- ASTER debuts on Robinhood, expanding access to millions of retail traders.

- Price drops 10% in 24 hours, with indicators showing short-term consolidation.

- Analysts see the listing as a bullish long-term milestone despite market weakness.

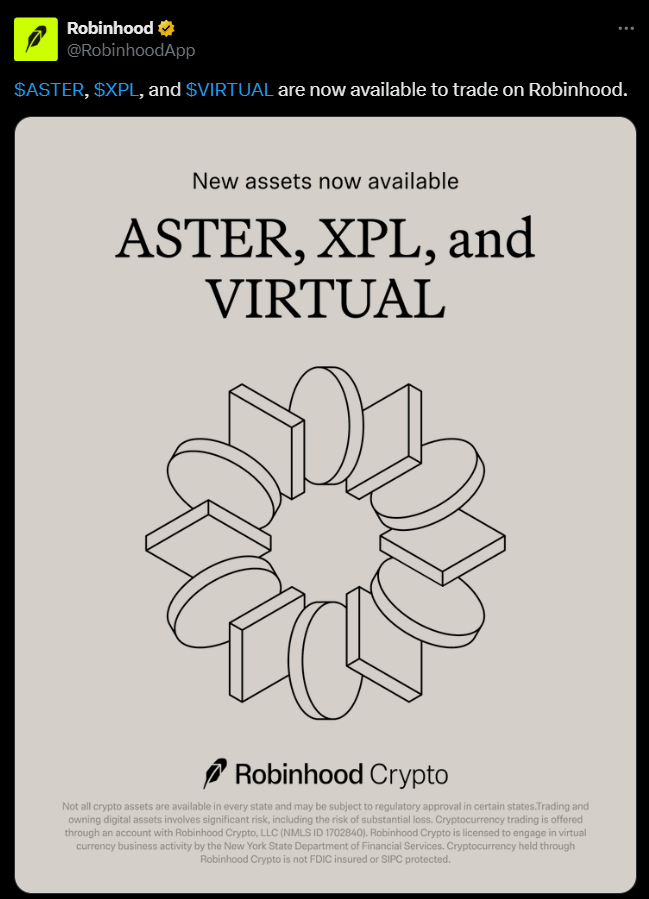

The ASTER token has officially launched on Robinhood, marking a major milestone for the rapidly growing blockchain project. The listing, first confirmed by crypto analyst Crypto Tony on X, now opens the door for millions of new retail investors across the United States. Yet despite the fanfare, ASTER’s price reaction has been unexpectedly weak — the token is trading around $1.30, down 10% in the last 24 hours and nearly 27% over the past week, giving it a market cap of about $2.62 billion.

Technicals Suggest Caution Amid Profit-Taking

On the technical side, ASTER’s short-term momentum appears muted. The RSI sits near 42, showing the asset is neither oversold nor signaling a clear rebound. Meanwhile, the MACD lines hover near a neutral crossover, pointing to a potential consolidation phase before any decisive move. Analysts suggest the current weakness may stem from profit-taking after prior volatility, a common trend for newly listed tokens on major platforms like Robinhood.

Broader Market Mood Dampens Reaction

The crypto market’s fragile sentiment may also be weighing on ASTER’s launch performance. Broader market pullbacks have limited upside moves, with traders favoring risk reduction amid uncertainty. Still, history shows that tokens newly added to Robinhood often see delayed rallies as liquidity builds and retail participation grows. Once broader sentiment improves, ASTER could benefit from its expanded visibility and accessibility to retail investors.

Long-Term Signal Remains Strong

Despite the near-term volatility, analysts agree the Robinhood listing legitimizes ASTER’s position in the market. It offers easier access for U.S. users and strengthens the token’s foothold among mainstream investors. As the project gains exposure and awareness increases, this milestone could lay the groundwork for a longer-term rally once stability returns to crypto markets.