- Bitcoin broke below $105K, falling nearly 6% in 24 hours.

- Support sits at $104,500—a break lower could open $103K–$100K.

- Profit-taking and macro headwinds are driving the selloff as traders eye the next move.

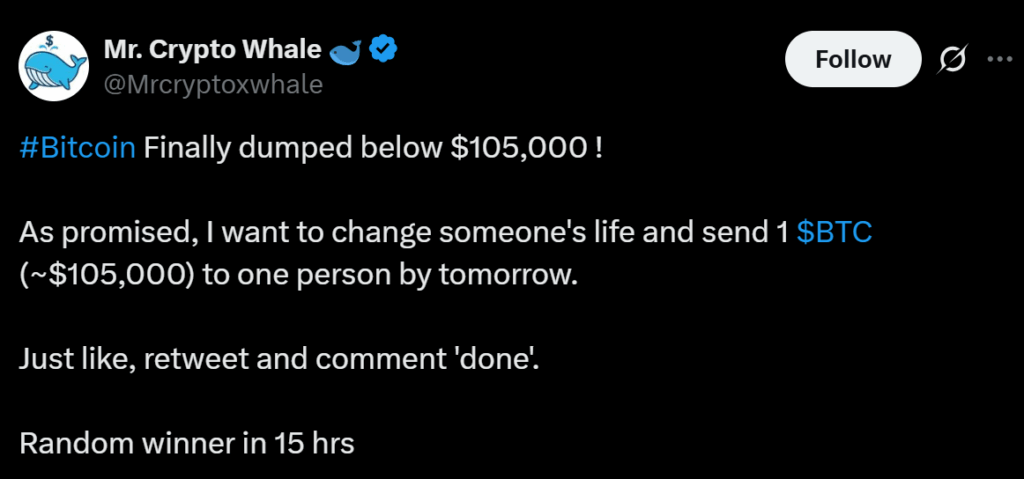

Bitcoin has officially slipped under the $105,000 mark, grabbing the market’s full attention as traders brace for what could be a volatile weekend ahead. While a viral giveaway post stirred social media hype, the real story lies in the charts—and the signals are flashing caution.

What the Chart Reveals

After peaking near $109,240, Bitcoin fell almost 6% within 24 hours, bottoming at $104,505. It’s now trading below three crucial moving averages—the 7-day, 25-day, and 99-day—a clear sign that sellers are steering momentum. Immediate resistance has formed between $106,700 and $108,900, while support sits near $104,500. A clean break below that could drag BTC toward $103,000, with $100,000 standing as the final major line of defense.

Why Bitcoin Is Dropping

The selloff follows a mix of profit-taking, macro pressure, and rising volatility. After flirting with $110K, traders began locking in gains amid a stronger U.S. dollar and higher bond yields. The broader risk-off mood across global markets added more weight, while social buzz and giveaway speculation fueled short-term chaos.

The Road Ahead

This breakdown below $105K isn’t just a dip—it’s a key test of conviction. If buyers defend the $104,500 zone, a rebound toward $107,500 is still possible. But if that fails, BTC momentum could accelerate toward the psychological $100K mark. With volatility tightening and sentiment on edge, discipline and timing matter more than ever.