- Traders lost about $1 billion betting in the crypto market as Bitcoin took a pause after its recent rally.

- The volatility caused over $900 million in liquidations on crypto-tracked futures, impacting both long and short positions.

- Despite the pause, bullish sentiment remains strong as many investors anticipate Bitcoin will continue setting new records and approach $100,000 by the end of the year.

The cryptocurrency market saw a brief pause in its recent rally following the U.S. election, but the overall bullish sentiment remains strong. Traders anticipate the market will resume its push upwards soon.

Massive Liquidations Cause Chaos

The volatility this week caused over $900 million in liquidations on crypto futures, impacting both longs and shorts. According to Coinglass, 262,620 traders were liquidated for a total of $968.18 million. The huge amount of leverage in the market led to the massive liquidations.

Bitcoin and Ethereum See Price Drops

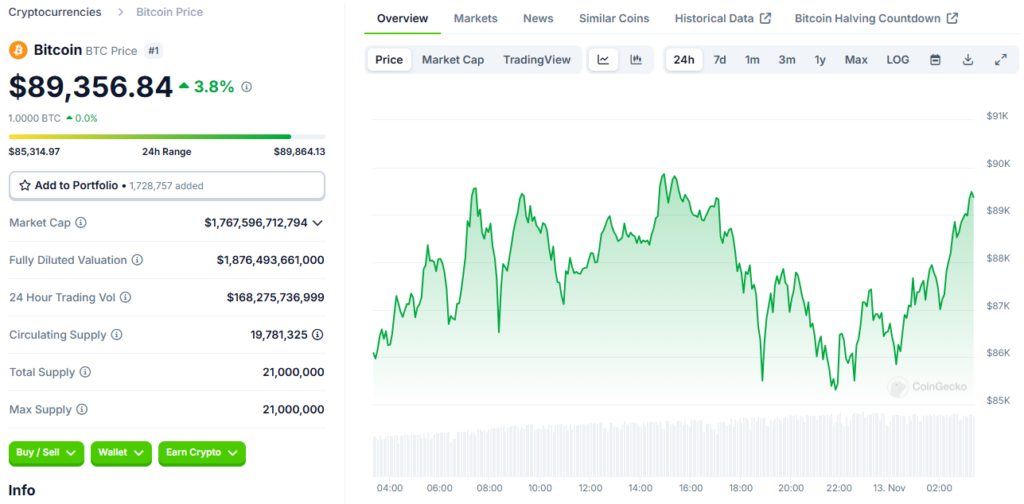

Bitcoin dropped to $85,300 on Tuesday after reaching $89,623 on Monday. Ether also fell 3% on Tuesday after gaining 33% the previous week. However, Bitcoin has still increased 26% since election day in early November, showing the bullish trend is intact.

Investor Sentiment Remains High

Many investors believe Bitcoin will continue setting new highs as it approaches $100,000 later this year. The market correction is seen as minor, and Bitcoin should find strong support between $86,500-$84,000. The euphoria surrounding Trump’s win is keeping sentiment high.

Altcoins See Mixed Reactions

Besides Ethereum’s drop, meme coin Shiba Inu fell 4% on Tuesday after surging 57% the week before. Altcoins saw mixed reactions compared to Bitcoin’s dominance of the overall market share.

Long-Term Owners Still Holding

According to Bitwise’s Matt Hougan, longtime Bitcoin owners have not sold yet below $100,000 despite the chance to take profits. This lack of selling pressure has supported the rally. Additionally, asset managers continue pouring money into Bitcoin ETFs.

Regulatory Hopes Under Trump

President-elect Donald Trump has pledged to improve the regulatory climate for cryptocurrencies. Currently, most crypto assets operate in a legal grey area besides Bitcoin. Many hope a Republican administration could provide more clarity.

The Market Cap Expands

The total crypto market cap currently sits around $3 trillion. Analysts predict it could reach $10 trillion by 2026 if the bull run continues. The market cap is now larger than individual big tech giants like Amazon, Google, Microsoft, and Apple.

Conclusion

While the market may see short-term pullbacks, the overall picture is still extremely bullish. Traders expect a slower rise to $100,000 from current levels. With growing mainstream adoption, the future looks bright for cryptocurrencies.