- Investing $200 monthly into XRP through dollar-cost averaging could build long-term wealth, with potential upside if adoption mirrors Bitcoin’s growth.

- XRP’s real-world utility in cross-border payments and Ripple’s expanding partnerships strengthen its case as a long-term hold.

- Risks remain from regulation, competition, and volatile market sentiment, so diversification and patience are key.

Crypto investing has always been a mix of high risk and high reward. Most people chase fast profits, jumping in and out of trades, but there’s another path that doesn’t get as much hype—steady, long-term accumulation. XRP, the token tied to Ripple, isn’t just about quick transactions or global payments anymore; it’s slowly becoming part of that long-term wealth conversation.

A lot of chatter in the community suggests that a small but consistent investment—say $200 every month—might grow into something life-changing if XRP follows a path anywhere close to Bitcoin’s historic run. The numbers might sound bold, but the strategy behind it is simple.

The Case for Dollar-Cost Averaging

This whole idea is based on dollar-cost averaging (DCA). Instead of stressing over timing the market, you just put the same amount in at regular intervals. When prices dip, you get more tokens. When prices are high, you buy fewer. Over time, that evens out volatility and avoids the panic-buy/sell cycle that wrecks most traders.

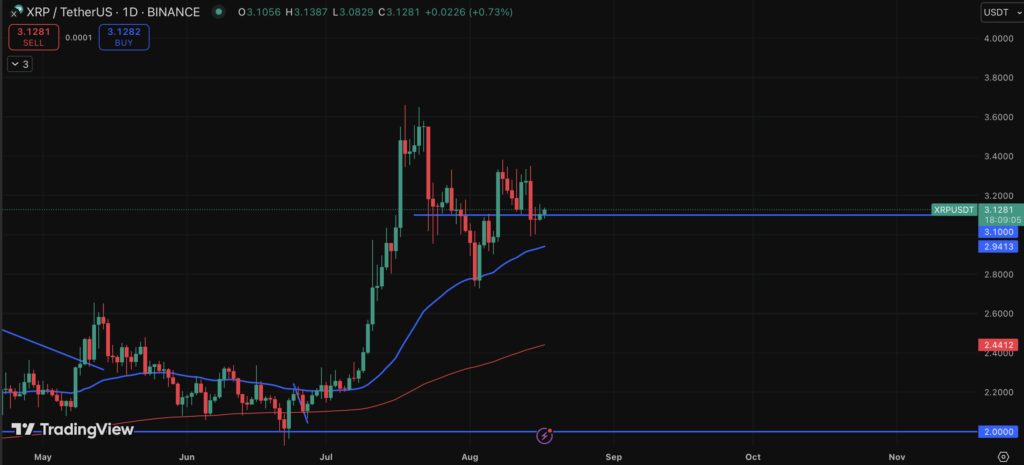

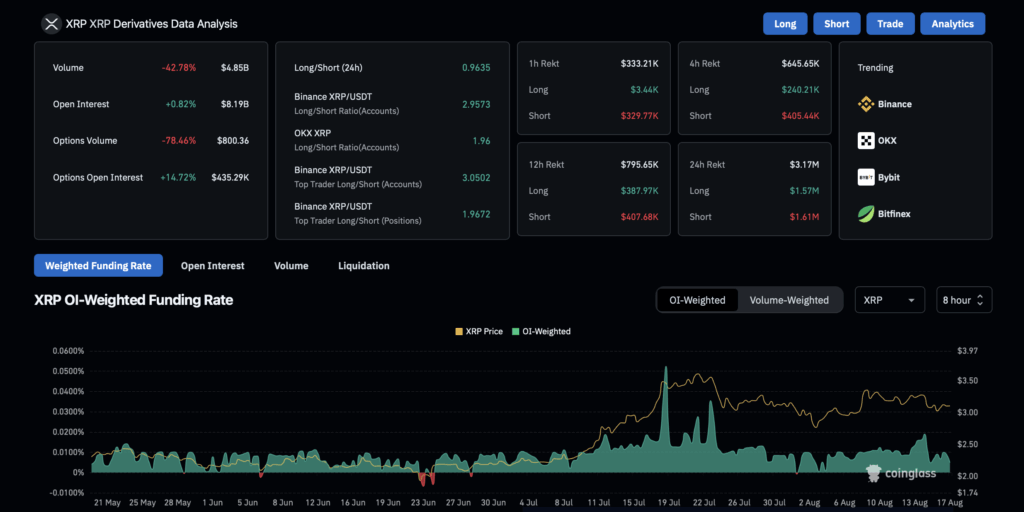

In traditional finance, DCA has proven itself, and crypto markets have shown it can work here too. For XRP—with its wild swings, rallies, and pullbacks—DCA could be one of the few ways to ride the wave without losing your head along the way.

The Math Behind the Dream

If you invest $200 every month for 15 years, that’s $36,000 out of pocket. On the surface, not groundbreaking. But if XRP grows like Bitcoin did during its adoption phase, the upside could be staggering. That kind of consistency, paired with compounding growth, could realistically turn into hundreds of thousands—or even push toward the $1M mark if adoption explodes.

Of course, this is hypothetical. No guarantees. But it shows why patience and discipline can sometimes outperform trying to hit home runs in a volatile market.

Why XRP Stands Out

Unlike meme coins or purely speculative plays, XRP has something tangible going for it—real-world usage. Ripple is actively partnering with banks and institutions to overhaul cross-border payments, aiming to replace clunky systems like SWIFT. Faster, cheaper transfers aren’t just theory; they’re happening.

If Ripple wins more partnerships and clears its legal hurdles, XRP could be positioned as one of the few digital assets with both utility and adoption. That’s the kind of foundation long-term investors like to see.

Risks That Can’t Be Ignored

It’s not all upside. Regulatory fights, especially Ripple’s long-running SEC battle, remain a cloud. Competition from Stellar, Solana, or even government-backed digital currencies could chip away at XRP’s role. And let’s not forget the market itself—crypto sentiment can swing from euphoria to despair overnight.

That’s why the golden rule holds: never invest more than you’re prepared to lose. DCA helps reduce stress, but it doesn’t erase the risks.

Balancing Strategy and Patience

The smarter approach? Mix DCA into XRP with diversification across other assets—both crypto and traditional markets. Crypto wealth often rewards the stubborn holders who can stomach years of uncertainty. If you’re putting in $200 a month, resisting the urge to panic-sell during downturns could make all the difference.

Final Take

The idea of turning $200 a month into $1 million might sound like a dream, but it reflects a bigger truth: crypto rewards consistency, patience, and belief in adoption. XRP, with its blend of utility and potential for global reach, makes for a compelling candidate.

Wealth in this space rarely comes from chasing quick wins. It comes from showing up month after month, riding the storms, and being there when the tide finally turns.