- XRP trades near $2.50, defending key long-term support.

- Analysts see a 57% chance of an upward breakout toward $9.50–$27.

- Holding above $2.50–$2.70 could confirm a bullish reversal for the next cycle.

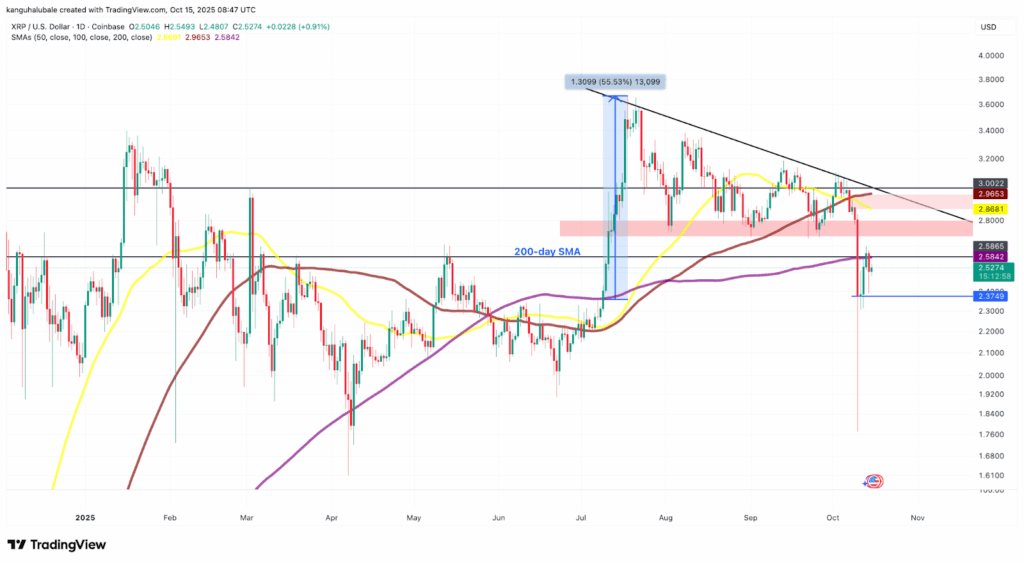

XRP is holding steady around the $2.50 level after a sharp correction from its July highs near $3.66, leaving traders wondering whether the next major breakout is around the corner. The asset is down over 31% from its peak and 12.5% in the past week, but analysts remain optimistic that XRP could stage a strong rebound if it holds above key technical levels.

XRP Needs to Reclaim Its 200-Day Moving Average

For XRP to confirm a recovery, it must reclaim the 200-day simple moving average (SMA) at $2.58 and turn the $2.70–$2.80 resistance zone into support. Technical traders point out that similar conditions preceded major rallies earlier this year, suggesting a bullish continuation is possible.

A decisive close above the 20-day EMA at $2.72 would be the first sign of renewed momentum, potentially paving the way for a move beyond $3.00. Analysts note that a flip of these levels into support could trigger a broader market shift toward renewed bullish sentiment for XRP holders.

Chart Patterns Hint at 57% Breakout Probability

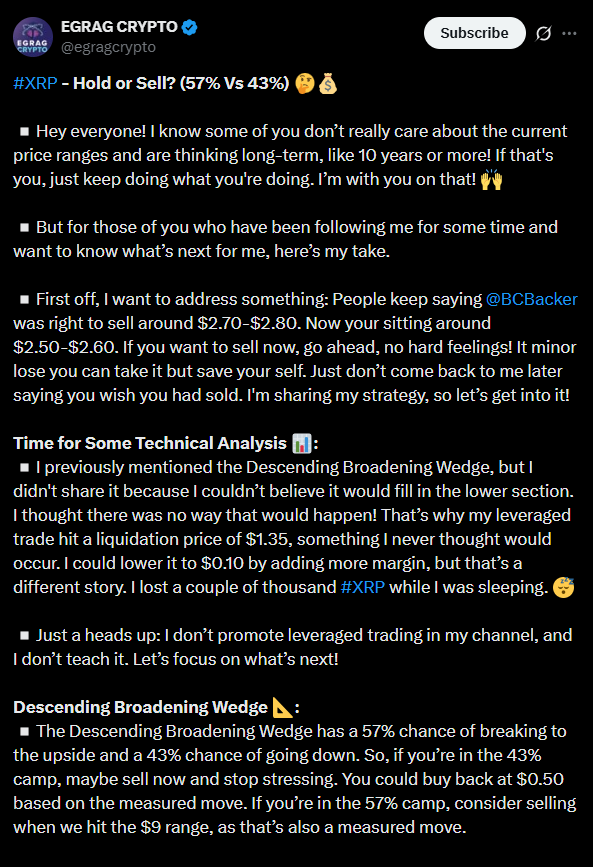

According to analyst Egrag Crypto, XRP’s current structure forms a descending broadening wedge, which statistically carries a 57% chance of breaking upward. If confirmed, this pattern could send XRP soaring toward the $9.50 level, with Egrag outlining an average target of $20 and an upper projection of $27 for this market cycle.

However, the analyst also cautioned that the pattern carries a 43% probability of a downside move that could drag XRP toward $0.50, calling it a potential “buy-back zone.”

Fellow analyst XForceGlobal echoed this view, describing the current range as XRP’s “confirmation stage” before a new impulsive rally. The Elliott wave chartist expects the next phase to mark the token’s wave 3 breakout, typically the strongest leg of a bullish cycle.

Macro Indicators Support the Bullish Case

On the weekly time frame, XRP’s Stochastic RSI remains in oversold territory, suggesting the token could be primed for a reversal. Combined with long-term support at $2.50 and rising on-chain activity, traders believe XRP’s current pullback could serve as a foundation for its next macro move.

If bulls maintain control above this zone, XRP could soon test $3.00 before expanding toward the $9–$10 range later this cycle. Analysts caution, however, that failure to hold $2.50 may open the door to deeper corrections before the uptrend resumes.