• Salim Ramji, the incoming CEO of Vanguard, stated that the company will not launch its own spot bitcoin ETF.

• Ramji did not address whether Vanguard will offer its clients access to other available spot bitcoin ETFs.

• Ramji previously headed the global iShares business at BlackRock, where he played a role in the company’s decision to offer and win approval for a spot bitcoin ETF.

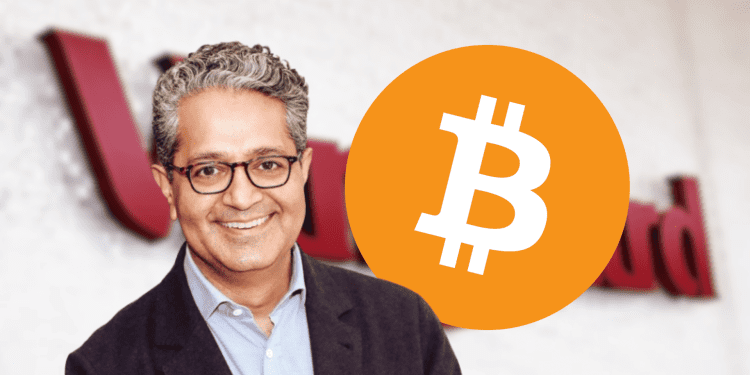

The new CEO of Vanguard, Salim Ramji, has indicated he will not reverse the company’s decision to not offer a bitcoin exchange-traded fund (ETF).

Vanguard’s Stance on Bitcoin ETFs

Ramji told Barron’s that “It is important for firms to have consistency in terms of what they stand for and the products and services they offer.” He agreed with Vanguard’s chief investment officer Greg Davis that a bitcoin ETF would be inconsistent with Vanguard’s investment philosophy.

Ramji did not address whether Vanguard will offer its clients access to existing spot bitcoin ETFs launched by other companies. Vanguard has faced criticism for not allowing clients to trade these products since they became available in January 2023.

Ramji’s Background

At BlackRock, Ramji headed the iShares ETF business and supported that company’s efforts to launch a spot bitcoin ETF. He left BlackRock in January 2023 to succeed Tim Buckley as Vanguard’s CEO starting on July 8, 2023.

Given his bitcoin ETF experience at BlackRock, some expected Ramji might change Vanguard’s stance. However, in the Barron’s interview, he made clear this will not happen under his leadership.

Bitcoin and Crypto Remain Controversial

Vanguard and some other traditional asset managers remain wary of offering crypto investment products. They view bitcoin as too volatile and speculative for most retail investors.

However, as cryptocurrencies continue to gain mainstream adoption, the pressure on Vanguard and its peers to provide access will likely intensify. For now, Vanguard is sticking to its conservative approach according to its incoming CEO.