- XRP’s Open Interest halved to $4.1B while leverage hit yearly lows, signaling market deleveraging.

- Whale inflows to exchanges are easing, hinting at reduced sell pressure.

- For recovery, XRP must reclaim $3.1 — and a Bitcoin rally above $117K would likely fuel it.

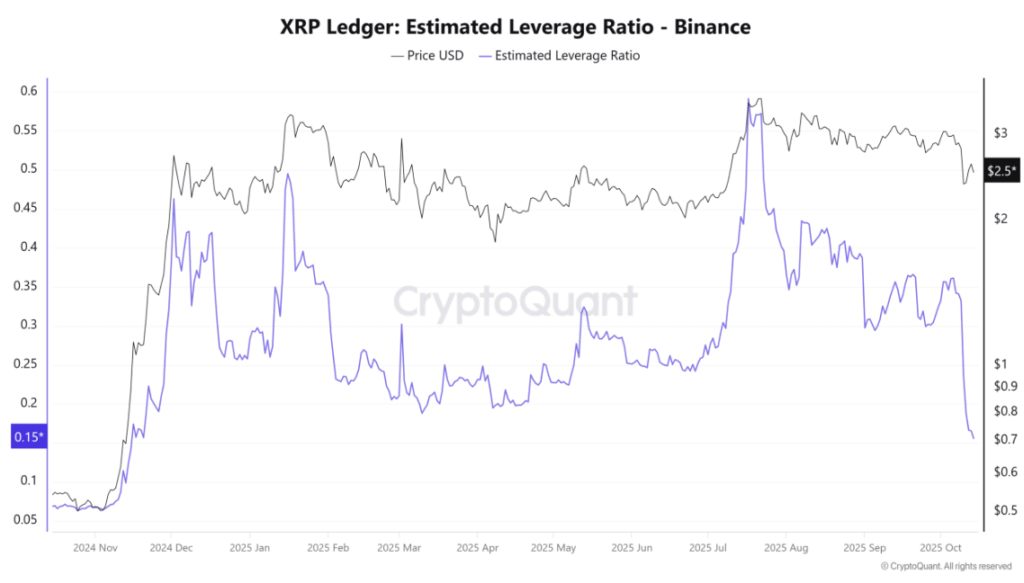

XRP just saw one of its sharpest leverage resets of the year, and traders are scrambling to make sense of what’s next. The asset’s Open Interest dropped to just above $4 billion, while its Estimated Leverage Ratio (ELR) sank to the lowest point of 2025. It’s a clear sign that the market has been flushed — but maybe that’s exactly what it needed.

After a brutal liquidation wave on October 11, XRP long positions worth roughly $610 million were wiped out in hours. The fallout was massive, dragging the ELR down to 0.155 with XRP trading near $2.5 — a far cry from its July level of 0.59 when the token sat at $3.41. Analysts say this marks a “healthy reset,” removing over-leveraged positions and setting the stage for potential stability.

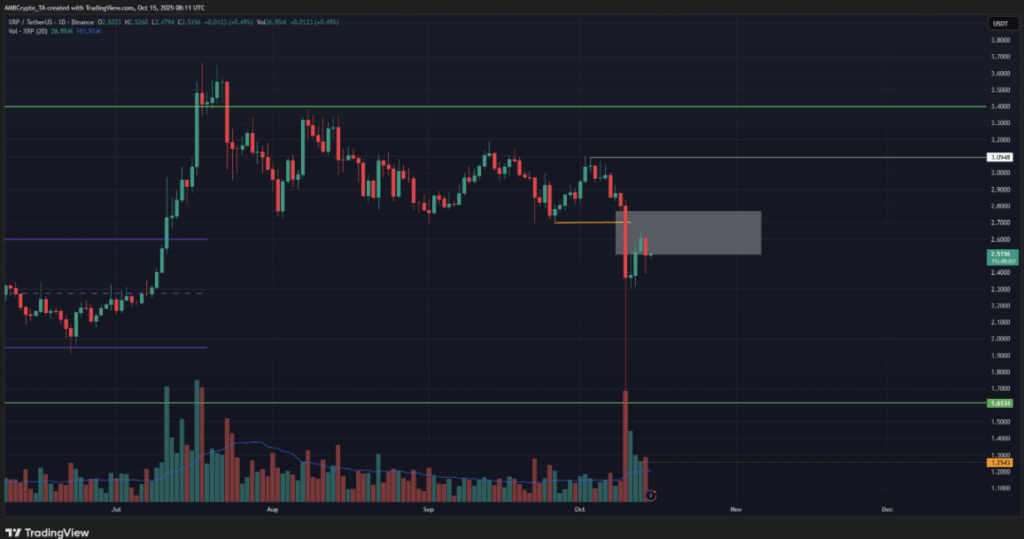

Traders Eye $3.1 as the Make-or-Break Zone

Despite the chaos, some metrics hint that things could turn around soon. The $3.1–$3.2 range now acts as a critical supply zone, and a break above that could confirm fresh bullish momentum. Open Interest, though halved in the past week, shows traders are still cautious — it stood at $4.14 billion, down from $8.47 billion on October 9, according to CoinGlass.

Market sentiment remains shaky, but analysts agree on one thing: for XRP to stage a convincing comeback, Bitcoin needs to reclaim $117K and reignite broader confidence across altcoins. Until then, XRP holders are stuck waiting for direction.

Whale Selling Pressure Eases — Finally

October has been rough for XRP whales, too. CryptoQuant data shows large holders sent a surge of tokens to exchanges earlier this month, sparking a cascade of selling pressure. However, in the last few days, whale inflows have begun trending downward, suggesting the worst might be over.

If the decline in whale activity continues, it could signal that heavy selling has run its course. That would give bulls a shot at pushing the price back toward the psychological $3 mark, where confidence could start to rebuild.

Spot Traders Stay Cautious for Now

The Taker Buy/Sell Ratio has stayed below 1 for most of the month — a clear sign that sellers still dominate the order books. Spot demand remains low, and until this ratio flips positive, the market is likely to stay in consolidation mode.

From a chart perspective, XRP remains technically fragile. The daily chart shows a bearish structure, with a recent high near $3.09 acting as key resistance. Bulls will need to flip this level and reclaim the $2.77–$3.00 zone to shift the market bias. Otherwise, short-term rallies might get sold off quickly.

Swing traders, for now, are playing it safe. A clear sign of renewed demand, easing whale inflows, and a rebound in Open Interest could confirm the start of a true recovery phase — but until then, patience is the name of the game.