• BlackRock, the world’s largest asset manager, now refers to Bitcoin as a “global monetary alternative”

• BlackRock’s presentation compared Bitcoin’s features to conventional financial assets like U.S. Treasuries and gold, highlighting Bitcoin’s fixed supply and decentralized nature

• The presentation explored scenarios where Bitcoin was allocated 1% to 5% of a portfolio, showing that despite higher volatility, portfolios with Bitcoin experienced better returns and risk-adjusted metrics

BlackRock, the world’s largest asset manager, has officially changed its perspective on Bitcoin. It now refers to the cryptocurrency as a viable global monetary alternative. This shift in perspective indicates growing acceptance of Bitcoin in mainstream finance.

BlackRock Highlights Bitcoin’s Fixed Supply

In a recent presentation, Jay Jacobs, the US Head of Thematic and Active ETFs at BlackRock, compared Bitcoin’s features to conventional assets like gold, Treasuries, and the US dollar.

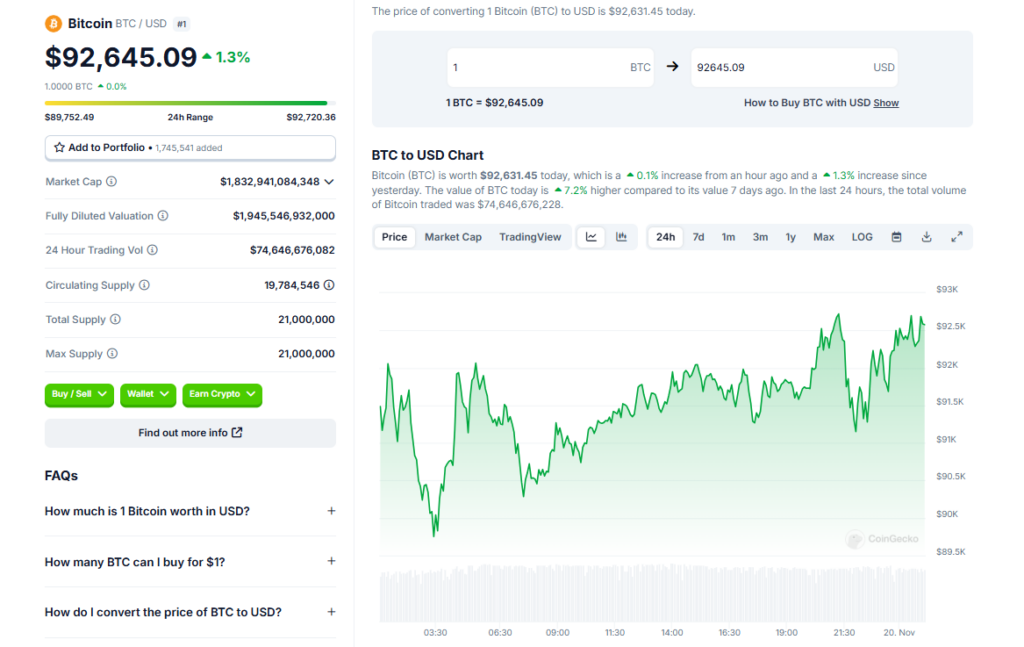

A key takeaway is that unlike the variable supply of US dollars, BlackRock views Bitcoin’s supply as fixed. While the supply of US Treasuries and gold is somewhat fixed, Bitcoin’s supply is predetermined and capped at 21 million coins.

Bitcoin’s Volatility vs. Gold and Stocks

Another distinction highlighted is Bitcoin’s relatively high volatility compared to gold and Treasuries, which have longer track records. However, Bitcoin’s volatility has declined over time as it matures.

In terms of relationships with other assets, Bitcoin has little correlation with stocks but is similar to gold as a decentralized store of value.

Bitcoin Diversifies Investment Portfolios

The presentation examined Bitcoin’s potential impact on conventional investment portfolios. Despite higher volatility, portfolios with modest (1-5%) Bitcoin allocations experienced better overall returns and risk-adjusted metrics.

While higher Bitcoin allocations increased returns, they also amplified drawdowns and risks. Nonetheless, Bitcoin provides portfolio diversification due to its low correlation with stocks.

Conclusion

As influential institutions like BlackRock recognize Bitcoin as a viable global asset, it could continue bridging the gap between crypto and mainstream finance. While risks remain, BlackRock’s evolving perspective highlights Bitcoin’s potential as a portfolio diversifier and alternative monetary system. Greater adoption by traditional finance giants seems imminent.