- BNB recently hit an ATH of $1,300 and is trading near $1,285, up 46% over the past month.

- Analysts like Javon Marks see upside toward $1,520, with CoinCodex projecting $1,524 by early January 2026.

- Technicals remain bullish, with 73% green days in the last month and rising investor confidence.

Binance Coin (BNB) has been one of the standout performers in the market, hitting a fresh all-time high of $1,300 before cooling slightly to $1,285 at press time. The token is up 27% in the past week and 46% over the last month, underscoring its strong momentum amid broader market gains. Analysts point to the combination of a weakening dollar, a U.S. government shutdown, and Bitcoin’s rally past $126,000 as key macro drivers fueling BNB’s rise.

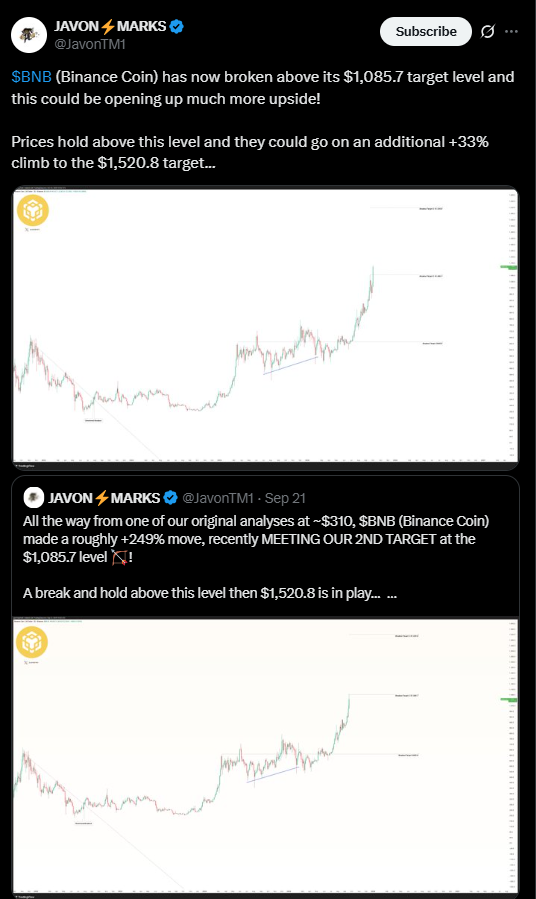

Expert Targets Point to $1,520

Crypto analyst Javon Marks has projected that BNB’s next target is around $1,520, highlighting the asset’s strong breakout momentum. He previously noted that breaking above the $1,085 mark opened the door to a potential +33% climb, with $1,500 firmly in sight. Technical analysts believe BNB’s current trajectory reflects both strong market sentiment and an established uptrend supported by heavy trading activity on the BNB Chain.

Technical Indicators Remain Bullish

According to CoinCodex forecasts, BNB is projected to climb by 18.87% and reach $1,524 by early January 2026. Current indicators show bullish sentiment, with the Fear & Greed Index at 60 (greed). Over the past 30 days, BNB logged 22 green days out of 30 (73%) with price volatility around 9.6%. These metrics suggest strong technical backing, with many analysts considering this an opportune moment for accumulation ahead of a potential breakout.

The Road to $1,500

While the path to $1,500 is within range, traders should remain mindful of volatility, especially as meme season on BNB Chain and broader market speculation amplify short-term swings. Still, with institutional inflows rising, strong fundamentals across the ecosystem, and supportive macro conditions, BNB is positioned as one of the leading candidates for continued upside into the next quarter.