- Over $883 million ETH absorbed in a single day.

- Big players quietly adding to their Ethereum holdings.

- Solana’s rise adds pressure, but ETH’s adaptability remains key.

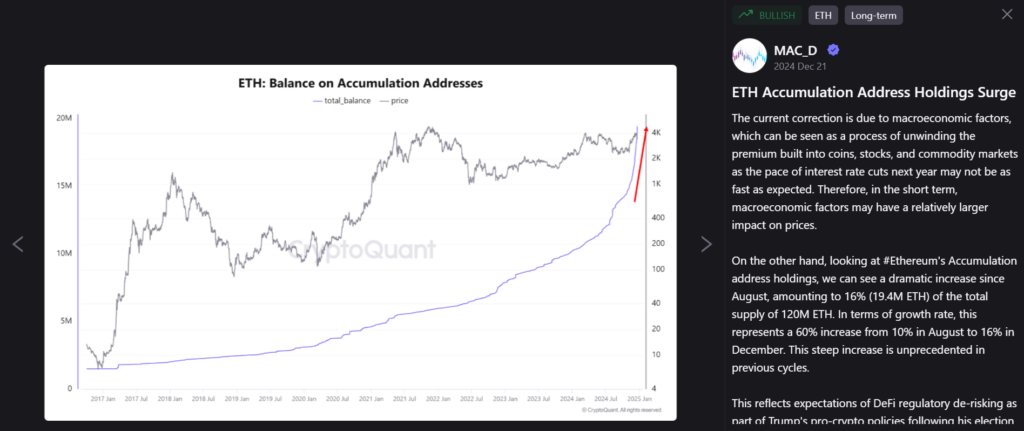

Ethereum accumulation addresses saw a massive spike on February 7, hinting at a growing belief in its long-term potential. Data from CryptoQuant revealed that over 330,705 ETH—valued at around $883 million—flowed into these addresses in a single day. This is the largest daily inflow on record, pushing the total ETH held by long-term holders to a staggering 19.24 million.

If you’re wondering what accumulation addresses are, think of them as vaults. These wallets receive ETH consistently without sending any out. They’re typically owned by long-term holders, institutions, or entities with a strategy to accumulate rather than trade. When inflows spike in these wallets, it’s usually a signal that confidence in Ethereum’s future is growing—and it often precedes price rallies.

A great example? Back in February 2023, when accumulation addresses hit a record inflow of 244,000 ETH, Ethereum’s price surged 35% over the following two months. It’s no guarantee, but history has a way of repeating itself in crypto.

Institutional Interest and Whale Activity Grow

Ethereum’s surge in accumulation isn’t just about retail investors; institutional interest is heating up too. Spot ETFs for Ethereum in the U.S. have seen a rise in inflows, almost matching the levels last seen during the market upswing following Donald Trump’s reelection in late 2024. This growing institutional activity suggests that bigger players are positioning themselves for the long haul.

At the same time, whale addresses—wallets holding between 10,000 and 100,000 ETH—have been steadily growing their balances. Even more intriguing is the increase in retail accumulation. Many smaller investors have taken advantage of Ethereum’s recent price dip to buy at multi-week lows, adding to the overall trend of long-term accumulation.

CryptoQuant analyst MAC_D points out that these large inflows reflect confidence in potential regulatory de-risking under Trump’s pro-crypto policies. It’s a clear signal that smart money is piling in, regardless of current price weakness.

Competition and the Road Ahead

Despite the positive signs, Ethereum’s journey won’t be without challenges. Its multi-year slump against Bitcoin is one of them, with the ETH/BTC pair still down significantly from its 2021 highs. Meanwhile, competition from layer-1 blockchains like Solana has been fierce. Solana’s rapid adoption and scalability have attracted projects in DeFi and NFTs, areas where Ethereum once dominated.