- Zcash (ZEC) hit a $10.6B market cap, outperforming Monero and other privacy coins.

- Influencers and cultural momentum revived interest in financial privacy and on-chain anonymity.

- Zcash’s hybrid model makes it a compliant yet privacy-preserving alternative in 2025’s market.

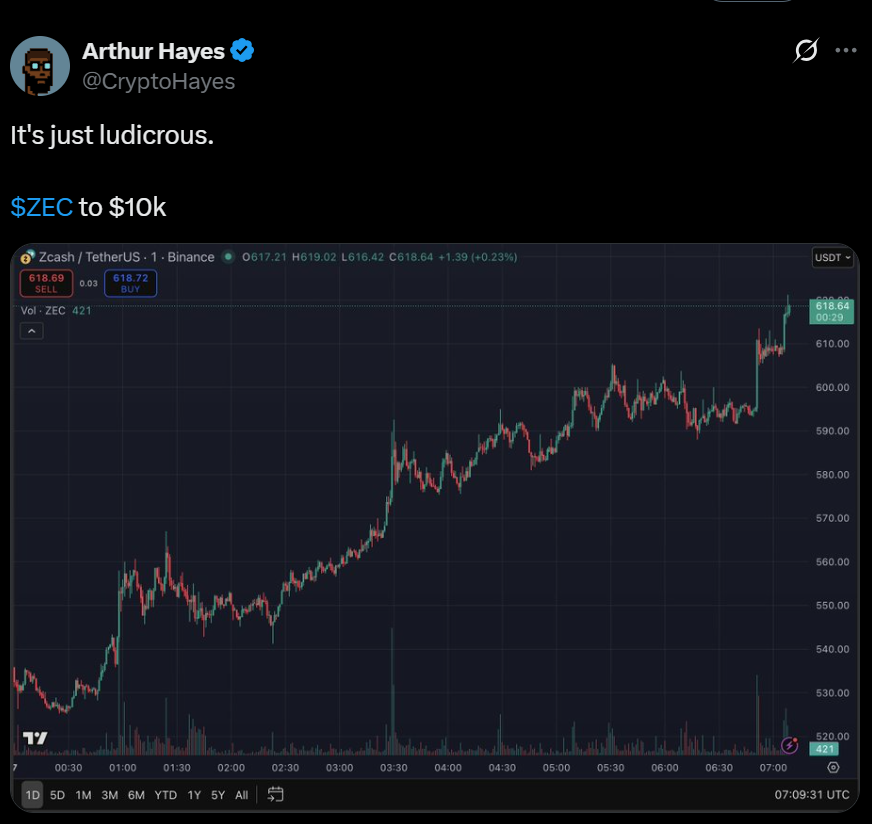

Zcash (ZEC) has taken the spotlight in a market otherwise cooling off, soaring past a $10.6 billion market capitalization and positioning itself as one of the year’s biggest comeback stories. The privacy-focused cryptocurrency briefly reached $655 before settling around $632, making it the 12th-largest crypto asset by market cap, according to CoinMarketCap.

ZEC’s price has surged 23% in the last 24 hours and over 63% in the past week, outperforming not only its peers in the privacy sector but much of the broader crypto market.

Zcash Leads 2025’s Privacy Revival

While Bitcoin (BTC) and Ethereum (ETH) consolidate near $100,000 and $3,200, respectively, traders have shifted focus to privacy coins, with Zcash leading the pack. Other major privacy tokens like Dash (DASH), Decred (DCR), and ZKsync (ZK) also posted strong weekly gains of 141%, 96%, and 122%, respectively. In contrast, Monero (XMR) — once the gold standard for privacy — rose just 12%, weighed down by exchange delistings and regulatory scrutiny.

Zcash’s dual-mode architecture, which offers both transparent and shielded addresses, has helped it succeed where other privacy coins struggled. The design allows ZEC to operate within regulatory frameworks while preserving user anonymity, making it appealing to institutions and retail investors alike.

A Cultural and Narrative Shift Toward Privacy

The latest surge is being driven by a powerful social and cultural narrative. Advocates such as Arthur Hayes, Naval Ravikant, Mert Mumtaz, and Threadguy have spent months emphasizing Zcash’s role as a true privacy solution in a surveillance-heavy financial world. Their discussions, podcasts, and posts have fueled an organic movement, sparking widespread retail and institutional curiosity.

According to Alex Bornstein, executive director of the Zcash Foundation, the wave of advocacy was not a paid campaign. “This is a spontaneous cultural shift,” he said, noting that the renewed demand for privacy reflects growing distrust of financial surveillance and a return to the cypherpunk roots of crypto.

Zcash’s Hybrid Model Gives It an Edge

Unlike Monero, Zcash’s hybrid approach allows users to choose between public transparency and full privacy, balancing regulatory compliance with personal freedom. This model has made ZEC a safer bet for investors wary of delistings while still offering the anonymity that defines the privacy coin narrative.

Still, not everyone shares the optimism. Samson Mow, CEO of Jan3 and a staunch Bitcoin advocate, advised investors to “figure out their positions,” even comparing Zcash to Dogecoin. His remarks, however, have done little to dampen enthusiasm as Zcash continues its momentum toward the top 10.