- Bitcoin, Ethereum, Solana, and XRP posted modest gains as crypto markets largely shrugged off Trump’s latest tariff threats.

- Analysts attribute investor calm to repeated tariff delays and growing conviction in crypto as a macro hedge.

- Institutional use of options — particularly with Bitcoin ETFs like IBIT — is helping smooth volatility and encourage rangebound trading.

Major cryptocurrencies — Bitcoin, Ethereum, Solana, and XRP — managed to post gains on Wednesday, even as news broke that the U.S. is reopening trade negotiations with multiple countries. The positive price action, while modest, underscores a growing resilience in the crypto market, particularly amid geopolitical volatility and macroeconomic headwinds.

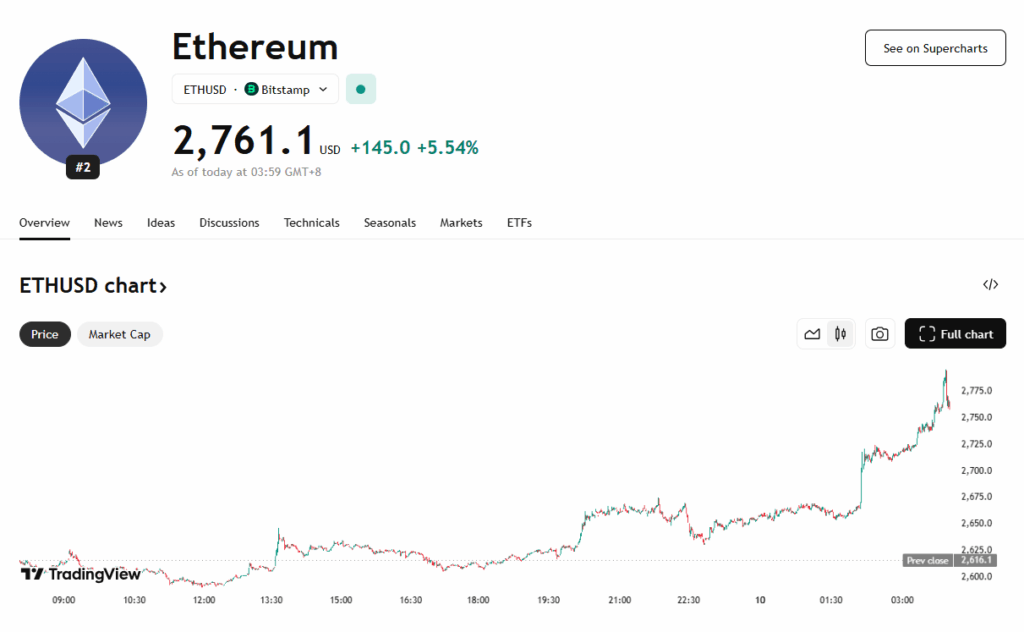

Bitcoin (BTC) climbed to $109,659, marking a 0.7% daily gain, with a narrow 30-day trading range between $107,000 and $110,000. Ethereum has hovered near $2,500, while Solana has remained steady at $150, reflecting a market that appears “rangebound” but quietly bullish. In the last 24 hours, Ethereum, Solana, and XRP gained between 2% and 4%, signaling renewed optimism despite recent tariff headlines from President Trump.

Market Sentiment: Calm Amid Policy Turbulence

Wednesday’s uptick came shortly after President Trump issued new tariff letters to 14 countries, including Japan, South Korea, and Thailand, with steep import taxes set to begin August 1. Curiously, the crypto market barely flinched. Analysts suggest this is due to trader confidence that the August deadline will again be postponed, feeding into a growing meme that “Trump Always Chickens Out,” also dubbed TACO in crypto circles.

eToro’s Bret Kenwell noted that repeated delays in Trump’s tariff actions have desensitized investors. “If there’s confidence that negotiations will continue or deadlines will be extended, markets may continue to shake off the headlines,” he said. As a result, many see any dip in crypto prices as a buying opportunity, helping maintain the current trading range.

Options Hedging and Institutional Calm

A more mature crypto market is also playing a role. According to Amberdata’s Greg Magadini, institutional investors are increasingly turning to options strategies to hedge macroeconomic uncertainty. For instance, many are buying shares in BlackRock’s IBIT Bitcoin ETF, writing covered calls for yield, and simultaneously purchasing protective puts to manage downside risk.

This hedging approach has reduced the impact of knee-jerk selloffs, even as tariffs and other risk-off triggers emerge. Magadini also highlighted that the market’s growing size requires substantially more volume to trigger large price swings, offering natural dampening against volatility.

Tariff Talk Fatigue?

Crypto investors seem to be taking Trump’s latest tariff warnings in stride — not because they don’t matter, but because they’ve seen this movie before. While the overall crypto market cap dropped 3% in 24 hours, it’s still up 35% since April, showing how sustained demand and strong positioning are outweighing short-term fears.

With the S&P 500, gold, and even Bitcoin increasingly viewed as hedges against poor fiscal management or inflationary risks, analysts believe crypto will continue to benefit from its “alternative asset” status as policy uncertainty lingers into the second half of 2025.