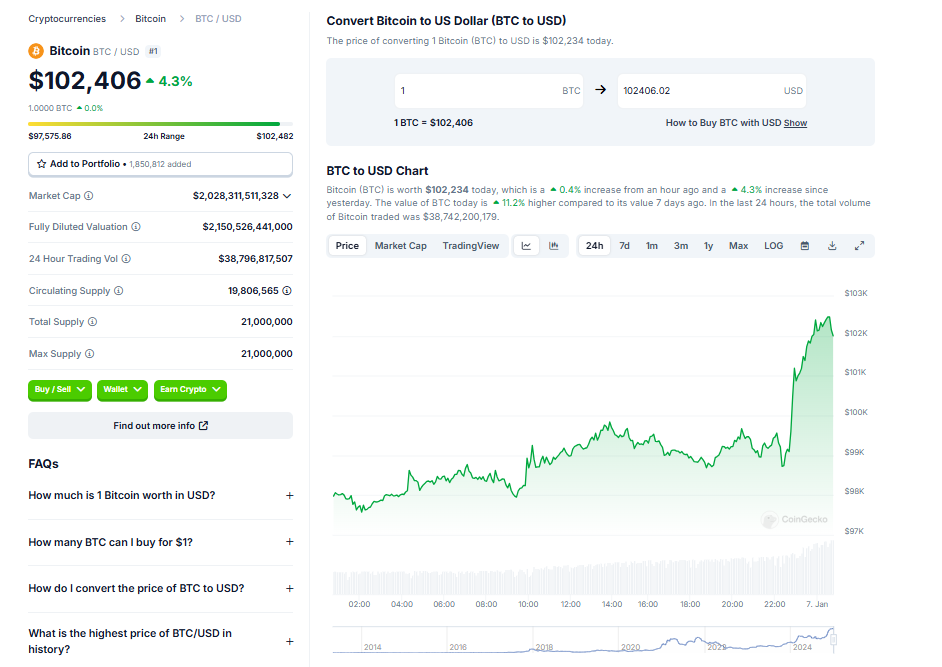

• Bitcoin (BTC) breaks the $100,000 level for the first time in 2025 on Monday, rallies to $101,184

• The move above the key level is likely driven by the return of institutional interest and rising BTC accumulation

• Bitcoin supply on exchanges shrinks, a bullish indicator for BTC price in the short term

Bitcoin, the leading cryptocurrency, has once again hit the impressive milestone of $100,000. It’s an event that has left the world asking – what’s next? This post delves into the factors driving this surge and explores the potential future of Bitcoin’s price.

The Bitcoin Surge: A Closer Look

Bitcoin crossed the $100,000 threshold early on Monday, the first time it has done so in 2025. This move is likely driven by a resurgence of institutional interest and rising Bitcoin accumulation. Additionally, Bitcoin supply on exchanges is shrinking – a bullish indicator for Bitcoin price in the short term.

Bitcoin’s Rise: Fueled by Two Key Catalysts

Bitcoin’s decline in institutional interest towards the end of 2025 was reversed in early January. Data shows a significant increase in Bitcoin tokens held off exchanges and a decrease in supply on exchange platforms. These metrics suggest a reduction in selling pressure and an increase in Bitcoin accumulation, supporting a bullish outlook for Bitcoin in the short term.

Market Movers Influencing Bitcoin’s Price

Bitcoin’s massive price increase following Donald Trump‘s win in the 2024 US Presidential election, and the subsequent appointments of pro-crypto candidates in key positions have fueled positive sentiment among traders. The new US administration’s expected embrace of crypto is also a key factor contributing to the rise in Bitcoin and crypto prices in 2025.

Bitcoin Price Forecast

Bitcoin price could retest resistance at $102,800. If successful, it could rally towards the all-time high of $108,353. On the downside, there’s a support zone between $95,151 and $96,100 which Bitcoin could test in the event of a correction. The Relative Strength Index and Moving Average Convergence Divergence further support Bitcoin’s recent gains.

Conclusion

Bitcoin hitting the $100,000 milestone signals strong investor confidence. However, the volatility of the crypto market means traders need to be aware of potential shifts. A daily candlestick close below the December 27 high of $97,544 could invalidate the bullish thesis for Bitcoin. As we navigate this exciting time for Bitcoin, the watchword is caution – the crypto market can be as unpredictable as it is promising.