- Robinhood now supports HBAR spot trading, marking a strategic expansion beyond major coins.

- HBAR price spiked over 10% post-listing, with whales and altcoin sentiment driving interest.

- Despite SEC crackdowns elsewhere, Robinhood is doubling down on tokens with strong ecosystems.

Robinhood just rolled out spot trading for Hedera’s HBAR token on its U.S. platform, expanding its crypto lineup and aiming to catch the wave of retail investors looking for the next altcoin breakout. The listing is part of a bigger strategy, as Robinhood keeps moving beyond the usual heavyweights like Bitcoin and Ethereum, leaning into emerging Layer-1 projects and even meme coins to attract fresh demand.

According to a post on X, users can now buy, sell, and hold HBAR directly on Robinhood without relying on external wallets or exchanges. Hedera runs on a hashgraph consensus model, which differs from typical proof-of-work or proof-of-stake setups, giving HBAR a unique angle in the crowded altcoin space. Robinhood’s push here could also boost HBAR liquidity and drive more speculative interest among retail traders.

Why Robinhood Is Expanding Into HBAR

This listing follows Robinhood’s broader pivot toward becoming a one-stop shop for digital and traditional financial products. Recently, the company introduced tokenized stock trading on the Arbitrum network and even started developing its own Layer-2 blockchain aimed at scaling transaction throughput. Adding HBAR shows its intention to offer a diverse range of crypto assets, especially those with growing ecosystems.

The strategy also aligns with earlier listings of niche tokens and Solana-based meme coins like MEW and MOODENG. By stacking its crypto portfolio with both serious infrastructure projects and trend-driven coins, Robinhood is making a play to keep its platform relevant in a fiercely competitive landscape.

HBAR Price Reaction and Market Outlook

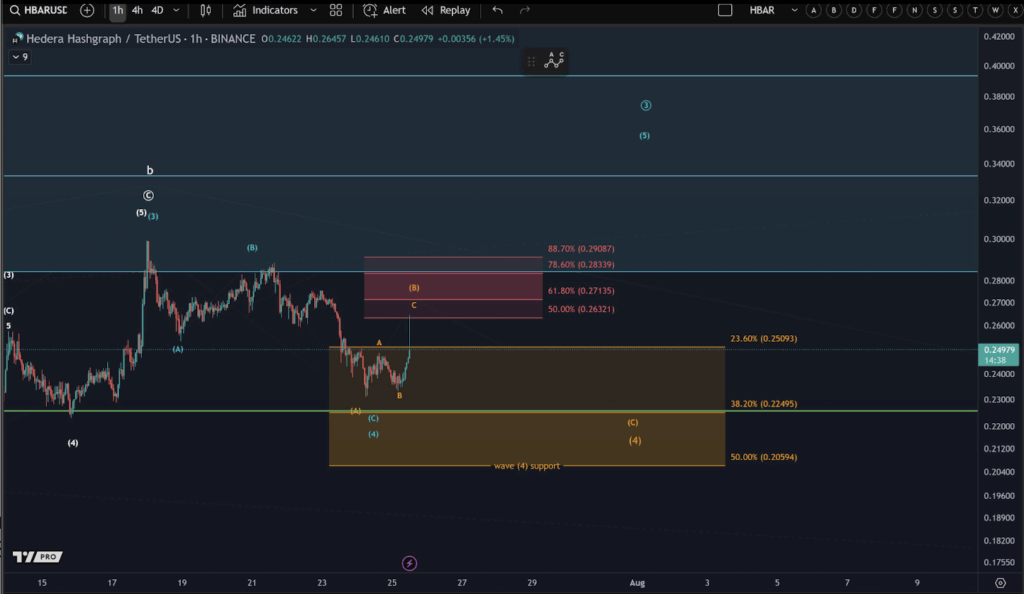

HBAR price popped 3% after the listing news and then jumped over 10%, currently trading near $0.2661. Analysts point to renewed whale activity and a growing appetite for altcoins as reasons behind the push. Earlier this year, HBAR tested the $0.32 level before pulling back, and traders are now watching for a retest of that key zone. A breakout above it might trigger renewed buying momentum.

However, analysts at “More Crypto Online” caution that HBAR could still be in a corrective phase, with the latest rally possibly forming a B-wave rather than a clean breakout. This suggests that while short-term gains are possible, the correction pattern might not be over yet.

Robinhood’s Position Amid Regulatory Shifts

The timing of this listing is notable, considering many U.S. exchanges are trimming their altcoin offerings due to SEC scrutiny. While some platforms are scaling back, Robinhood continues to add new tokens, focusing on those with strong communities and active networks. Earlier this year, the company removed a few riskier tokens but has since doubled down on assets with real traction.

If momentum in altcoins continues and the altseason narrative gains steam, HBAR’s addition to Robinhood could give it extra visibility—and potentially a price boost—during this cycle.