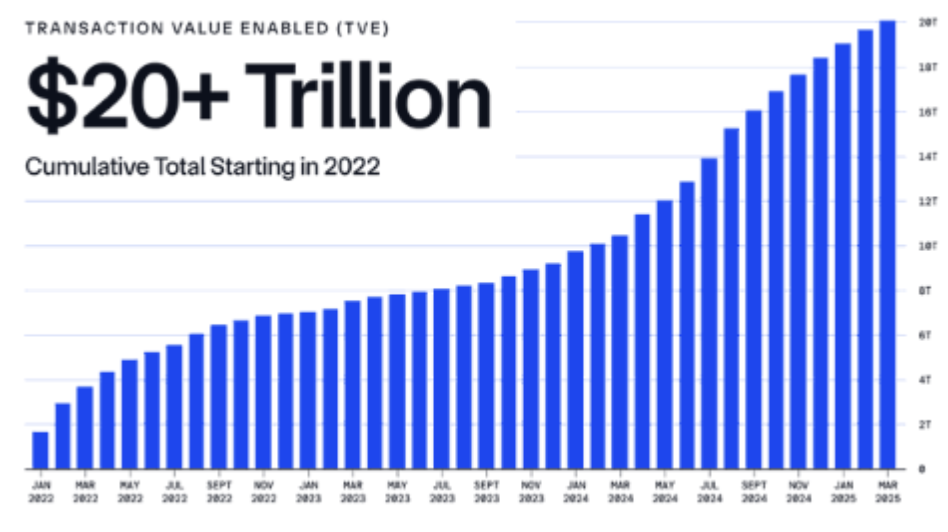

- Chainlink has facilitated over $27.6 trillion in verified transaction value, positioning itself as core financial infrastructure

- Major banks and institutions are moving from pilots to real integrations using Chainlink’s data and interoperability tools

- The platform has evolved into a full computing environment, aiming to simplify cross-chain and offchain workflows

Chainlink has spent years carving out a role that sits somewhere between traditional finance and blockchain, and lately, that position is getting harder to ignore. The decentralized computing network has now enabled more than $27.6 trillion in transaction value, a number that puts it in a very different category from most crypto projects.

Rather than chasing narratives, Chainlink has focused on plumbing. Data verification, interoperability, and secure execution. That focus is why both financial institutions and decentralized protocols continue to rely on it as the connective tissue between old systems and new ones. Whether it’s banking rails, capital markets, or DeFi platforms, Chainlink keeps showing up in the background.

Tapping Into a $867 Trillion Opportunity

The scale of what Chainlink is targeting is hard to wrap your head around. Global financial assets are estimated at around $867 trillion, yet only about 0.1% of that value exists onchain today. The rest remains locked inside legacy infrastructure that was never designed to talk to blockchains.

This is where Chainlink fits in. Its oracle and verification systems provide the secure data layer needed to move real-world assets onchain without breaking trust assumptions. So far, the network has facilitated over $27.6 trillion in verified transaction value and delivered more than 19 billion cryptographically verified messages to blockchains.

That’s not abstract activity. Each message represents data that smart contracts can actually rely on. Today, more than 2,500 projects integrate Chainlink across DeFi, gaming, supply chains, and financial services, showing how broadly its infrastructure is being used.

Banks and Institutions Are Moving Beyond Experiments

Chainlink’s institutional footprint has expanded quickly, and not just through pilot programs. Major players like Swift, J.P. Morgan, and Fidelity are already using the network to explore tokenization and settlement workflows. Euroclear, UBS, and ANZ have followed, alongside digital asset banks such as Sygnum and SBI Digital Markets.

Recent reporting reinforces that momentum. CoinDesk highlighted Trump-backed World Liberty Financial selecting Chainlink’s data services. FinTech Futures covered Brazil’s central bank working with Chainlink and Microsoft on a CBDC trade finance pilot. Yahoo! Finance reported on Sygnum and Fidelity International partnering through the network.

Even payments giants are circling closer. Watcher.Guru noted Visa and PayPal expanding stablecoin initiatives alongside Chainlink and Swift milestones, while Crypto Briefing reported Colombia’s largest bank tapping Chainlink for stablecoin transparency. These aren’t fringe experiments anymore. They’re early signs of production-grade adoption.

From Simple Oracles to a Full Computing Platform

Chainlink today looks very different from what it was at launch. Back in 2019, it started with basic data feeds, Any API, and Flux Monitor. That was enough to solve early oracle problems, but it didn’t stop there.

Over time, the platform added Verifiable Random Function for gaming, Proof of Reserve for asset verification, Off-Chain Reporting, and automation tools. In 2023, the launch of Cross-Chain Interoperability Protocol pushed things further by creating a standard for moving value across chains.

More recent upgrades include Chainlink Functions, Data Streams, the Transporter bridging app, and the Digital Assets Sandbox. Features like the Privacy Suite and VRF 2.5 are clearly aimed at institutions that need confidentiality alongside transparency.

The next step is the Chainlink Runtime Environment. CRE is designed to let developers coordinate workflows across onchain contracts and offchain systems in a single environment. The goal is speed and simplicity, cutting development cycles from weeks down to hours. An upcoming bootcamp on January 21–22 will showcase this by walking developers through building prediction markets using CRE.

Chainlink isn’t flashy, and it doesn’t need to be. Its value shows up in the systems that keep running, quietly, as more of the financial world inches onchain.