- XRP is rallying strongly, but analysts expect a short-term dip rather than a breakout above $2.50.

- Market optimism, ETF speculation, and potential Fed rate cuts may shape XRP’s December trajectory.

- A bigger rally is possible if macro conditions shift and investor sentiment stays elevated.

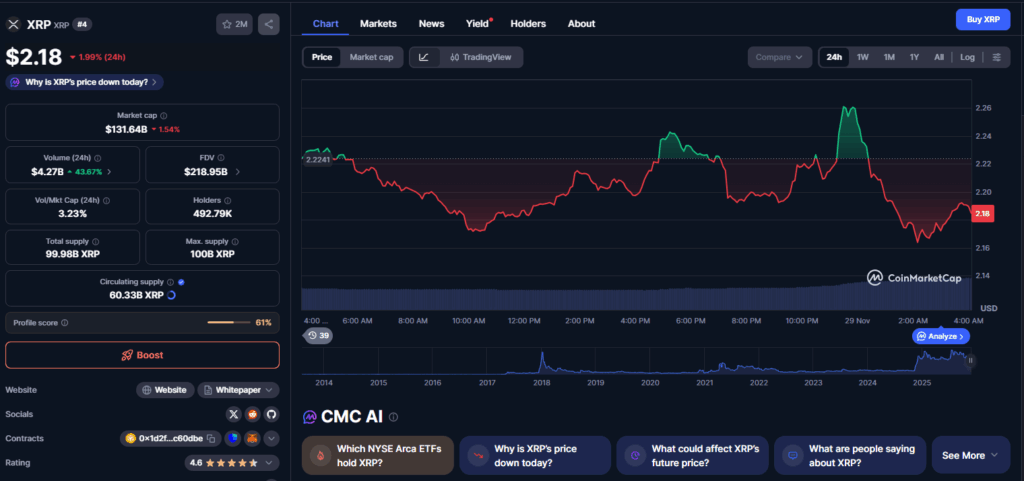

XRP has been climbing pretty aggressively lately, pulling in a 1.4% gain over the last 24 hours, 16.5% over the past week, and a pretty solid 52.4% rise since late November 2024. Even with the jump, the token is still slightly red in the 14-day and monthly charts, which adds a bit of tension to its short-term outlook. With the market showing signs of recovery, the big question right now is whether XRP can actually push toward the $2.50 level before the weekend wraps up.

Market Rebound Fuels XRP’s Upside Momentum

XRP’s recent rally didn’t happen in isolation — Bitcoin’s move back above $91,000 seems to have sparked a more confident mood across the market. Some of this momentum is tied to improving macro expectations, especially the growing chance of another interest rate cut in December. Investors may have also taken advantage of the recent dip, pushing capital back into large-cap assets like XRP. If this trend keeps rolling through the weekend, XRP does have a shot at brushing up against that $2.50 mark, though Monday could bring some choppy action once post-holiday trading kicks in again.

Could XRP Hit $2.50 Before Monday?

There’s definitely a path for XRP to test $2.50, but it’s not exactly guaranteed. Positive sentiment around potential ETF launches has kept the token in the conversation, and strong inflows could give it an extra push. Still, holidays often cause weird, uneven trading patterns, and a sharp influx of volatility on Monday might stall the climb or force XRP to cool off near current levels. In other words, the door is open, but the timing is delicate.

Analyst Outlook Suggests a Short-Term Pullback

CoinCodex’s latest forecast points to a possible pullback instead of a breakout. Their models suggest XRP could slide toward $2.21 on Sunday, Nov. 30, which would be about a 1% dip from where it’s trading now. They don’t see a move above $2.50 until at least mid-December, meaning the weekend rally may not carry enough strength just yet. Even so, December could become the turning point for XRP if the Federal Reserve issues another 25-basis-point rate cut — a move that might set the stage for XRP to retest its all-time high of $3.65.