- UNI has surged over 30% in a day and more than 68% on the week, making it one of the strongest performers among major cryptocurrencies.

- A new governance proposal from founder Hayden Adams, including routing fees to burns and a 100M UNI treasury burn, has sharply boosted investor sentiment.

- UNI’s rally could face a correction in a shaky market, but a stronger Bitcoin uptrend and improving macro backdrop may help it sustain higher levels.

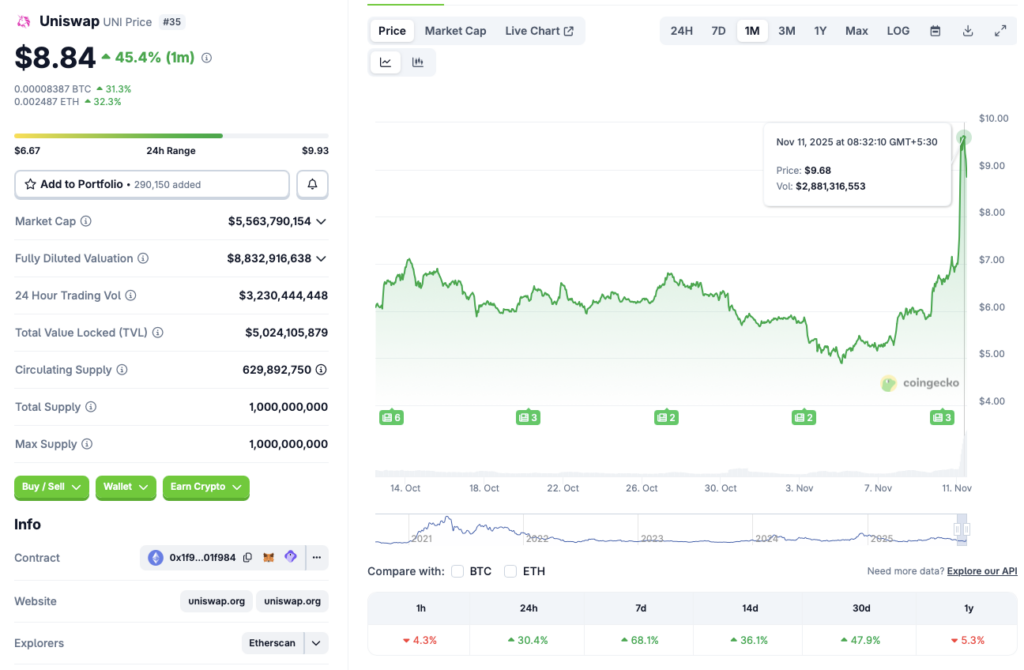

Uniswap (UNI) is dominating the large-cap crypto leaderboard right now. While most of the top coins are stuck in consolidation, UNI is ripping higher across every major short-term timeframe. According to CoinGecko data, UNI has surged about 30.45% in the daily charts, 68.1% on the weekly, 36.1% over 14 days, and 47.9% over the last month.

UNI is now trading at its highest level in nearly two months, even though it’s still down around 5.3% compared to November 2024. That combination of strong near-term momentum with some longer-term recovery room is exactly the kind of setup that tends to pull in aggressive traders and fresh capital.

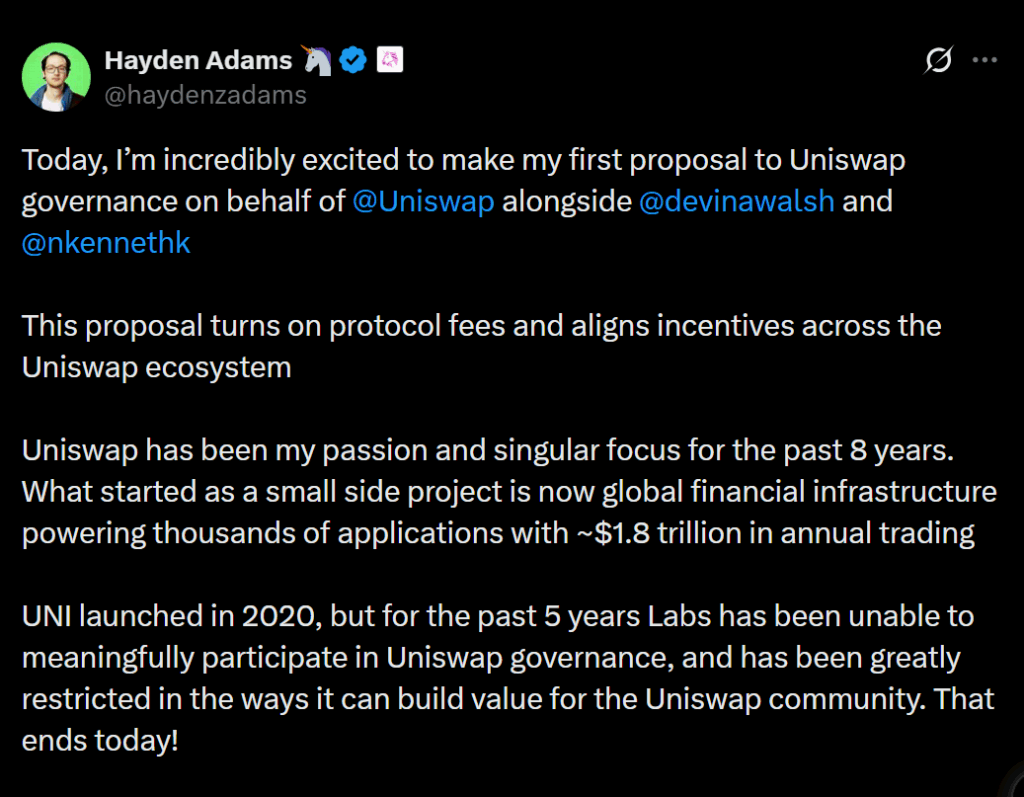

Hayden Adams’ Proposal Sparks Supply Shock Hopes

The main catalyst behind this latest move comes straight from Uniswap’s founder and CEO, Hayden Adams. In his first-ever proposal to Uniswap governance, announced on X, Adams laid out a set of changes designed to tighten UNI’s token economics and push more value back into the protocol.

The proposal aims to route network fees to burn UNI tokens and direct Unichain sequencer fees toward additional UNI burns. On top of that, it calls for burning 100 million UNI tokens from the treasury, a huge potential supply reduction if approved. The plan would also introduce Protocol Fee Discount Auctions, a mechanism meant to improve liquidity pool outcomes and internalize more MEV to the protocol rather than letting external actors capture it.

All of this is wrapped in a broader push to drive protocol growth and adoption. But from a market psychology standpoint, the headline is simple enough: less supply, more alignment between protocol usage and token value. That alone is likely a big reason sentiment flipped so hard in UNI’s favor.

Can UNI Hold Its Gains in a Fragile Market?

Despite UNI’s explosive move, the wider crypto market is still in a consolidating, slightly cautious posture. Bitcoin and other majors are mostly moving sideways, even after the U.S. government shutdown ended and the Federal Reserve delivered another 25-basis-point rate cut. Those two developments could eventually support a broader risk-on move, but it hasn’t fully arrived yet.

That leaves UNI in an interesting spot. On one hand, it has a clear fundamental catalyst, strong near-term momentum, and renewed attention from both DeFi natives and general traders. On the other hand, if the overall market turns lower again or risk appetite fades, UNI could easily see a sharp correction as traders lock in profits from this run.

If Bitcoin does kick into a more convincing uptrend over the next few weeks, UNI has a real shot at extending its outperformance, especially if Hayden Adams’ proposal advances smoothly through governance. But even in that bullish scenario, some pullbacks along the way are almost guaranteed after a move this fast.