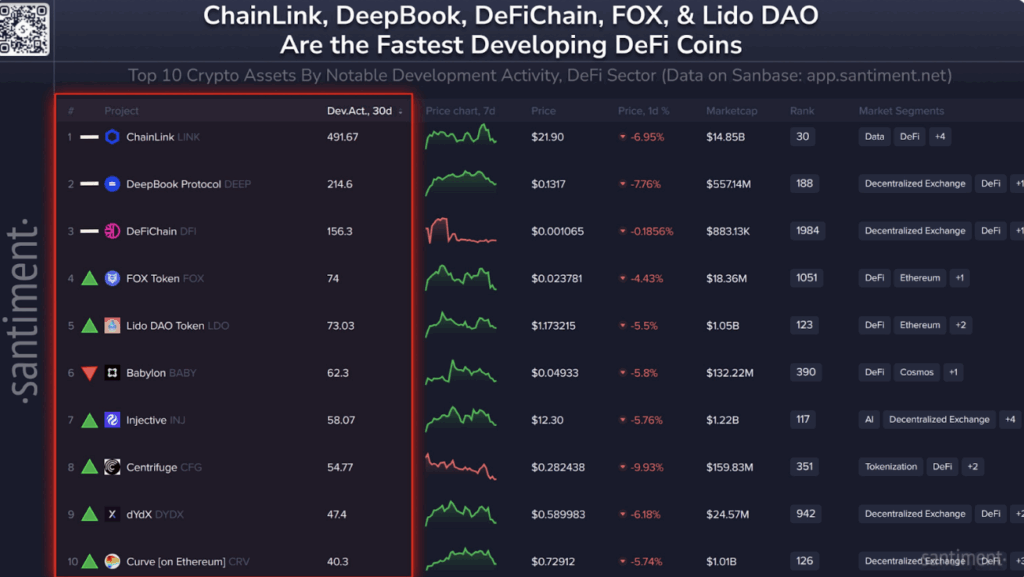

- Chainlink tops Santiment’s dev activity ranking with 491.67 points.

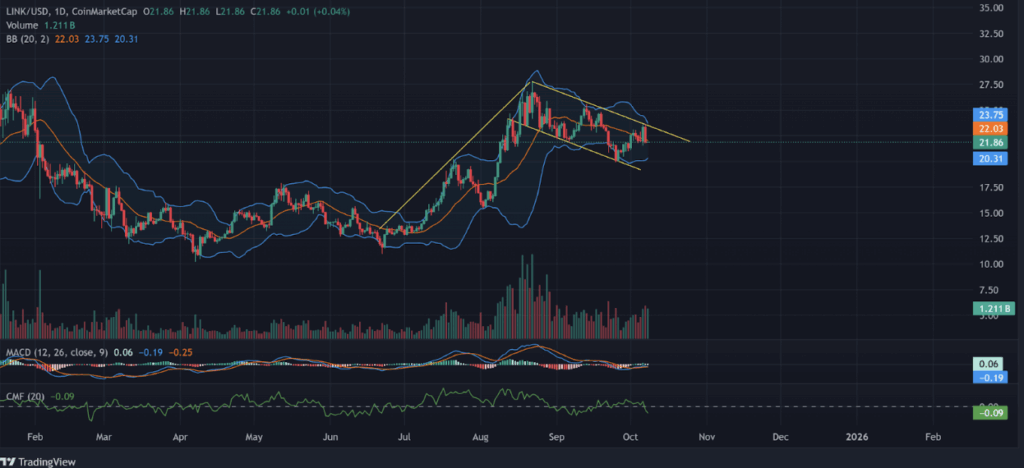

- Price consolidates between $20.3 support and $23.7 resistance.

- Tightening volatility hints at a breakout — $26 to $30 upside possible if bulls take control.

Chainlink (LINK) isn’t letting go of its crown anytime soon. Santiment’s latest October report shows the project sitting comfortably at the top of the DeFi development activity rankings. Over the last 30 days, LINK logged a massive score of 491.67, putting it well ahead of everyone else in the race.

That kind of consistency isn’t just noise — it shows developers are actively building, updating, and pushing upgrades. For a sector where hype often fades quick, Chainlink’s steady climb is a big deal.

The Rest of the Field: DEEP, DFI, and More

Right behind LINK, DeepBook Protocol (DEEP) grabbed second with 214.6, proving it’s gaining traction fast. DeFiChain (DFI) came in third at 156.3, keeping its spot as a solid mid-tier player.

Further down, FOX Token (FOX) and Lido DAO (LDO) claimed fourth and fifth, while Babylon (BABY) slid slightly to sixth at 62.3. Interestingly, new faces like Injective (INJ), Centrifuge (CFG), dYdX (DYDX), and Curve (CRV) rounded out the top ten, hinting at a more competitive middle pack than we’ve seen in months.

The shakeup suggests dev activity isn’t just clustered at the top anymore — it’s spreading out, with multiple ecosystems pushing forward at the same time.

LINK Price Eyes $23–$30 Range

While development activity looks great, LINK’s price has been a bit choppier. The token fell around 7% in the last 24 hours, even though trading volume actually went up by about 5%. On the charts, LINK is coiling inside a descending channel, pulling back after its sharp rally earlier this quarter.

Key levels to watch: $23.7 as resistance on the top end, and $20.3 as support below. If bulls manage a breakout above that channel, LINK could easily push toward $26 and even the $30 zone. But if the token slips under $20, it risks dropping further, possibly down to $17.5.

Bollinger Bands are tightening, which usually means volatility is about to spike. Basically, the market’s winding up for a bigger move.

Indicators and Market Outlook

The MACD still leans bearish, though signs of convergence suggest buyers might be gearing up to step in. Meanwhile, Chaikin Money Flow (CMF) stays slightly negative, showing modest outflows of capital.

The bigger picture? Once Bitcoin recovers from its brutal dip to $120K, LINK looks set to be one of the first DeFi tokens to bounce back. With Chainlink powering so much of the data infrastructure across blockchains, it has a strong foundation to ride the next leg of the market.