- The chair of the Commodity Futures Trading Commission urged Congress to pass new legislation providing a regulatory framework for cryptocurrencies. He said 49% of the CFTC’s actions last year involved digital assets.

- The CFTC chair told Congress that Bitcoin and Ethereum are considered commodities, not securities, since they don’t meet the criteria. He acknowledged the strong investor appetite for Bitcoin regardless of government recognition.

- In his testimony, the CFTC chair highlighted the growing prominence of crypto markets and pressed Congress to pass legislation that protects investors while enabling responsible innovation in the sector.

The chair of the Commodity Futures Trading Commission (CFTC) recently urged Congress to provide much-needed crypto regulation through new legislation. His testimony highlighted the growing relevance of digital assets like Bitcoin and Ethereum, while emphasizing the importance of appropriate investor protections.

The Need for Crypto Legislation

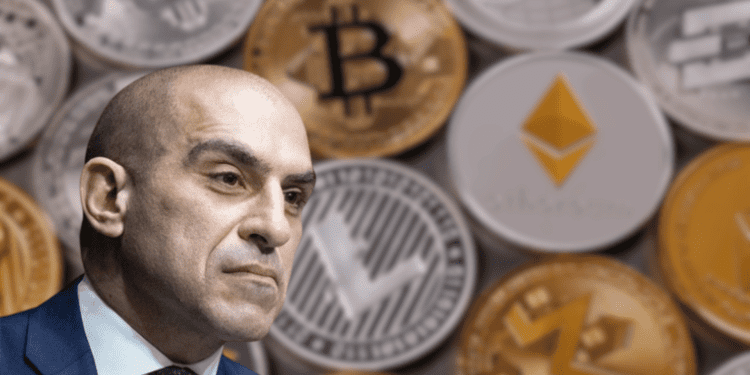

During a budget hearing before the House Agriculture Committee, CFTC chair Rostin Behnam told Congress that the notion crypto is going away is false. He explained that 49% of CFTC actions in the past year involved digital assets, despite no federal agency having direct oversight of the industry. Behnam called for proactive legislative measures to ensure regulatory clarity. He estimated needing 12 months to develop a comprehensive framework if Congress passes the Financial Innovation and Technology (FIT) Act.

Classifying Leading Cryptocurrencies

When asked about labeling cryptocurrencies as commodities or securities, Behnam said Bitcoin and Ethereum are considered commodities since they do not meet the criteria to be securities. He acknowledged the strong investor appetite for Bitcoin regardless of government recognition. While regulators have struggled to fit crypto into existing frameworks, Behnam admitted the industry needs to be considered on its own.

Conclusion

In his testimony, the CFTC chair highlighted the growing prominence and maturity of the crypto markets. He pressed Congress to provide legislative guidance to protect investors while enabling further responsible innovation. The hearing shed light on regulators’ evolving perspective on digital assets as they aim to develop tailored oversight of this unique sector.