- Ethereum has been lagging behind Bitcoin’s rally by 50%, and a break below $2121 targets $700-1000 for Ethereum.

- To start a more meaningful rally, Ethereum bulls need to push the price over $2800.

- The analysis suggests that Ethereum’s price action may still be stuck in a more significant 4th wave correction, targeting $700-1000, before potentially staging its next bull run.

Ethereum has been lagging behind Bitcoin’s rally by 50%. Unless Ethereum bulls can push the price over $2800, a break below $2121 is likely to target $700-1000. Ethereum needs to start a more meaningful rally to catch up to Bitcoin’s gains.

Price Reflects Market Opinion

Ethereum vs Bitcoin Performance

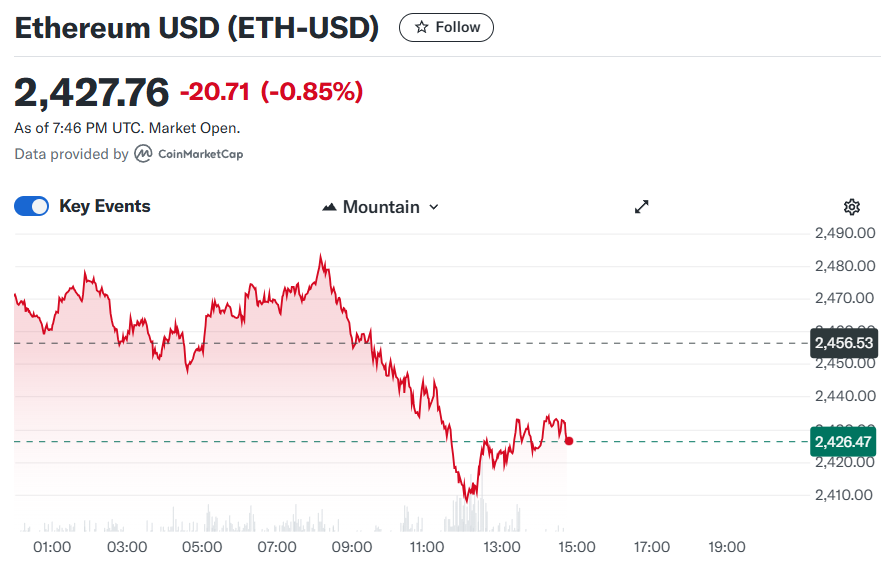

Ethereum bottomed out on August 5 at $2121, just like Bitcoin. But that’s where the similarity ends. Since then, Ethereum has only gained 50% while Bitcoin has climbed 27%. Also, Bitcoin is just 2% away from its all-time high. In contrast, Ethereum still needs to rally 50% to reach its previous peak.

Lackluster Performance

Due to Ethereum’s lackluster performance, we have not provided any public updates. In our last analysis, we questioned whether Ethereum would reach $900 or $9000. Now $900 looks more likely unless Ethereum can break above and hold $2800. We don’t know why Ethereum is lagging, but the reason doesn’t matter. The price reflects the aggregate market opinion of Ether‘s value. Currently, that combined opinion has soured.

Failed Technical Breakout

Moreover, Figure 1 shows that Ethereum failed to clear the 2nd warning level for bears that we highlighted in September. After two months of sideways price action, Ethereum has gone nowhere.

Corrective Price Action

More Significant Correction

The overlapping price action suggests a correction is underway. As a result, it now seems likely August/September low was not a W-4 wave bottom. That means the March high was not a W-3 wave top either, but rather a W-C wave. This points to Ethereum still being stuck in a more significant 4th wave, targeting $700-1000 (see Figure 2).

Extensive B Wave Rally

In that case, the rally from the 2022 low of $833 to the 2023 high of $4092 was an extensive B wave. A final W-C wave to $700-1000 now looks to be underway to complete the correction. To confirm this, Ethereum needs to break below the August/September lows. Ideal bearish confirmation would be a break below $2800.

Conclusion

Our speculation on Ethereum’s lagging performance is irrelevant. The price action is what matters. We now have clear parameters to indicate whether Ethereum will rally more directly above $2800 or revisit triple digits below $2121 before advancing again. Only the price will tell.