- XRP broke above a bullish reversal pattern but is now testing the neckline for support—a key level to watch.

- Derivatives activity is surging, but short sellers are still betting against the move, which could fuel a short squeeze.

- Fundamentals like transaction volume and NVT ratio are improving, hinting at growing real-world utility behind the rally.

Ripple’s XRP just pulled off something interesting. After weeks of going sideways and testing traders’ patience, the price finally broke out above the neckline of an inverted head-and-shoulders pattern—a classic bullish signal, if you’re into chart stuff. But of course, it didn’t rocket to the moon right after. Instead, it’s pulled back a bit, right back to that neckline zone. And now? We wait to see if bulls show up again.

As of now, XRP is hovering around $2.29, just off a local high of $2.33. Not a huge drop, but enough to make folks wonder if this is a fakeout or just a textbook retest before the real fireworks begin. If buyers defend this level, we might be looking at the start of a much bigger move.

Open Interest Surges, Traders Start Piling In

So why’s everyone watching XRP all of a sudden? Well, there’s been a pretty sharp jump in Open Interest—up 6.82% to $5.02 billion—and the trading volume nearly doubled to over $10.2 billion. Those kinds of numbers usually don’t show up without serious intent behind them.

When both volume and Open Interest rise together, it often means traders aren’t just gambling on noise—they’re placing real bets, with real conviction. In this case, most of the action is pointing up, even if there’s a bit of shakiness on the surface.

Shorts Still Betting Against the Move

Funny thing, though: funding rates have dipped slightly negative. We’re talking -0.004%—not a lot, but enough to raise an eyebrow. That basically means short sellers are paying to hold their positions open, which is kinda gutsy considering the breakout.

Here’s the thing—when funding turns negative during an uptrend, it can lead to a short squeeze. That’s when the shorts get squeezed out, buying back in at higher prices and unintentionally fueling the rally. So yeah, the more they doubt the move, the more explosive it could get.

Fundamentals Don’t Look Too Bad Either

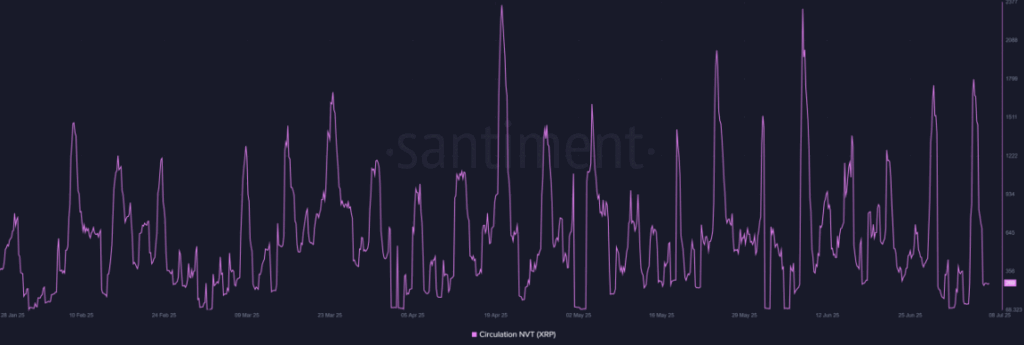

Beyond the charts, XRP’s network activity is showing signs of life. The NVT Ratio—basically a measure of how much value is moving through the network versus its market cap—has dropped. That’s usually good. Lower NVT means people are actually using the token, not just holding and hoping.

More usage equals stronger fundamentals, and when the technicals and fundamentals line up, it usually builds a better case for long-term growth.

So… Is This XRP’s Comeback Story?

Look, the breakout is real. The pullback might even be healthy, especially if buyers step in again around this neckline zone. And all those rising metrics—Open Interest, transaction activity, volume—they’re not just noise. They could be signs that XRP’s finally gearing up for a bigger move.

But let’s not get carried away. Negative funding rates and weak volume on any bounce could mean bulls are getting cold feet. If XRP can’t hold this level, it risks slipping back into consolidation—or worse, retesting support down below. But if momentum kicks in again soon, this might just be the start of something a lot bigger.