- The bankruptcy administrators have filed a proposed plan to see a possible restart of FTX.

- The re-booted exchange would only be available to offshore customers.

- FTT token holders will not receive any distribution under the plan.

The collapsed crypto exchange FTX exchange has unveiled a new draft plan to “reboot” nearly nine months after sliding into bankruptcy. According to a draft plan filed on July 31, FTX presented a plan to classify its creditors into different classes of claimants and to seek the help of third-party investors from among these classes to revive the now-defunct exchange. However, the rebooted exchange would be available only to offshore customers.

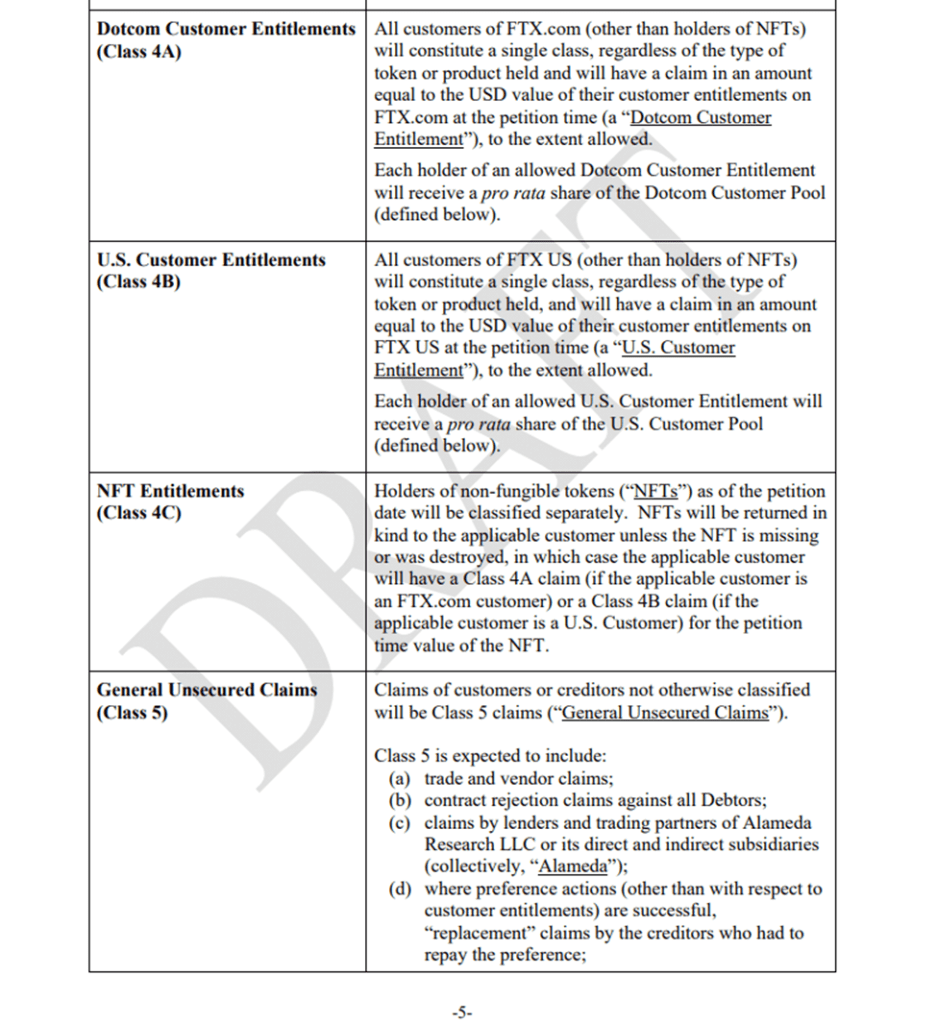

The draft plan outlines the debtors’ strategy to categorize claimants into distinct groups. Users of the FTX.com offshore exchange will be classified as “Dotcom customers.” In contrast, FTX US users will be identified as “U.S. customers.” The customers of its NFT exchange are categorized, along with general unsecured, secured, and subordinated claims. The general claims include those from Alameda’s lenders or trading partners. Additionally, the subordinated claims pertain to taxes and fines arising from penalties.

The proposal states that “each holder of the Permitted Dotcom Customer Entitlement shall receive a pro-rata share of the Dotcom Customer Pool. On the other hand, “each holder of the Permitted U.S. Client Eligibility shall receive a proportionate share of the U.S. Client Pool. The proposal stated:

“Instead of all cash, the Borrowers may stipulate that the Offshore Exchange Company send non-cash consideration to the DotCom Client Pool in the form of equity securities, tokens, or other interests in the Offshore Exchange Company, or the right to invest in such equity securities, tokens or other interests.”

However, the filing indicates claims from FTT holders that the collapsed exchange’s native token “will be canceled and extinguished as of the Effective Date, and holders will not receive any distribution. Claims from non-customers, such as those for regulatory penalties and taxes, will be subordinated.

The draft plan, open to amendments based on feedback from Consulting Parties and other stakeholders, presents a novel approach to resolving the complex issues surrounding the collapsed cryptocurrency exchange.

FTX 2.0 Reboot Has Been In The Works

Potential FTX reboots have already been hinted at, as seen by interim CEO John Ray III’s fillings from May, where he talked of an “FTX restart” or a “2.0 reboot.” In a court filing on May 22, the FTX team presented a compensation report outlining the efforts made by Ray during the Chapter 11 bankruptcy proceedings, highlighting his work to safeguard the debtor’s interests. However, mentioning a possible reboot of FTX drew significant interest from the crypto community.

In January, Ray first discussed rebooting the struggling crypto exchange. During that period, news reports indicated that the bankrupt exchange had identified $5.5 billion in liquid assets, and the new CEO was collaborating with creditors to devise a revival strategy. Subsequently, in April, the exchange managed to recover $7.3 billion in assets. As a result, the FTX team has set a target to restart the exchange by the second quarter of 2024.