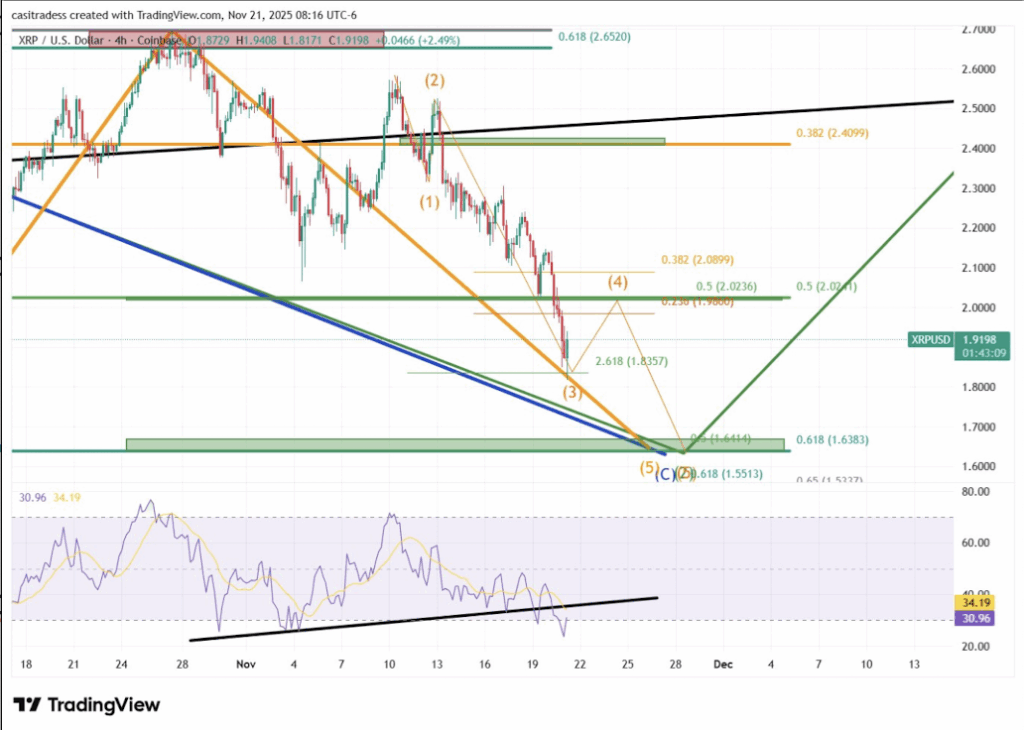

- XRP broke below the 0.5 retracement and is now targeting $1.65 as the final bottom.

- The bounce to $2–$2.09 is likely a subwave, not a reversal.

- BTC dipping to $80k would align with XRP hitting $1.65, ending the correction for both.

XRP has been grinding through a rough and very decisive stretch of market structure. The drop hasn’t been small or slow either — the pace of this decline has created a setup many traders see as a final test before the next major direction becomes obvious.

Analyst CasiTrades (@CasiTrades) shared new charts from Coinbase and Binance, laying out her short-term roadmap with a pretty sharp level-by-level breakdown. She believes XRP is extremely close to finishing this corrective phase, but not quite done. The structure still needs one more flush lower, in her view, before a real bottom forms.

Break of the 0.5 retracement triggered the deeper slide

Casi notes that XRP’s first key breakdown happened when the price fell below the 0.5 Fibonacci retracement on Coinbase. That break opened the door for XRP to move deeper into extended Wave 3 support near $1.84 — and price hit that level almost perfectly.

On Binance, XRP tagged its own macro 0.5 at $1.88, almost identical. She highlighted the cross-exchange alignment because it confirms that the higher-timeframe structure is intact.

XRP bounced after touching support, but Casi doesn’t see that as anything more than a subwave 4 reaction — basically a temporary lift before the next drop. She expects XRP to test $2.00–$2.09 resistance, get rejected, and fall into its final corrective leg.

Her target for the true bottom?

The 0.618 macro support near $1.65.

She calls this level “the bottom” for both Coinbase and Binance charts. Once hit, she expects momentum to flip upward.

Bitcoin’s move will dictate timing

Casi believes XRP’s final leg ties directly to Bitcoin’s next move. BTC came close to its own macro 0.382 retracement, but hasn’t touched it yet. She expects BTC to dip into that level — around $80,000 — at the same moment XRP slides into $1.65.

In her view, this would mark a synchronized end to the corrections in both assets.

After that, she expects Bitcoin to kick off Wave 5 toward new highs. When BTC resumes its trend, XRP would begin its Macro Wave 3, which historically is one of the strongest phases in an Elliott Wave cycle. The two will move together, but XRP may show different strength depending on where it sits in its own chart structure.

The bottom line

According to CasiTrades, XRP is close — very close — to completing its correction. But it still needs one more move down into the $1.65 zone. Bitcoin dipping into its final retracement should trigger the shift.

Once that happens, both charts transition from “correction mode” back into “trend continuation.”