- Ethereum’s NVT ratio has dropped to historic lows, hinting at undervaluation but also raising questions of sustainability.

- Open Interest and liquidation data reveal rising speculative appetite and heavy pressure on shorts.

- With Binance clusters shifting upward, Ethereum’s momentum leans bullish, eyeing the $5,000 mark.

Ethereum’s 30-day NVT ratio has plunged to unseen depths, signaling the network is buzzing with activity compared to its market cap. Historically, such deep bottoms in NVT often hint at strong rebounds since undervaluation tends to draw in new buying pressure. But there’s a catch—sometimes these dips in NVT only reflect temporary transaction spikes that fade just as fast. Right now, Ethereum sits at a crossroads, with investors asking if the current inflows mean real adoption or just speculative churn.

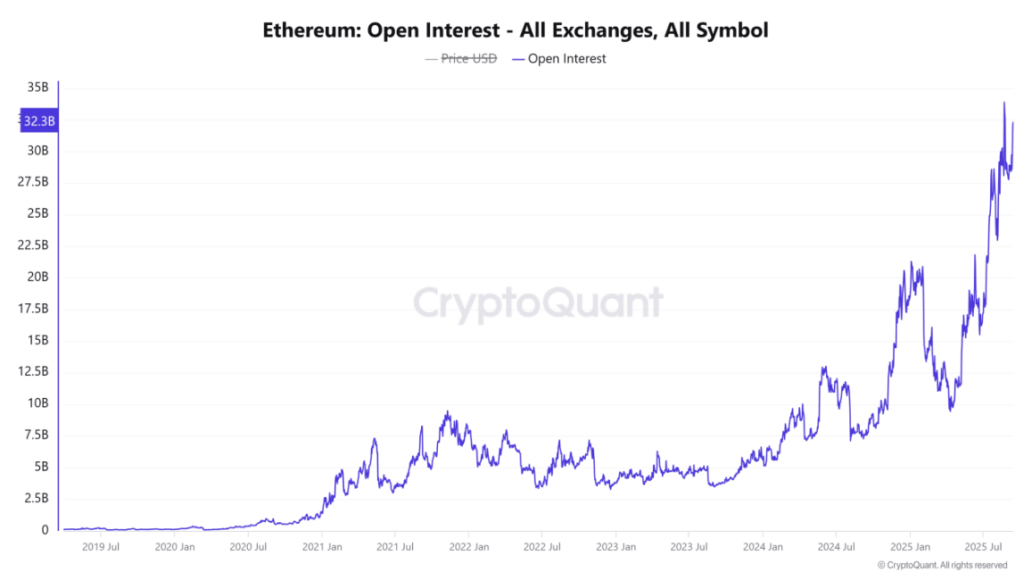

Open Interest Surge Reveals Rising Speculative Appetite

Ethereum’s Open Interest has jumped to $32.27 billion, a 4.11% spike in just 24 hours. This surge shows traders are stacking up positions on both sides of the market, with longs and shorts gearing up for the next move. Historically, growing OI in bullish cycles has amplified volatility, as leverage traders wrestle for control. If this momentum sticks, it could signal faith in Ethereum’s breakout—but the flip side is risk. Heavier OI makes the market more fragile, where sudden liquidations, especially near resistance zones like $4,700, could trigger sharp swings.

Short Squeezes Hit Bears as Liquidations Mount

The derivatives market shows a heavy tilt against shorts, with over $14 million in short positions liquidated compared to only $3 million from longs. Bears are taking the brunt of the pain, while bulls seem to hold the upper hand. This imbalance often sparks short squeezes that extend rallies, particularly when leverage doesn’t reset at calmer levels. Still, momentum is fragile—one wave of profit-taking could flip sentiment on its head, proving just how unstable Ethereum’s current liquidation landscape remains.

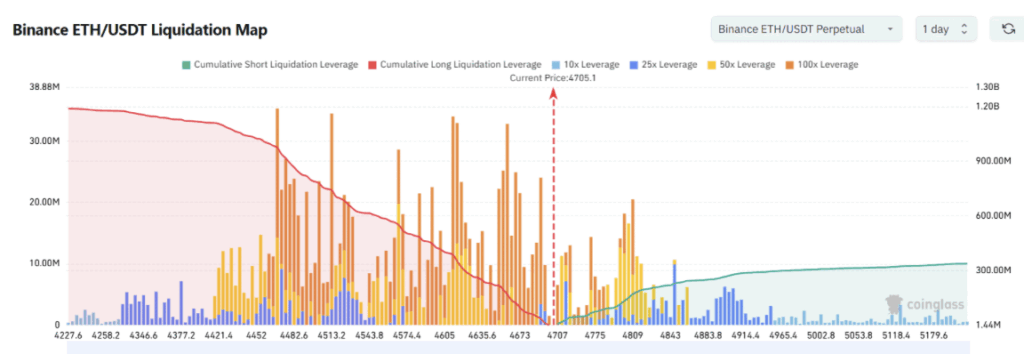

Binance Data Shifts Battle Toward Higher Price Clusters

Fresh Binance liquidation data shows $4,700 was the key pressure point, but Ethereum has already broken through. Attention now moves higher, toward clusters around $4,900 to $5,000. With heavy leverage stacked just above the breakout zone, volatility is likely to intensify as price pushes into new ranges. If ETH consolidates and holds its ground, cascading liquidations could fuel a fast surge higher. On the other hand, slipping back under $4,700 risks a sharp retest—but with shorts already battered, the odds lean in favor of the bulls holding dominance.

Ethereum’s Path Toward $5,000 Looks Increasingly Strong

Ethereum’s breakout above $4,700 confirms bullish strength, powered by undervaluation on NVT, swelling Open Interest, and relentless short liquidations. With Binance leverage clusters shifting upward, conditions favor a continued run toward $5,000. This rare alignment between on-chain signals and derivatives data paints a clear picture: Ethereum is stepping into a fresh expansion phase, with momentum firmly on the side of buyers.