- Zcash developers left ECC to form a new company but will continue building the protocol.

- The Zcash network itself remains unaffected, with no change to core functionality.

- Price volatility reflected governance uncertainty, not technical risk.

Zcash saw a sharp bout of volatility on Thursday after the core development team behind the privacy coin announced it had left to form a new company. The move followed a governance dispute with Bootstrap, the nonprofit organization created to support the network. On the surface, it looked like a major fracture. ZEC dropped as much as 19% on the day, interrupting what had otherwise been a standout year, with the token up roughly 880% in 2025.

But once the noise settles, the picture looks far less dramatic than the price reaction suggests.

The Builders Didn’t Leave Zcash

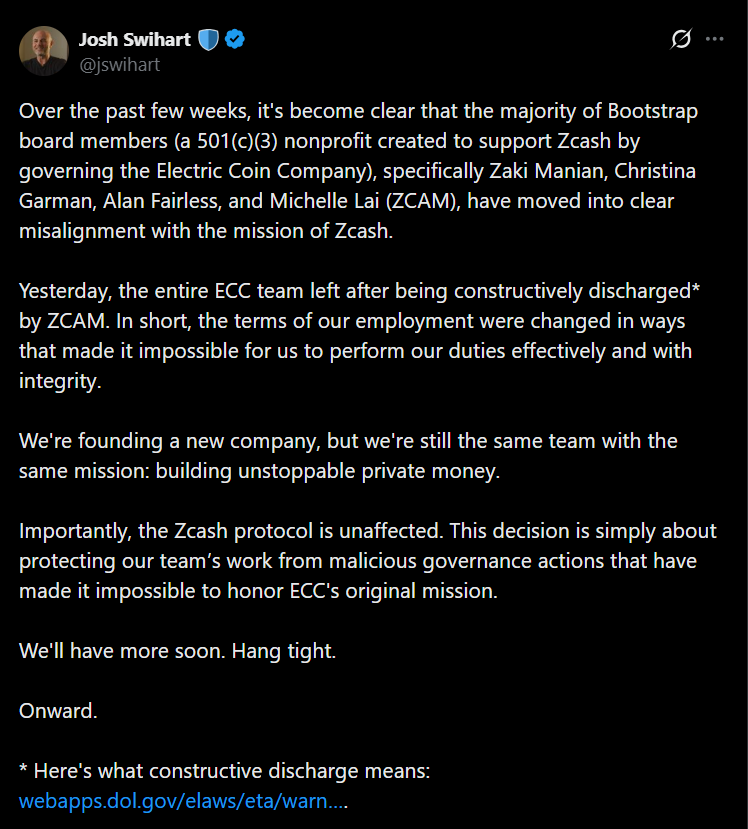

The departing team, formerly part of Electric Coin Company, made it clear they are continuing to work on Zcash, just under a new corporate structure. According to former ECC CEO Josh Swihart, the protocol itself remains untouched. The decision was framed as a response to governance friction, not a rejection of the network’s mission. Bootstrap will still oversee the nonprofit side of Zcash and could even fund the new development entity through open grants.

Mert Mumtaz, CEO of Solana’s API platform Helius, summed it up bluntly. Zcash didn’t lose anything. The same builders, the same codebase, and the same roadmap remain, only now without a board structure the team felt was slowing progress.

Governance Tension Was the Breaking Point

At the heart of the dispute was governance direction, particularly around Zashi, a mobile wallet tied to the protocol. The development team wanted flexibility to explore external investment and faster iteration, while Bootstrap emphasized legal caution and compliance. That mismatch eventually became untenable. Several prominent contributors described the situation as constructive discharge, arguing that bureaucracy was interfering with Zcash’s broader goal of advancing financial privacy.

Veteran cryptographer Sean Bowe echoed that view, suggesting the new structure would allow the team to move faster and stay aligned with Zcash’s original purpose. Other builders emphasized that no one actually quit the project, they simply changed the wrapper around how the work gets done.

Why the Network Is Likely Unchanged

Zcash’s core properties are not dependent on any single company. The protocol is open source, permissionless, and already live. Former ECC CEO Zooko Wilcox reinforced that point, stating that nothing about the network’s security or privacy is affected by internal organizational disputes. For users, shielded transactions still work, upgrades still ship, and day-to-day functionality remains the same.

That distinction matters. Markets often conflate governance drama with technical risk, but the two don’t always overlap.

Monero Benefited From the Optics

While Zcash absorbed the shock, Monero caught a bid. XMR rose as much as 6.5% following the announcement, widening its market cap lead over ZEC. Some market participants framed the move as a contrast between governance-heavy and governance-light privacy models. Whether that narrative sticks remains to be seen, but in the short term, Monero benefited from the uncertainty.

What This Really Means Going Forward

The real risk isn’t technical failure, it’s relational friction. Strained ties between developers and governance bodies can slow coordination over time, even if the code keeps moving. That said, Zcash has weathered internal restructuring before. The builders responsible for shielded transactions and major upgrades are still at the table, just operating under a different name.

For now, this looks less like an existential crisis and more like a messy but survivable transition.