- Trump Media raised $2.5 billion to buy bitcoin, marking one of the largest BTC treasury moves by a public company.

- The company partnered with Crypto.com and Anchorage Digital to custody assets and launch crypto ETFs.

- CEO Devin Nunes called bitcoin a defensive asset against financial discrimination, as the firm pivots deeper into crypto.

Trump Media just made its boldest move yet. On Tuesday, the company announced it’s raising $2.5 billion from institutional investors—with the money going straight into Bitcoin. It marks one of the biggest BTC treasury plays ever by a publicly traded company.

The deal, which includes $1.5 billion in common stock and $1 billion in convertible notes, will fund a massive purchase of Bitcoin that the company says will now sit alongside cash and other core assets on its balance sheet. Around 50 institutional investors have already signed subscription agreements, according to the company.

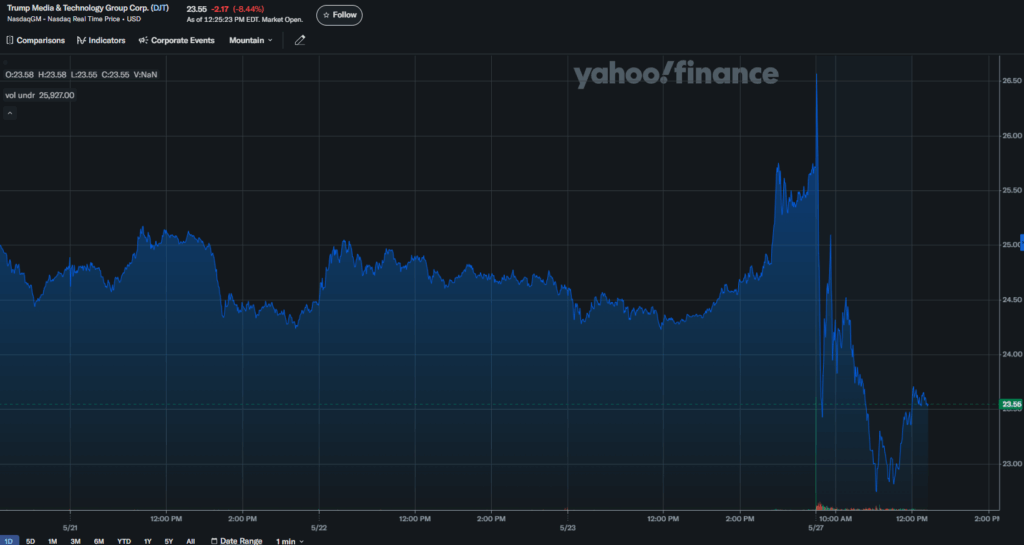

But markets weren’t exactly thrilled. Trump Media shares dropped about 10% after the news, continuing a rough patch that’s seen the stock slide nearly 30% this year.

Bitcoin, Politics, and a Crypto Power Play

Trump Media isn’t shy about its crypto ambitions. This isn’t just about stacking Bitcoin—this is part of a bigger pivot into financial services. The firm recently partnered with Crypto.com to roll out a new line of crypto ETFs, and Tuesday’s press release confirmed that both Anchorage Digital and Crypto.com will custody the BTC.

The timing? Not subtle. This all hit as the Bitcoin 2025 conference kicked off in Las Vegas—a major gathering of digital asset diehards that’s doubling this year as a campaign flex for President Trump, who’s already being branded by some as America’s first true “crypto president.”

The White House presence is full force: JD Vance, Don and Eric Trump, David Sacks, and a few more Trump-aligned crypto figures are all attending.

“Apex Asset” and a Broader Battle

CEO Devin Nunes called Bitcoin an “apex instrument of financial freedom” and said the move is both strategic and defensive. His angle? Holding Bitcoin will shield Trump Media from what he called “discrimination by financial institutions” targeting conservative businesses.

Despite its growing ambitions, Trump Media reported just $3.6 million in revenue last year… and over $400 million in losses. Still, the company has a market cap of around $5.3 billion, with Trump himself indirectly owning more than 114 million shares through a revocable trust.

The firm’s upcoming ETFs—pending regulatory approval—are expected to include baskets of top tokens like Bitcoin, Cronos (Crypto.com’s native asset), and traditional securities. These will carry the Trump Media brand and be listed across major brokers and the Crypto.com app, which serves 140 million users globally.

The Bigger Trend: Bitcoin as Political Strategy

This isn’t happening in a vacuum. Conservative companies and politically-aligned firms are increasingly shifting corporate treasuries into Bitcoin—following the path Michael Saylor’s MicroStrategy set back in 2020, but now with a more ideological twist.

The move comes amid rising Republican frustration with what they see as “debanking” of conservative voices, a theme that’s echoed in hearings and headlines. Trump himself recently called out Bank of America and JPMorgan, accusing them of locking out political rivals.

Other crypto figures are riding this wave too. Jack Mallers is reportedly building a BTC-heavy firm with backing from Tether and SoftBank, while Trump advisor David Bailey just merged his own crypto vehicle, Nakamoto Holdings, with healthcare startup KindlyMD, rebranding it with—you guessed it—a crypto-first mission.

Bailey, who’s helping lead this push from inside the movement, said the vision is simple: “Strategy, squared.”