- The REX-Osprey Solana Staking ETF debuted with $12M in inflows and $33M in trading volume, becoming the first U.S. ETF to offer both spot Solana exposure and staking rewards.

- It overcame SEC objections using a unique regulatory structure, sidestepping the traditional 19b-4 filing and opening the door for future staking-enabled ETFs.

- Analysts predict a wave of altcoin ETF approvals in 2025, with Solana, XRP, and Litecoin expected to receive the green light by year-end, signaling growing institutional appetite.

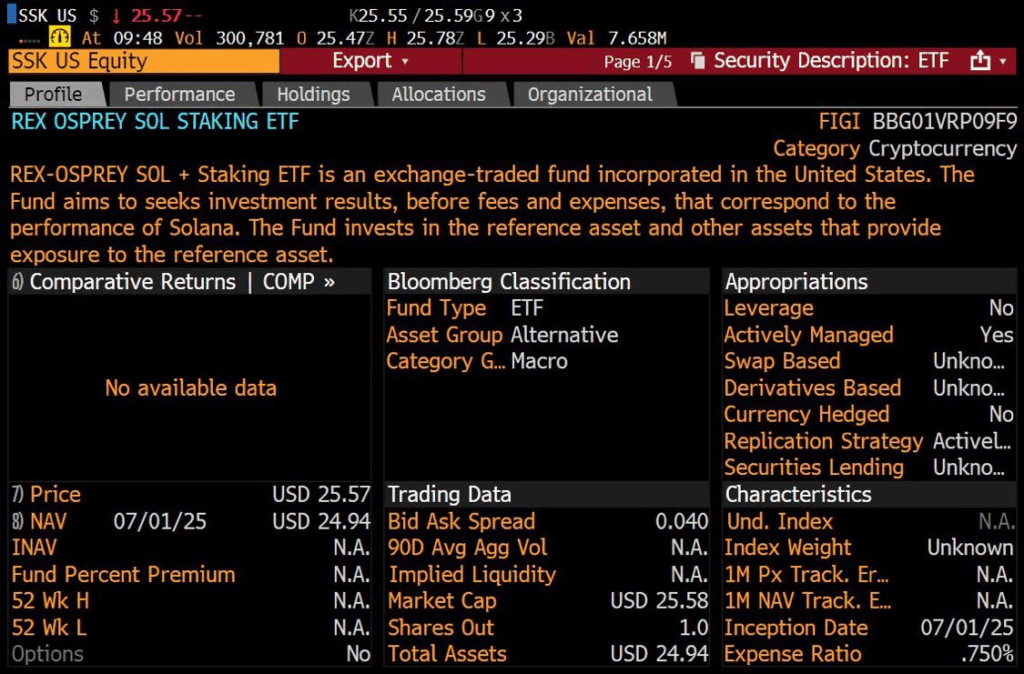

The REX-Osprey Solana Staking ETF (SSK) launched with a bang this week, closing its first day with $12 million in inflows and a robust $33 million in total trading volume. As the first U.S.-approved staking-enabled ETF, it marks a huge milestone for Solana and for crypto ETFs more broadly. The product gives investors exposure not just to spot Solana (SOL), but to staking rewards as well—a feature that distinguishes it from other crypto-based financial products.

Breaking Barriers: A Regulatory Workaround That Worked

The road to launch wasn’t exactly smooth. The SEC initially pushed back in May, questioning whether the ETF qualified as an “investment company.” REX-Osprey sidestepped this hurdle by allocating at least 40% of its assets into other exchange-traded products (ETPs), mainly outside the U.S. Structured under the Investment Company Act of 1940, the fund avoided the traditional 19b-4 filing process used for spot ETFs. While some call it a regulatory loophole, others see it as a bold precedent for future staking ETFs.

A “Healthy Start” Amid July 4 Holiday Trading

ETF analysts like James Seyffart described the launch as a “healthy start,” noting $8 million in trading volume within just the first 20 minutes. While modest compared to spot Bitcoin ETF debuts—which saw $4.6 billion in day-one volume—SSK still outperformed earlier futures-based Solana and XRP ETFs. Given the U.S. holiday week, analysts say true demand may be even stronger than initial numbers suggest. Anchorage Digital, the ETF’s staking partner, called the launch “a defining moment for digital assets.”

A Glimpse into ETF Summer? More on the Horizon

This ETF debut comes just as analysts forecast a “second-half wave” of altcoin ETFs. Seyffart and Balchunas now assign a 95% probability that spot Solana, XRP, and Litecoin ETFs will gain SEC approval by year-end. With Grayscale’s Digital Large-Cap Fund ETF conversion already approved, momentum is building. Whether or not SSK is classified as a “true” spot ETF, its launch is a sign that institutional appetite for Solana and staking yield is real—and growing.

SOL Price Muted, But Futures Tell a Different Story

Interestingly, SOL’s price didn’t spike dramatically on the news, gaining just 3.6% in 24 hours. But look beneath the surface and the picture changes—Solana CME futures hit record open interest at $167 million following the ETF’s debut, indicating institutional traders are paying attention. SOL is still down 48% from its January highs, but signs of long-term interest are clearly building.

Final Thoughts

The successful launch of the REX-Osprey Solana Staking ETF marks a pivotal moment for both Solana and the broader crypto market. It’s not just about the $12 million in inflows or the regulatory gymnastics—it’s about proving that staking-enabled ETFs can exist within U.S. financial infrastructure. This could reshape how traditional investors gain access to yield-bearing digital assets.

Though it didn’t spark an immediate price breakout for SOL, the ETF’s strong debut shows that institutional interest is real—and growing. With record open interest in Solana futures and analysts forecasting a wave of altcoin ETF approvals, SSK may end up being the first domino in a much bigger shift. The quiet strength of this launch might just set the stage for staking to become a standard feature in the next era of crypto investing.