British investors have been turning to Bitcoin (BTC) as a hedge against instability as the Sterling pound (GBP) continues to weaken against a strengthening United States dollar (USD.

Bitcoin Trading Volumes Against GBP Explode

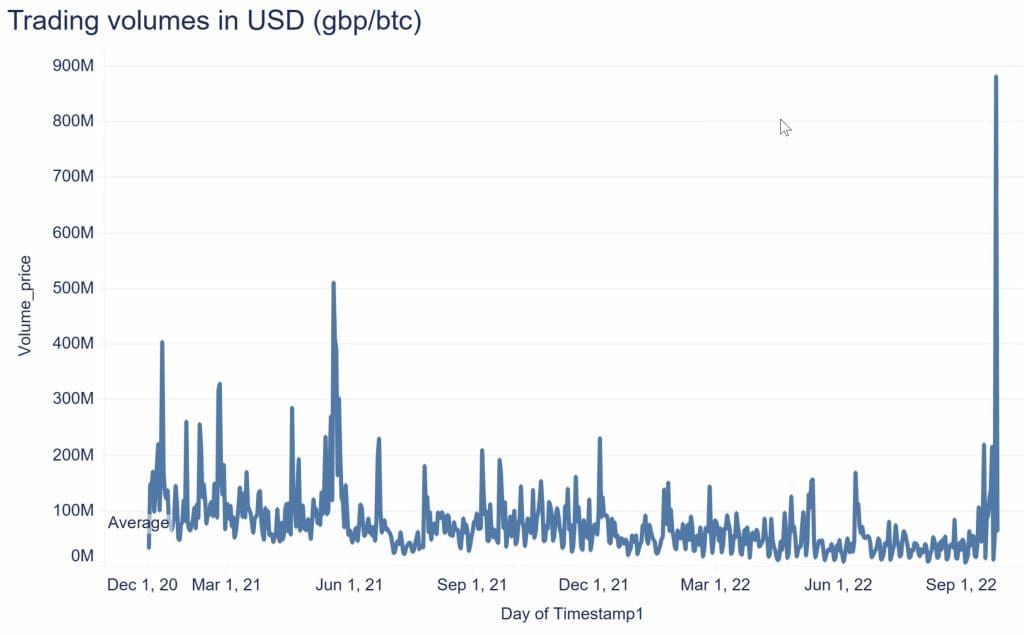

Investors’ increasing interest in the big crypto was highlighted by the skyrocketing BTC/GBP trading volume. According to data shared by James Butterfill, the Head of Research at Coinshares, Bitcoin’s trading volume against the British pound on exchanges hit a record high of $881 million, up from a daily average of $70 million. This represented an over 1,150% rise from the normal levels.

The data also revealed that the BTC/GBP trading volume has soared by over 878% in the past 30 days and 1,431.76% over the previous year.

Besides the British pound, data shared by Butterfill also revealed an increase in trading volume of other major world currencies with flagship cryptocurrency. For example, the BTC/EUR trading volume had spiked 84.84% over the past month. At the same time, the BTC/USD trading volume climbed by 66.52% in the last 30 days. This increase was 29.52% for the Japanese Yen and 23.65% for the Mexican Peso over the same period.

The data also showed that Bitcoin trading volume against major stablecoins has also surged. For example, the BTC/USDT trading volume had spiked 38.39% over the past month and 58.24% over the year.

According to Butterfill, the data points to investors favoring Bitcoin when a fiat currency is threatened. His September 27 tweet read:

“#Bitcoin volumes against #GBP were US$881m yesterday (US$70m average) when a FIAT currency is threatened, investors start to favor Bitcoin.”

Butterfill’s remarks are about investors’ behavior observed during previous currency meltdowns marked by increased funds flow into Bitcoin as a hedge against inflation. Similar trends have previously been observed in Turkey, Argentina, Venezuela, and Nigeria, where citizens’ crypto adoption seems to rise.

The shift from GBP to BTC comes after British Prime Minister Liz Truss’s proposal to increase government borrowing to pay for tax cuts sparked concerns and fears that it might worsen inflation. The situation led to a drop in the pound’s value, sending it to historical lows, which forced the Bank Of England to state on Wednesday to calm down the markets.

Implications Of A Weak British Pound

As the pound dropped to record lows, British citizens are increasingly pumped funds into the crypto sector. A recent report by VoucerCodes released on September 23 shows Britons have spent $34.7 billion investing in cryptocurrencies. The report indicated that each Brit spent an average of $433 on cryptos.

According to the data, more than a third of British citizens own different cryptocurrencies. Among the top cryptos owned are Bitcoin (BTC) with a share of 20%, Ether (ETH) at 8%, and Dogecoin at 6%. This is proof that Britons are increasingly embracing digital assets.

According to Bloomberg, the British pound collapse has not only impacted investor behavior but is also likely to dent the reputation of the U.K. government on the global stage. According to Bloomberg analysts, the U.K. is facing a “self-inflicted financial crisis” that has left international players concerned about its ability to repay its debts.

The price of Bitcoin (BTC) has responded positively to the frenzied British investors. BTC is trading at $19,520, up 0.5% in the last 24 hours and 1.5% for the week after reaching a weekly high of $20,383, according to data from CoinMarketCap.

With the Brits turning their attention to Bitcoin and cryptocurrencies, the situation partly validates the concept by crypto advocates that Bitcoin can act as a hedge against inflation.