- Ethereum’s institutional accumulation and ETF inflows signal growing confidence, as whales add 200K ETH and on-chain supply hits multi-year lows.

- ETH remains range-bound between $2,400 and $2,700, with a decisive breakout above $2,800 needed to confirm a new bull phase.

- Failure to hold $2,500 could trigger a drop toward $2,200, while a move past $2,800 may pave the way for a rally to $3,000 and beyond.

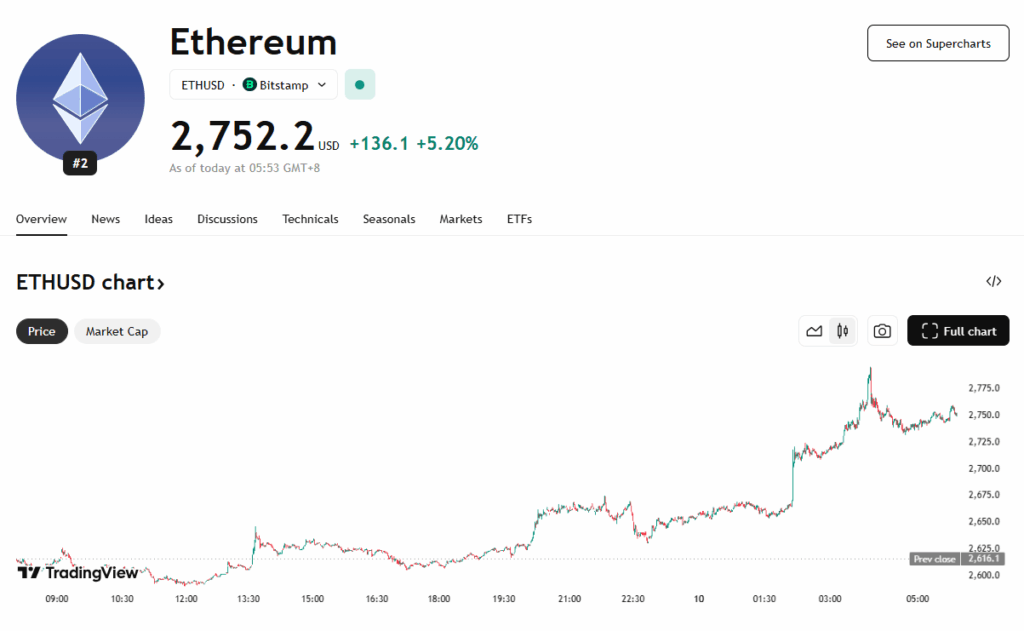

Ethereum has recently crossed the $2,700 threshold, sparking renewed bullish optimism throughout the crypto community. This push higher is fueled by a mix of factors: increasing institutional interest, declining exchange supply, and technical strength in ETH/BTC that hints at Bitcoin dominance fading. Large ETH wallets holding between 10,000 and 100,000 coins have accumulated over 200,000 ETH, pushing centralized exchange reserves to a multi-year low of 18 million. These on-chain movements suggest growing investor conviction and a shift in long-term positioning.

Ethereum’s Core Fundamentals Remain Strong

The fundamentals also remain robust. Ethereum still commands the lead in DeFi and tokenized assets, with a $65 billion TVL and a $126 billion stablecoin market cap. Its proof-of-stake mechanism is seeing continued traction, with more than 35.5 million ETH staked by over 100,000 validators. Institutional inflows are also reinforcing this bullish case—U.S. spot Ether ETFs have drawn in nearly $2 billion since April. Analysts see these flows as a key signal of rising confidence in Ethereum’s role as a settlement layer for financial assets.

Technical Indicators Point to Critical Resistance Ahead

Technically, Ethereum has been consolidating in a range between $2,400 and $2,700 since early May. The MACD has turned positive, and the price recently moved above both the 50- and 100-day SMAs. But the real test lies near $2,800, where Ethereum faces heavy resistance from its 200-day SMA and a key liquidity zone. A clean break above that level could confirm a breakout from the multi-month range, with potential upside toward $3,000. Still, a rejection at these levels could pull the price back to $2,400 or even $2,200, especially if macro pressures reemerge.

Final Thoughts: Make-or-Break Moment for ETH

Despite the bullish setup, caution lingers. Analysts like Carl Runefelt point to Ethereum’s current rising wedge pattern—a potentially bearish structure. Ethereum must decisively break above $2,700–$2,800 to escape the risk of a pullback. Otherwise, this surge could end up being just a temporary relief rally. Ultimately, Ethereum’s ability to reclaim $2,800 and flip it into support will likely determine the next big move—not just for ETH, but for the broader altcoin market.