- Binance denies claims it profits from listings, calling them “false and defamatory.”

- The exchange launches a $400 million “Together Initiative” to support affected users and institutions.

- Legal action may follow against those spreading misleading accusations about Binance’s listing practices.

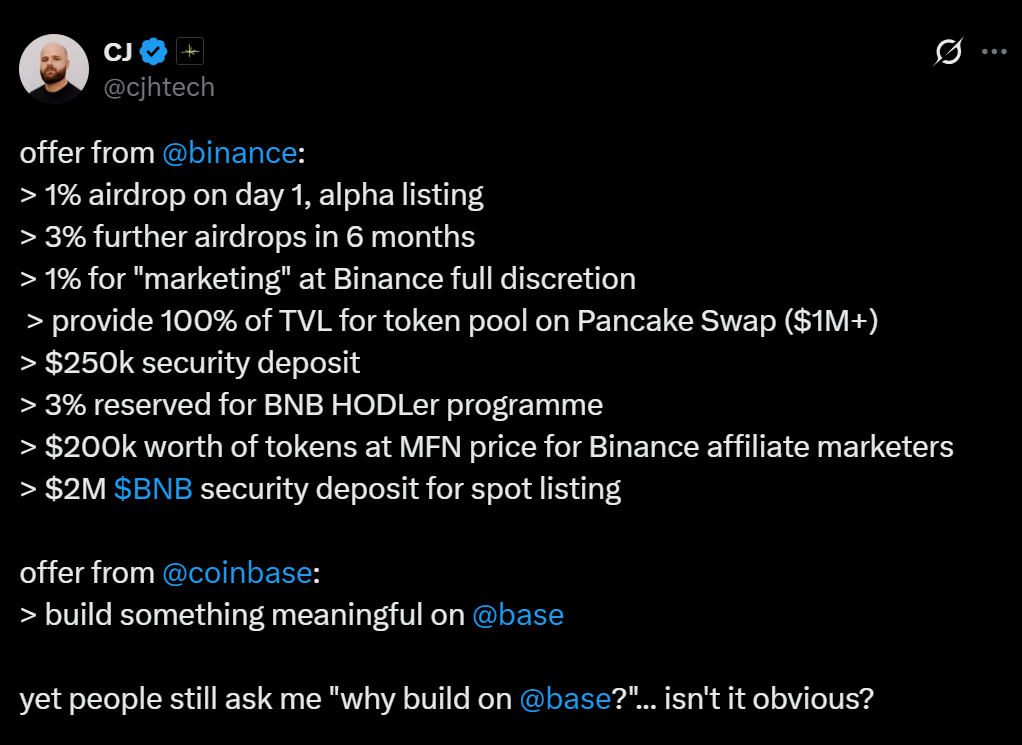

Binance has issued a sharp response to accusations that it profits from token listings, labeling the claims as “false, defamatory, and misleading.” The exchange clarified that it does not charge fees or take token allocations in exchange for listings, directly refuting posts made on X by Limitless Labs CEO CJ Hetherington on October 14, 2025.

Binance Pushes Back Against “Defamatory” Allegations

In a statement posted through Binance Customer Support’s official X account, the company said the allegations circulating online were designed to “attack the integrity of Binance’s listing process.” Hetherington had claimed that Binance demanded 8% of his project’s token supply, along with deposits in fiat and cryptocurrency — a claim echoed by 6MV founder Mike Dudas, who said he had seen similar proposals recently.

A Binance Square user under the name 韭菜不红Leek added that projects were allegedly asked to allocate 8% of tokens for community activities like airdrops. Binance denied these accounts, stating it does not profit from listings, and that all deposits made by projects are fully refundable within 1–2 years. The company also denied any allegations that its executives dumped project tokens.

Representatives described the accusations as “illegal and unauthorized disclosures of confidential correspondence” and said Binance reserves the right to take legal action against those spreading false information.

$400 Million “Together Initiative” Announced After Market Turmoil

Amid the controversy, Binance also announced a $400 million user recovery and support program known as the “Together Initiative.” This comes in response to the October 11 market crash, which caused a wave of forced liquidations.

The initiative includes $300 million in token vouchers for retail users who lost over $50 and at least 30% of their net assets during the event. Eligible users will receive compensation within 96 hours through Binance’s Rewards Hub.

Additionally, a $100 million low-interest loan fund will be made available to institutional users and ecosystem partners, aimed at restoring liquidity and stabilizing operations. Binance stressed that these payments do not imply liability for user losses but are part of its broader effort to rebuild industry confidence.

Binance’s Broader Response

The allegations and compensation program come as Binance faces scrutiny after the $19 billion liquidation cascade earlier this month. Despite market volatility and criticism, the exchange continues to emphasize user protection and transparency, positioning itself as a stabilizing force in a shaken crypto market.

Binance’s latest move follows its launch of Meme Rush — Binance Wallet Exclusive, a new early-access platform for meme tokens announced on October 9, signaling the exchange’s continued push for ecosystem engagement despite turbulent conditions.