- Lido has put forward a design for ETH withdrawals from the liquid staking protocol.

- The withdrawals feature will be implemented once the Ethereum Shanghai upgrade happens.

- The proposed design will be put to the vote on the DAO after some community feedback.

With the Ethereum community preparing for the upcoming Shanghai hard fork slated for March, the development team for the liquid staking project Lido has disclosed plans to develop an in-protocol withdrawal feature.

Based on recent developments, the team behind Lido has presented suggestions for how the protocol is supposed to support ether (ETH) withdrawals upon activating the networks oncoming Shanghai upgrade.

In a post on the community’s forum, the Lido team proposed new designs to the project’s governance form, the Lido DAO, highlighting that the feature would allow users to unstake their staked ETH tokens upon launching the Shanghai upgrade.

In their description, the Lido team said that they went through the complex task of designing the process for the withdrawal feature, attributing the complexity to the way staked ETH withdrawals will work after the Shanghai debut and noting:

“The process will be asynchronous, which means withdrawals will not happen simultaneously for all participants.”

Noteworthy, the development team published the proposal concerning withdrawals after the Shanghai upgrade on January 24, 2023.

Withdrawals To Feature Two Modes

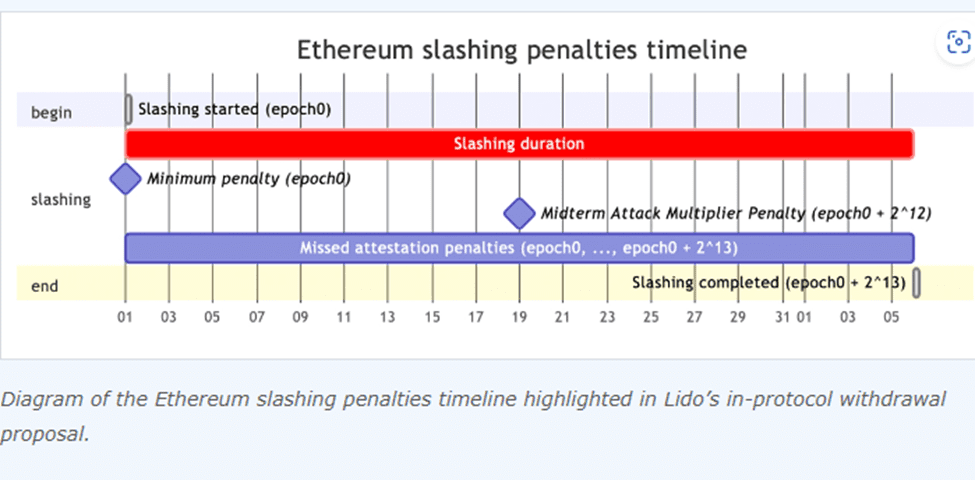

Based on the design document, Lido’s planned withdrawal feature will have two modes. Accordingly, the first mode, dubbed “turbo,” would process unstaking requests in an expedited manner, while the second mode, dubbed “bunker,” would be initiated during conditions of mass slashing.

Notably, slashing defines penalty validators incur in a proof-of-stake (PoS) network when they are repugnant of consensus regulations. In Ethereum, validators are penalized by having a part of their staked tokens burned.

The design document also adds that Lido’s bunker mode is targeted at preventing cosmopolitan actors from profiting at the expense of the community.

The withdrawal feature is a crucial component in Lido’s operations in the future, with a Dune dashboard stating that Lido is the most dominant liquid staking protocol on Ethereum. The analytics platform notes that the project accounts for 29% of all staked ether (ETH).

The Lido DAO ecosystem will deliberate on the design intricacies and specifics. Accordingly, the community will vote on any new recommendations before implementing the plans in the protocol.

“We are seeking the community’s feedback to ensure that our proposal takes all important considerations into account and to identify any potential improvements.”

The Lido team also stated, “Your feedback is invaluable to creating a proposal that is effective, efficient, and fair for all stakeholders.”

Ethereum’s Shanghai Upgrade

Ethereum developers are committed to making the Shanghai hard fork happen this March to allow staked withdrawals. In a summary of the withdrawals landscape on the Lido protocol, the team said:

“The design proposed by Lido on the Ethereum Protocol Engineering team addresses these challenges with the in-protocol withdrawal requests queue.”

They added, “The process has to be asynchronous due to the asynchronous nature of Ethereum withdrawals.”

Lido Dominates DeFi Economy With $7.9 Billion in TVL

As of the time of writing, the decentralized finance (DeFi) liquid staking protocol Lido stands the dominant DeFi protocol on Total Value Locked (TVL) metrics. Based on data from DeiLlama.com, Lido’s $7.92 billion TVL leads the $46.56 billion TVL held in DeFi today, representing around 17% of the DeFi TVL.

Lido is the biggest holder of staked ETH, with the protocol commanding almost 29% of the staked Ether supply. In addition, Lido’s Ethereum derivative token STETH is the 13th largest market valuation in the entire crypto economy, recording $7.73 billion.

Moreover, Lido has a governance token christened Lido Dao (LDO), with a market cap of approximately $1.87 billion as of January 27, 2023.