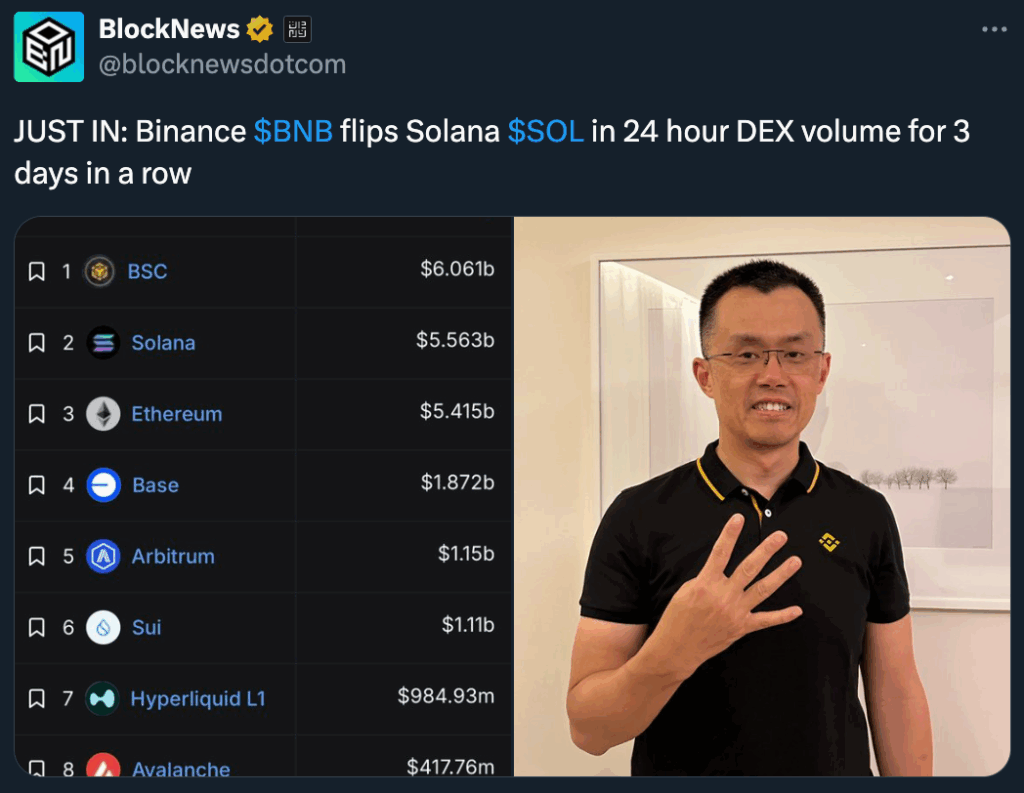

- BNB Chain has flipped Solana in 24-hour DEX volume for three straight days.

- Meme coin activity, new listings, and institutional inflows are fueling record growth.

- BNB’s rising dominance could reshape Layer-1 competition heading into Q4.

In a major shift across decentralized exchanges, BNB Chain has overtaken Solana in 24-hour DEX trading volume for three consecutive days—signaling a breakout moment for Binance’s ecosystem.

According to data from LunarCrush, BNB’s DEX volume reached $9.03 billion on October 8, surpassing Solana’s $7.10 billion. The surge comes amid heavy meme coin trading, strong on-chain engagement, and growing institutional interest.

BNB’s momentum extends beyond trading volume. Its price has climbed to a new all-time high of $1,330.51 up 47% over the past month, while market cap surged to $183.7 billion, overtaking XRP for the #3 position. Analysts credit the rally to the ongoing “BNB meme season” and successful listings like $ASTER and $4 on Aster DEX, which alone have generated more than $2 trillion in cumulative volume.

Further fueling the boom, CZ’s YZi Labs unveiled a $1 billion builder fund aimed at expanding DeFi, AI, and RWA development on BNB Chain—signaling Binance’s deeper push into next-generation blockchain sectors.

Solana Still Strong, But Pressure Builds

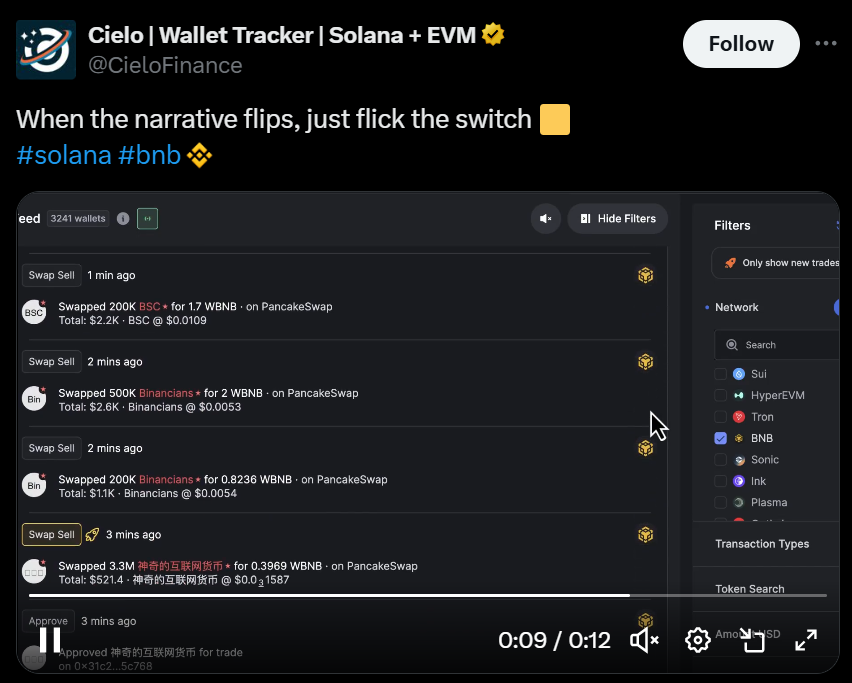

Solana remains a formidable competitor, trading at $222.30 with a $121 billion market cap and a well-established DEX ecosystem. Yet, BNB’s ultra-low fees (0.05 Gwei) and access to Binance’s 460 million users are attracting traders in droves. On-chain participation has grown by over 100,000 wallets in the past week, and 70% of new BNB meme buyers are currently in profit, per Bubble Maps.

As BNB approaches the $1,500 mark, its expanding dominance could reBdefine Layer-1 rivalries heading into 2026. For Solana, the message is clear—continued innovation and liquidity incentives will be key to reclaiming momentum.