- Ethereum fell by 10%, closing at $3,383 as selling pressure intensified.

- Key support stands at $3,490, with resistance observed near $3,750.

- Market sentiment remains cautious, influenced by macroeconomic factors and declining trading volumes.

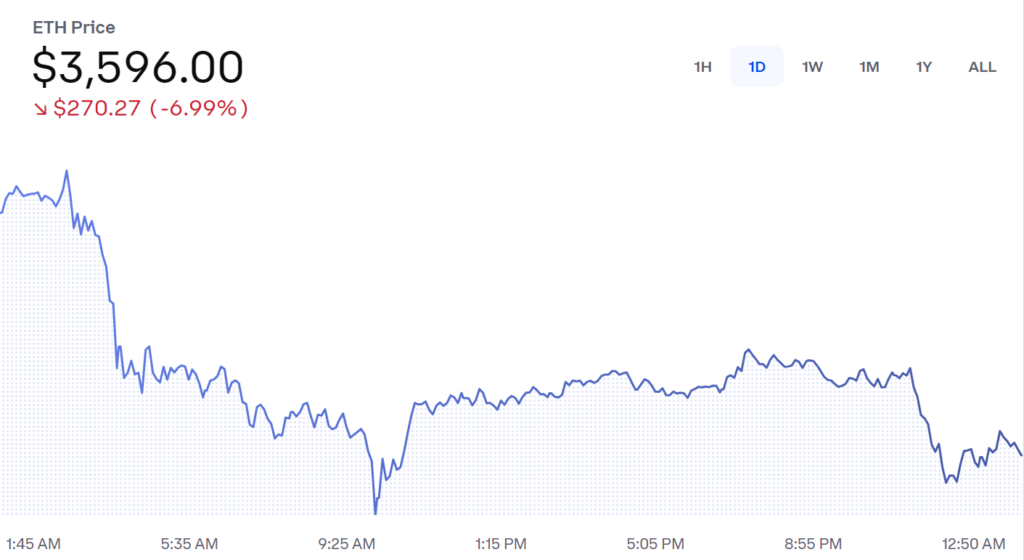

Ethereum faced a notable decline on December 19, 2024, losing over 0% of its value and closing the day at $3,383. The cryptocurrency experienced sustained selling pressure throughout the session, mirroring a wider downturn across the digital asset market.

The day on Coinbase began with Ethereum priced at $3,866, briefly attempting to test resistance levels. However, as the morning progressed, bearish sentiment overwhelmed the market, driving the price below $3,600 by mid-afternoon. Ethereum attempted a recovery during the late trading hours but faced stiff resistance, ultimately settling near its daily low.

Market Dynamics and Technical Insights

Ethereum’s downward trajectory aligns with the broader crypto market’s struggles. Analysts attribute the drop to a combination of macroeconomic concerns and cautious sentiment among traders. Key support has been identified at $3,400, a level that, if breached, could lead to further losses toward $3,200 or even $3,000. Resistance remains firm around $3,750, where significant selling pressure is evident.

Trading volumes for Ethereum have shown a noticeable decline, reflecting a lack of conviction among market participants. The Relative Strength Index (RSI) indicates that Ethereum is nearing oversold territory, suggesting that bearish momentum might ease in the short term. However, a meaningful recovery would require a reversal in sentiment and stronger buying activity.

The cryptocurrency’s performance has also been impacted by external factors, including interest rate decisions and regulatory updates, which have influenced market confidence. Ethereum’s role as a backbone for decentralized applications and smart contracts remains a strong fundamental driver, but short-term price movements are heavily tied to market conditions.

Outlook for Ethereum’s Price Action

Ethereum’s ability to maintain its position above the $3,500 support level will be crucial in determining its next move. If buyers re-enter the market, the cryptocurrency could aim for a recovery toward $3,750 or higher. On the other hand, persistent selling pressure might push prices further down, extending the current bearish trend.

Analysts are closely watching developments in the broader financial markets, as they play a pivotal role in shaping cryptocurrency sentiment. Ethereum continues to be a key player in the digital asset space, and its performance is likely to remain a barometer for the overall health of the market.