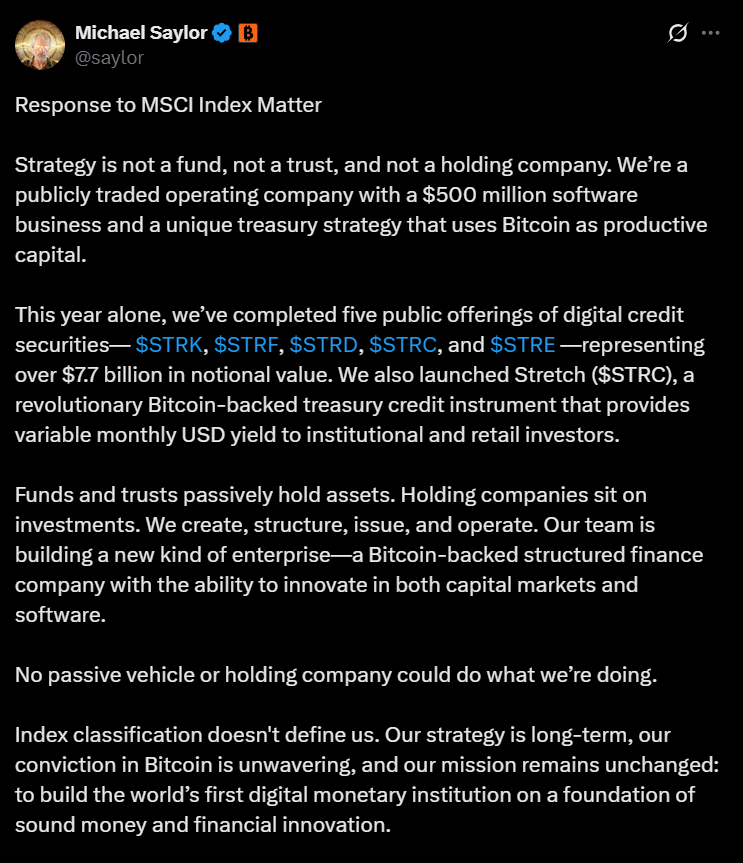

- Saylor says MSCI classifications miss MicroStrategy’s true role as a Bitcoin-backed structured finance company.

- MicroStrategy has issued over $7B in BTC-backed credit products, far beyond simple BTC holding.

- At current BTC prices, MicroStrategy can fund 71 years of dividends; a 1.41% annual BTC rise fully covers payouts.

Michael Saylor is, once again, reshaping the narrative around MicroStrategy. In a new response to the MSCI index classification, Saylor argued that traditional sector labels fail to capture what MicroStrategy has actually become.

He insists the company is not a passive Bitcoin holding vehicle, nor is it a fund. Instead, he calls MicroStrategy an operating software firm that actively uses Bitcoin as productive capital, powered through a growing suite of structured BTC-backed financial products. This pushback arrives while investor demand for Bitcoin credit instruments is skyrocketing across both Wall Street and the broader digital asset market.

A Software Company Using Bitcoin as Productive Capital

While MicroStrategy still runs a software business generating hundreds of millions annually, Saylor says the company’s operational base is what allows it to use its massive BTC treasury creatively — not passively.

Over the past year alone, MicroStrategy issued five Bitcoin-backed credit instruments with over $7 billion in notional value. These include products like Stretch, a BTC-backed credit note that pays monthly dollar-denominated yield to retail and institutional buyers.

The strategy blends familiar traditional finance structures with Bitcoin reserves, letting MicroStrategy offer yield-bearing credit notes instead of simply sitting on BTC. Saylor says this model makes MicroStrategy more like a Bitcoin-backed structured finance company than a traditional software firm or ETF-style holding entity.

MicroStrategy’s Bitcoin Treasury Strategy Looks Even Stronger

On November 20, MicroStrategy emphasized just how robust its BTC-driven financial model has become. At current Bitcoin prices, the company says it has enough treasury coverage to support 71 years of dividends even if BTC never moves. Even more striking, the company said Bitcoin only needs to appreciate 1.41% per year to fully offset all dividend obligations.

This shows MicroStrategy sees Bitcoin not only as long-term digital gold, but as a productive revenue engine capable of sustaining shareholder returns well into the future.