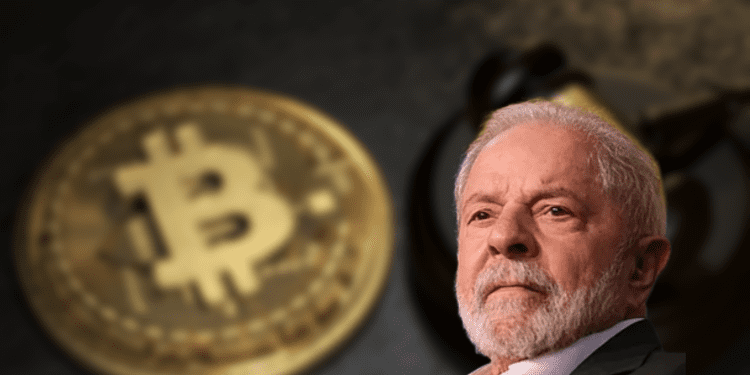

The presidential candidate that got many votes in the first voting round, Luis Inacio Da Silva, commonly known as ‘Lula,’ signaled his support to the Central Bank of Brazil. According to his views, the Central Bank would have to be responsible for building cryptocurrency regulations due to its autonomous character.

He added that the effects of cryptocurrencies must be measured to eliminate any adverse effects the national economy might suffer from crypto. Lula said that cryptocurrency has extensively developed lately, attracting regulators’ attention to the issue. Lula also said,

“The law framework should help to “avoid illegal practices that we can do using crypto assets, such as money laundering and currency evasion, in addition to avoiding fraudulent trading practices.”

Current Regulatory Attempts for Cryptocurrency

Currently, Brazil is in the phase of running its central bank digital currency, the digital era. Lula has been Brazill’s big supporter of the nation’s dependence on international dollar markets. In July, he promised to support Latam’s common currency issuance if he won the elections. Unfortunately, he did not talk more about the topic.

The Brazilian Congress’ deputy chamber is working on a cryptocurrency bill project independent of Lulu’s statements. The billing project has, however, not been discussed because most of the deputies’ and nation’s focus are now on the general elections. One setback is that if the bill’s discussion gets delayed and pushed to the coming year, the account will be forced to enlist a new rapporteur’s support.

Accordingly, the new deputies will have to analyze and discuss the project repeatedly, and this process would delay the current bill’s approval. Similarly, if Lula wins the elections this month, he could veto the passed laws, as seen before in other Latam countries.

Brazil Cryptocurrency Laws

The fiat currency in Brazil has been The Real since 1994, and it has a massive legal tender. Cryptocurrencies are classified as movable property and goods regardless of whether they are used privately or as an alternative payment method.

In May 2019, crypto assets were first defined when Brazil’s Federal Revenue (RFB) Office gave a normative ruling to introduce reporting transaction needs involving cryptos. Per Global Legal Insights, RFB Normative Ruling No. 1888/19 defined crypto assets as,

“a digital representation of value denominated in its unit of account, the price of which can be expressed in local or foreign currency, traded electronically using cryptography and distributes registration technologies, used as a form of investment, value transfer instrument or access to services, and that is not recognized as a currency.”

In early 2013, Brazil adopted a law that regulated the adoption of electronic currencies. In 2014, The Brazilian Central Bank made it clear in its policy statement that no monetary authority issues or guarantees virtual currencies, nor do they convert the virtual money to any sovereign currency.

Later in 2017, Brazil adopted a policy that warned companies selling and storing crypto does not have regulation, nor are they supervised by national authorities. In 2018, Brazil adopted a decree that gave guidelines, strategies, and rules to approach digital transformation policies.

This was accompanied by a 2020 policy to embrace the possibilities of improving digital public administration services. Currently, Brazil has a bill concerning cryptocurrency waiting to be discussed and voted for as well as Lula’s support for the involvement of the Central Bank in Crypto.