- Bitcoin has dropped over 15% since Trump’s tariff threats, hitting as low as $86,400.

- Market uncertainty and fears of a “Trumpcession” have driven investors to pull $3.5 billion from Bitcoin ETFs.

- While Bitcoin struggles, global investors are hedging with fiat alternatives like the euro, gold, and the Japanese yen.

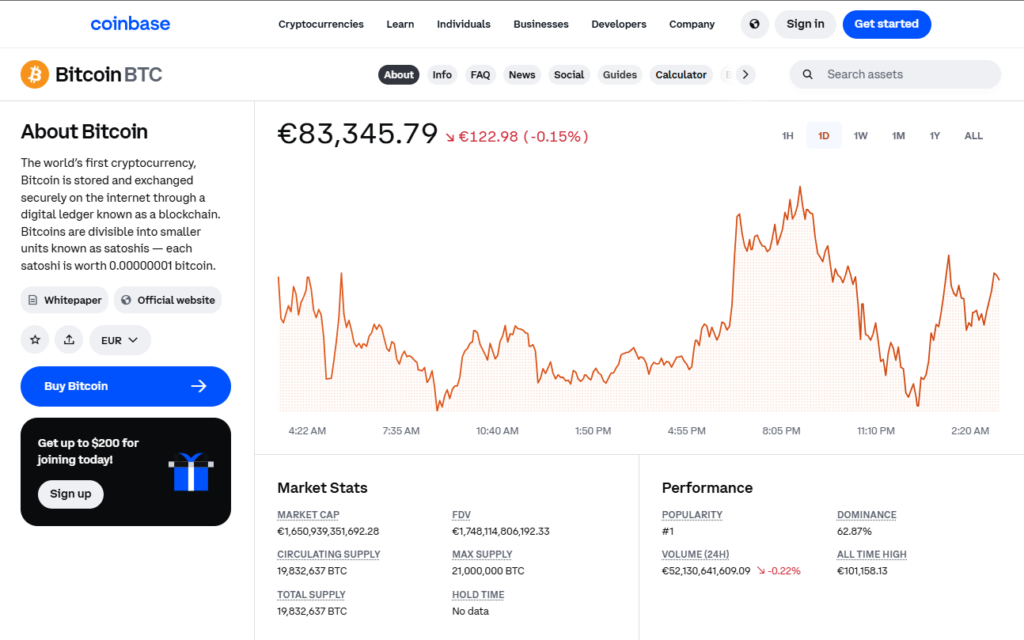

Bitcoin has taken a hit, dropping over 15% since Feb. 3, the day President Trump threw out fresh tariff threats against China, Mexico, and Canada. By March 5, it was trading as low as $86,400. Meanwhile, investors have yanked more than $3.5 billion from U.S.-based spot Bitcoin ETFs, according to Farside Investors data.

Economic uncertainty spooks risk-on traders

The U.S. slapped a 25% tariff on Canada and Mexico and a 10% tariff on China on March 4, setting off alarms about supply chain chaos and rising costs. Some fear this could lead to a so-called “Trumpcession.”

Normally, when markets panic, risk assets take a hit. Back in August 2019, Trump’s China trade war sparked an 800-point Dow drop—but interestingly, Bitcoin soared as Chinese traders used it to bypass capital controls. That didn’t last long, though, as Beijing cracked down on Bitcoin trading and OTC desks soon after.

This time around, Bitcoin is acting more like a typical risk asset. Its 30-week correlation with the Nasdaq is sitting at a high 0.91, meaning it’s moving in sync with traditional equities. And with JPMorgan now turning “tactically bearish” on U.S. stocks due to trade war fears, Bitcoin could feel more pressure if that correlation holds.

Bitcoin never sleeps—24/7 volatility

Unlike traditional stock markets that take weekends off, Bitcoin trades around the clock, reacting instantly to macroeconomic shifts. When Trump’s tariff plans were confirmed over a weekend in early February, crypto traders wasted no time offloading BTC before Wall Street even had a chance to react.

This knee-jerk selloff drove Bitcoin down to $91,000 on Feb. 3, marking a three-week low. The broader crypto market bled over $1 trillion in market cap from its December highs by late February. Yet, the volatility works both ways—when Trump announced plans for a U.S. Bitcoin reserve on March 3 (also a Sunday), BTC spiked 9.58%, its biggest daily gain since Nov. 11, 2024.

The takeaway? Policy shifts—especially when they break on weekends—can send crypto prices into wild swings, with fewer traders available to stabilize the market.

Global investors are hedging elsewhere

Typically, tariffs should boost the U.S. Dollar Index (DXY) by reducing imports and driving demand for domestic goods. But this time? Not quite. DXY peaked around Trump’s tariff announcement and has been sliding ever since—mirroring Bitcoin’s decline, which defies the usual narrative that BTC is a hedge against economic uncertainty.

So where’s the money flowing? Into fiat alternatives. The euro has strengthened since Feb. 3, suggesting global investors are shifting capital into more stable currencies rather than riskier assets like Bitcoin. Gold, another classic hedge, has also been on the rise since Trump’s announcement, and the Japanese yen (JPY), a traditional safe haven, has climbed 4.5% in the same period.

If the tariffs stir up widespread fears of an economic slowdown, traders could continue dumping risk assets—including Bitcoin. And if investors also start avoiding the dollar over recession fears, Bitcoin may not see the safe-haven bid some expect.

Final Thoughts

Bitcoin’s knee-jerk reaction to Trump’s tariffs shows just how closely it’s tied to macroeconomic uncertainty. While some argue it could benefit long-term if inflation rises, the immediate response from investors has been one of panic. With Bitcoin trading 24/7, that fear-driven volatility can hit even harder compared to traditional markets.

As always, markets will adjust, and Bitcoin’s narrative as either a hedge or a risk asset will continue evolving. But for now, traders are watching global policy shifts like hawks—because in crypto, timing is everything.