- XRP price scenarios change dramatically when viewed through market cap comparisons

- Matching Bitcoin implies XRP near $30, while silver and Apple point closer to $66–$67

- These models don’t predict price, but they help frame realistic discussions around scale

XRP price debates tend to circle back to one big idea. What happens if XRP ever reaches the size of the world’s largest assets. A recent breakdown shared by TheCryptoBasic puts structure around that question, using Bitcoin, silver, and Apple as benchmarks. It’s a numbers-first approach that avoids hype and focuses on scale.

XRP entered 2025 with strong expectations, but the year unfolded unevenly. After rallying to a high near $3.65 in July, price slipped into a steady downtrend that deepened in the final quarter. By year-end, XRP was trading around $1.84, a far cry from mid-year optimism.

XRP’s Market Cap Tells a Clearer Story

Price weakness translated directly into market cap movement. XRP began 2025 with a valuation of roughly $119.4 billion and climbed to a peak of $216.69 billion, marking an all-time high. That momentum didn’t last. Selling pressure pulled valuation back below $200 billion, closing the year near $111.6 billion even as circulating supply continued to rise.

Early 2026 has brought some stability back into the picture. XRP has recovered about $10 billion in market cap, hovering near $121.1 billion. It’s still well below previous highs, but it provides a clean base for exploring how different valuation scenarios could impact price.

What If XRP Matched Bitcoin’s Market Cap

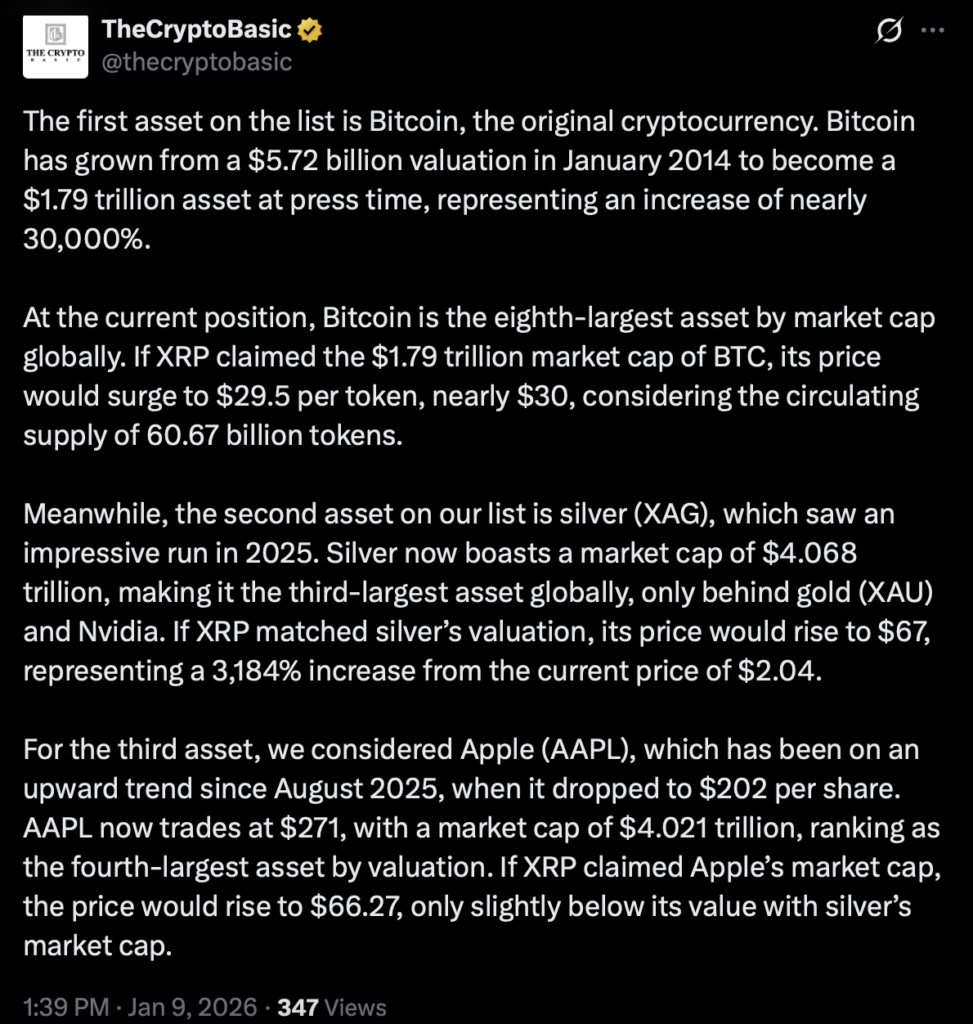

TheCryptoBasic starts with Bitcoin for obvious reasons. Bitcoin remains the most established crypto asset and one of the largest assets globally, with a market cap near $1.79 trillion at the time of analysis. That scale puts it in a different league altogether.

If XRP were to match Bitcoin’s valuation, the price math changes quickly. Using an estimated circulating supply of 60.67 billion tokens, XRP price would land around $29.5. That’s just under $30 per token, and it shows how much price depends on total valuation, not just token supply or short-term momentum.

Silver Pushes the Numbers Much Higher

Silver provides a very different comparison point. After a strong 2025, silver now carries an estimated market cap of about $4.068 trillion. That places it behind only gold and Nvidia among global assets.

Applying that same market cap to XRP produces a much larger figure. If XRP matched silver’s valuation, price would rise to roughly $67 per token. Compared to XRP trading near $2 at the time of analysis, that represents a gain of more than 3,000%. The takeaway here isn’t prediction, it’s perspective. Traditional commodities still sit far above crypto in total valuation.

Apple Lands XRP in a Similar Range

Apple offers a familiar equity benchmark. After dipping earlier in 2025, Apple shares regained strength later in the year and now trade around $271. That gives the company a market cap of approximately $4.021 trillion, just slightly below silver.

If XRP reached Apple’s valuation, TheCryptoBasic estimates price would climb to about $66.27. The similarity between the Apple and silver scenarios reinforces a key point. It’s the market cap that drives the calculation, not the type of asset or brand recognition behind it.

Why These Comparisons Matter for XRP

Market cap comparisons help ground XRP price discussions in math rather than emotion. TheCryptoBasic approach avoids guessing catalysts or timelines and instead focuses on how valuation and circulating supply interact. Bitcoin, silver, and Apple work as reference points because they represent crypto, commodities, and equities at massive scale.

These models don’t predict outcomes, but they do frame the conversation. For XRP to approach even a fraction of these market caps, major shifts in adoption, utility, and capital allocation would need to happen. Looking at scale instead of short-term price swings opens the door to more realistic discussions about where XRP might fit among the world’s largest assets.