OpenSea, the largest NFT marketplace in the world, has turned into a ghost town after witnessing a massive drop in daily trading volumes over the last 90 days. The ongoing debt crisis on the crypto lending platform BendDAO increases the risk of the NFT bubble bursting.

NFT Trading Volume on OpenSea At Record Lows

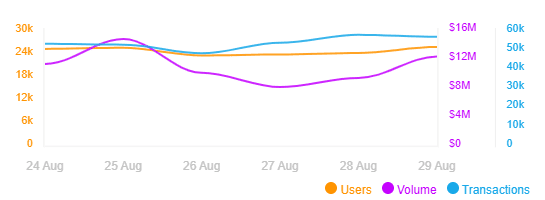

OpenSea processed approximately $12.36 million worth of non-fungible tokens (NFTs) on August 29, tanking about 99% from its record high of $405.74 million reached on May 1, according to data from DappRadar.

Similarly, the number of users has plummeted from a peak of around 49,500 in January to 25,490 on August 29. Daily transactions have also plunged 34.5% from 85,500 to 56,000 over the same period.

The massive declines in daily trading volumes, number of users, and transactions suggest that the value and interest of NFTs have diminished over the last three months due to the crypto market downturn.

These declines are coming when the NFT marketplace is reducing its headcount by 20%, citing the need for the company to adapt effectively to the current conditions in the market. Confirming this reduction in the workforce, OpeanSea’s CEO, Devin Finzer, said,

“We need to prepare the company for the possibility of a prolonged downturn.”

The declining NFT trading volumes coincide with similar drops in crypto prices and the value of stocks as investors drop off risky assets over fears that increased interest rates and runaway inflation would force world economies into a recession.

NFT Floor Prices Drop Significantly

Top NFT collections have also been witnessing severe drops in terms of trading volumes, many sales, and floor prices. For example, one of the leading digital collectibles, the Bored Ape Yacht Club (BAYC) NFTS, has experienced an approximately 15% drop in daily trading volumes over the last month, along with a 32% decline in sales.

Its floor price – the minimum amount a collector is ready to pay for an NFT – has dropped by approximately 53% from a high of 153.7 ETH (~$434,050) on May 1 to 72.5 ETH (~$114,910) on August 29, according to data from CoinGecko.

Meanwhile, the floor price of CryptoPunks, another leading NFT collection, plummeted approximately 20% from a high of 83.72 ETH (~$132,361) on July 18 to 67.45 ETH (~$107,043) on August 29. Moreover, data from NonFungible.com, a website that tracks the performance of the NFTs market, reveals that search volumes related to NFTs have also declined tremendously. The NFT search volumes have drooped roughly 80% from their peak levels in September 2021.

Is the NFT Bubble Ready To Burst?

NFT prices are valued in terms of the native currency of the blockchain upon which they are built. Thus, digital art created on Ethereum is quoted in Ether (ETH). Similarly, an NFT collectible developed on the Solana blockchain is purchased using SOL.

This also means that NFT prices fall as the valuation of the cryptocurrency they are quoted in plummets. A bearish crypto market appears to be one of the key drivers behind poor NFT prices, sales, and transaction volumes. Notably, the total crypto market capitalization has fallen from its peak of $3 trillion on November 10, 2021, to below $1 trillion in August 2022.