- Polymarket odds show 70% chance BTC dips under $100K before 2026.

- ETF outflows, liquidations, and risk-off macro sentiment add pressure.

- Gold’s surge and strong dollar pull liquidity from crypto markets.

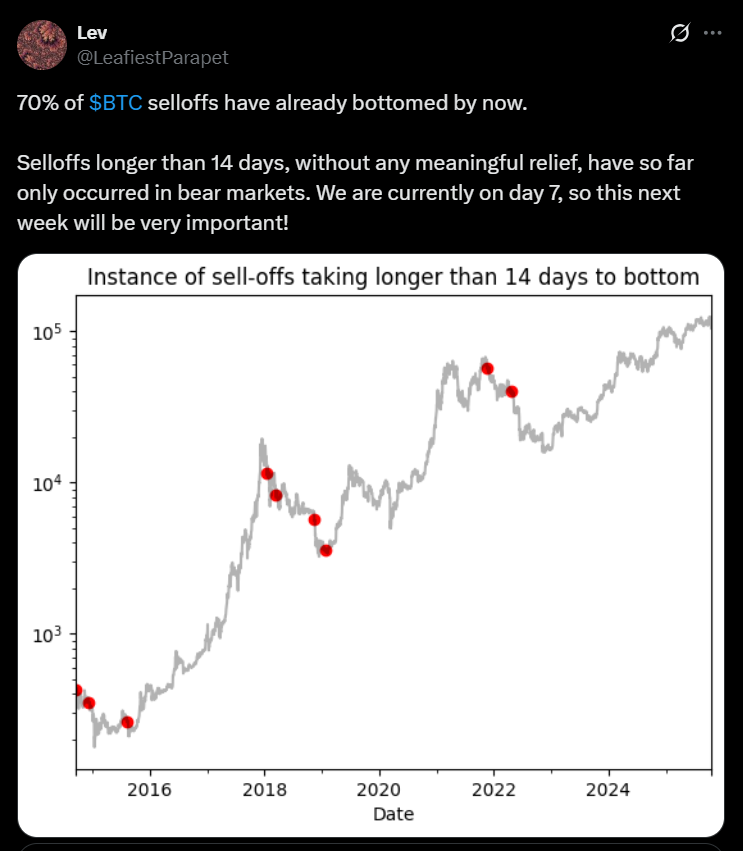

Prediction markets are turning cautious. On Polymarket, traders are giving roughly 70% odds that Bitcoin dips below $100,000 before the end of 2025. The question—“Will Bitcoin dip below $100K before 2026?”—has seen heavy volume, and right now, the bearish side holds the edge. Prices shift quickly, but today’s tape clearly favors a pullback.

ETF Outflows and Leverage Pressure

Flows and leverage are flashing red. Spot Bitcoin ETFs saw about $536 million in outflows this week—the biggest since August. When that happens, market makers unwind hedges and liquidity thins out, making every drop sharper. Meanwhile, futures traders are getting squeezed: roughly $0.8–$1.2 billion in liquidations hit over 24 hours as BTC briefly touched $107K. With thin books and cascading stops, even a short-term panic could easily wick prices under $100K before stabilizing.

Risk-Off Sentiment Returns

Macro worries are back in play. Talk of U.S. tariffs on China resurfaced, European bank stocks sold off, and U.S. regionals sparked credit jitters again. Stocks slid, yields rose, and crypto felt the pinch—BTC sank to a 3-month low near $104.7K, roughly 17% below recent highs. When the market goes risk-off, traders pull capital from volatile assets first, leaving Bitcoin exposed to another sharp leg down, especially with weekend liquidity drying up.

Gold Steals the Spotlight

Safe-haven demand is heading elsewhere. Gold is surging on central bank buying and macro fear, hitting new highs with India’s reserves topping $100B and a 65% year-to-date rally. Analysts are now talking about $4K–$5K gold in 2026. Combine that with a firm U.S. dollar (DXY ~99), and risk capital naturally flows out of BTC. Gold looks stable, Bitcoin looks risky—and capital follows safety when nerves are high.