- Ethereum forms a rising wedge near $4,250, signaling a possible breakout or breakdown.

- Exchange supply ratio falls to 0.33, showing strong on-chain accumulation.

- A break above $4.3K could launch ETH toward $4.7K, while failure risks a pullback to $3.8K–$3.4K.

Ethereum’s price structure is tightening again, hinting at a potentially explosive move in either direction. On the 4-hour chart, ETH is forming a rising wedge pattern following its sharp V-shaped rebound from the $3,400 low. The asset now trades close to the 0.618 Fibonacci retracement level around $4,250, an area overlapping with its former breakdown zone ($4,200–$4,300) — a key decision point that could define Ethereum’s short-term trend.

Key Levels to Watch: $4.3K or $3.8K Next

If Ethereum breaks above $4,300, it would invalidate the bearish wedge and confirm a bullish continuation toward $4,450–$4,700, aligning with the next daily supply region. However, a breakdown below the wedge could trigger renewed weakness, potentially dragging ETH back toward the $3,800–$3,400 demand zone.

Momentum remains cautiously constructive, but volatility has compressed sharply inside the wedge — often a precursor to a major breakout. Traders are watching closely for confirmation as Ethereum hovers near this inflection point.

On-Chain Data Hints at Strong Accumulation

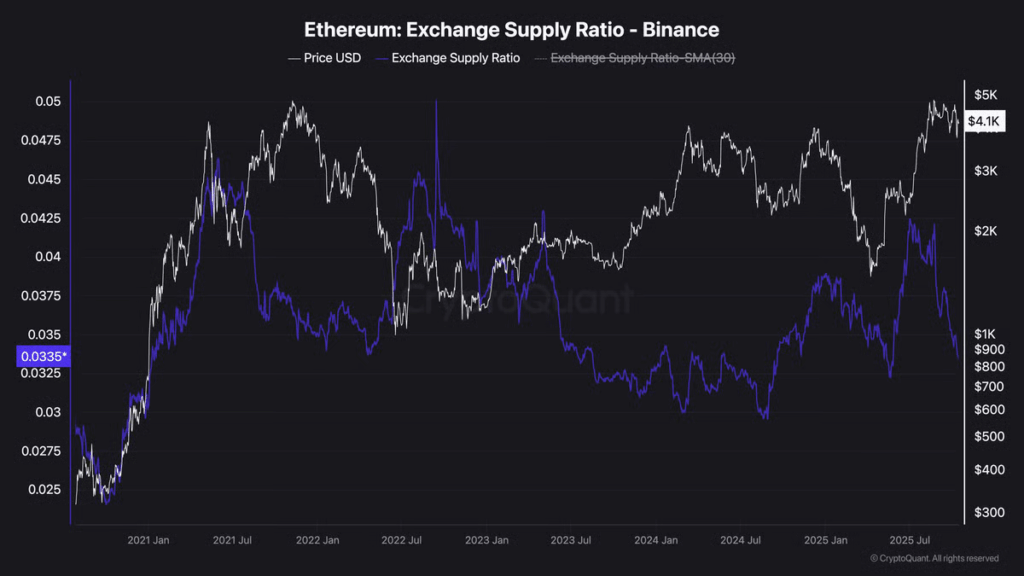

According to on-chain metrics from Binance, Ethereum’s exchange supply ratio has dropped to 0.33, nearing its lowest level since May 2025. This decline follows a short-lived increase in exchange balances during ETH’s stabilization around the $4K range.

The drop indicates that holders are withdrawing ETH into self-custody and cold wallets, signaling reduced selling pressure and strengthening conviction among investors. Such behavior typically reflects accumulation, especially when both retail and institutional participants show consistent withdrawals.

Fewer coins on exchanges mean lower immediate liquidity, which can amplify upside moves if demand accelerates. This trend reinforces the view that Ethereum’s current rebound is not purely technical but supported by genuine on-chain demand.

Outlook: Breakout Could Spark a Sustained Rally

If Ethereum successfully breaks above $4,300, it would confirm both a technical breakout and an on-chain shift toward accumulation, setting the stage for a mid-term rally. With liquidity tightening and supply leaving exchanges, ETH could see renewed upside momentum supported by improving fundamentals.

Until then, traders remain on edge as Ethereum’s wedge formation approaches its breaking point — a decisive move in either direction now looks imminent.