- Ethereum buyers continue defending the $3,150 accumulation zone, with 2.53M ETH held in this range and steady absorption signaling strong demand.

- Exchange Reserves dropped 9.75% and spot outflows hit $50.9M, reinforcing a bullish accumulation trend as supply leaves exchanges.

- Binance top traders sit 73% long, aligning with on-chain strength and supporting the case for a breakout toward $3,659 if ETH exits the descending channel.

Ethereum slipped all the way down to about $3,155 after a sharp 10% daily drop, but interestingly… buyers haven’t flinched. Instead, they keep stepping in around the $3,097–$3,200 accumulation zone, almost like this area has become a line in the sand for both retail and whales. And honestly, it kind of has.

The cost-basis heatmap shows nearly 2.53 million ETH sitting right inside this range, making it one of the strongest demand pockets on the chart. Each time ETH drops toward this zone, you can literally see traders absorbing sell pressure almost instantly — a behavior that usually only shows up during high-conviction accumulation phases.

All of this signals something simple but important: people aren’t panic-selling at these levels. They’re buying quietly, waiting for a reaction, maybe even a breakout, once the market finally gets its footing again.

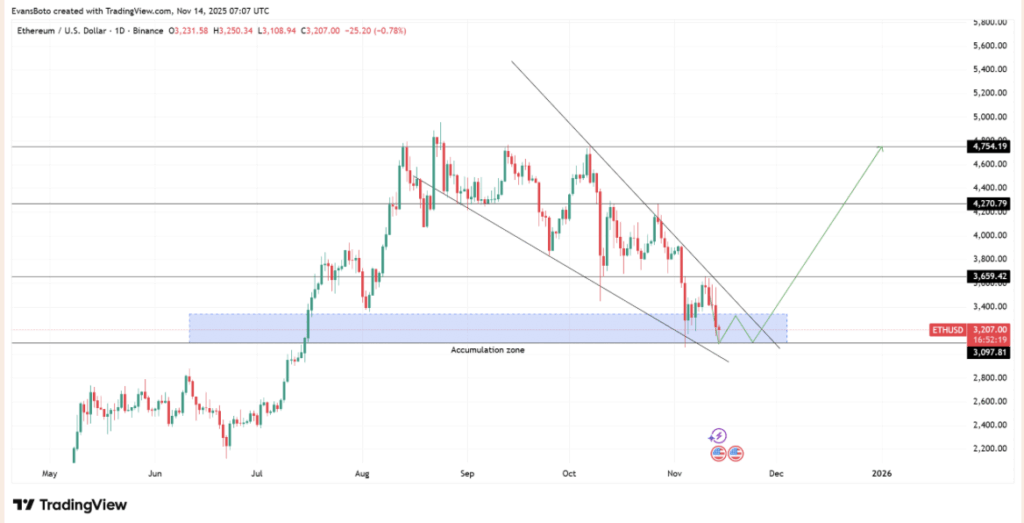

Ethereum Coils Inside a Descending Channel — But Buyers Keep Catching the Floor

ETH has been stuck in a downward-sloping channel for a while now, but the interesting part is where the channel’s lower boundary lands — right on top of the major accumulation area. Every time price approaches the channel floor, buyers hit the gas pedal.

This combination of structural support + historical demand is basically a dream setup for high-conviction traders. And the chart even shows a projected breakout path, with $3,659 showing up as the first obvious upside target if ETH manages to break out cleanly.

And it’s not some random guess — previous channel breakouts have triggered strong rallies before. Traders will be watching closely for the one thing ETH still needs: rising volume to fuel a real breakout attempt.

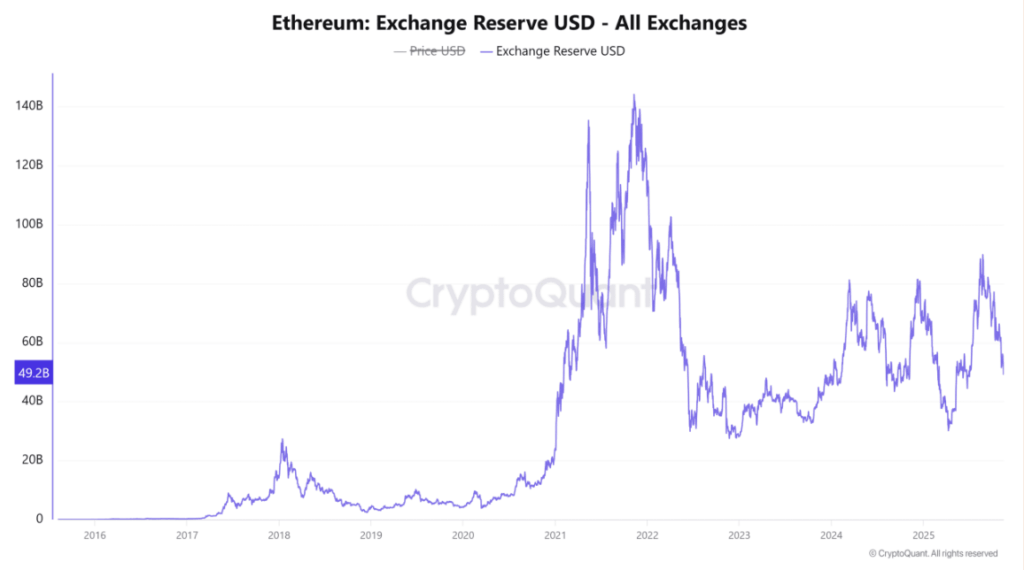

Exchange Reserves Are Dropping Hard — And That’s Usually Bullish

Now here’s where things really start stacking together…

Exchange Reserves (in USD) have dropped a massive 9.75%, signaling a sharp reduction in ETH held on trading platforms. When traders expect lower prices, they send coins to exchanges. When they expect higher prices, they pull them out.

Right now? ETH is leaving exchanges fast.

This kind of behavior usually shows up during accumulation phases — and it amplifies upward pressure because less supply means every buy order hits harder. The fact that this trend lines up perfectly with the defense of the $3,150 area strengthens the entire bullish argument.

Spot Outflows Hit $50.9M — Another Strong Accumulation Signal

Spot flow data shows another bullish sign: a massive $50.91 million outflow in a single session. The chart is literally filled with red bars — consistent outflows — which suggest that sellers are losing momentum while buyers keep scooping up supply.

This pattern is extremely similar to past moments right before Ethereum recovered sharply. The timing, combined with the drop in reserves, paints a clear picture: the market is positioning for a rebound instead of a breakdown.

Top Traders Are Leaning Heavily Long — 73.16% Long vs. 26.84% Short

Over on Binance, the “top-trader” data shows a huge long bias: 73.16% long exposure compared to just 26.84% short.

This matters a lot because these traders usually adjust their exposure before the average trader notices anything. When they load up on longs near a major demand zone, it’s typically a signal that they expect a bounce, maybe even a trend shift.

This long-heavy positioning perfectly matches everything else we’re seeing: shrinking exchange reserves, strong spot outflows, and a defended accumulation zone.

Final Thoughts

Ethereum is flashing strength across several critical metrics — accumulation zones holding firm, exchange reserves dropping, spot outflows increasing, and derivatives traders flipping aggressively long.

Buyers are clearly defending the $3,150 zone with confidence, and if ETH breaks out of the descending channel, the path toward $3,659 and higher becomes very realistic.

For now, the market still needs that clean breakout. But the foundation is undeniably bullish, and the pressure building under the surface looks like it’s only getting stronger.