- XRP gained 2.81% to $3.29 on heavy institutional flows, peaking at $3.33 before late profit-taking.

- Ripple’s SEC settlement has improved corporate treasury flexibility, though new wallet growth remains muted.

- Traders are watching for a breakout over $3.33 or a breakdown below $3.20 to set the next move.

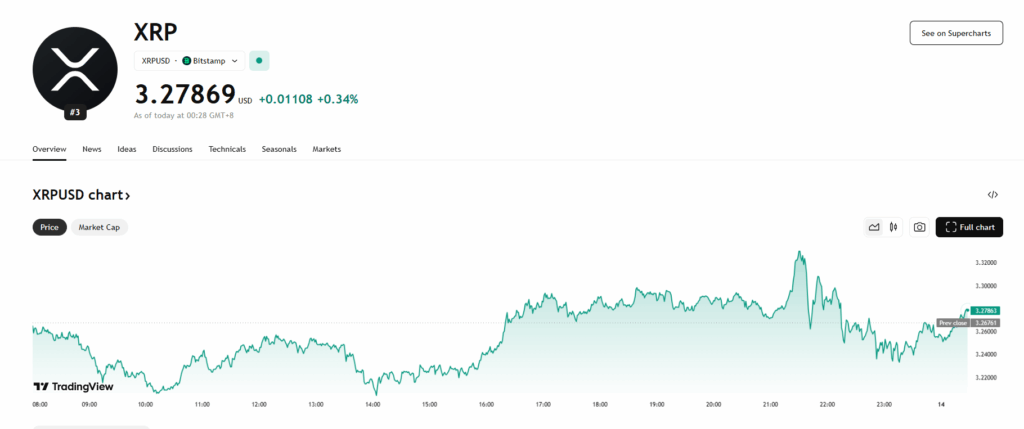

XRP climbed 2.81% in the past 24 hours, closing at $3.29 after touching a session high of $3.33. The move came on heavy institutional flows, with peak volume hitting 193.9 million — more than twice the daily average — signaling strong interest from large players.

The rally follows Ripple’s settlement with the SEC, which has lifted a multi-year compliance overhang and given corporate treasuries greater flexibility to hold XRP. Despite this positive shift, on-chain data shows wallet growth has yet to pick up meaningfully, suggesting the current strength is still being driven by existing holders rather than new entrants.

Technical Picture Shows Clear Battle Lines

XRP traded in a $0.13 range between $3.20 and $3.33 — a 3.89% volatility window — with $3.20 acting as firm support and $3.33 proving to be a ceiling. In the late session, price climbed from $3.27 to $3.32 before slipping to $3.26 as profit-taking kicked in, only to recover slightly by the close.

Key support at $3.20 has been reinforced by high-volume buying, while resistance around $3.32–$3.33 remains the primary barrier to further upside. The interplay between these zones reflects tactical moves by institutional traders — accumulating on dips and trimming positions into strength.

Market Sentiment and Next Levels

Market mood remains constructive while XRP stays above $3.20. Traders are now watching for a decisive breakout over $3.33, which could open the path toward $3.40. Conversely, any breach of $3.20 support might invite a fresh round of selling pressure.

Institutional positioning after the SEC resolution continues to underpin the market, but fresh wallet growth will likely be the trigger for the next major leg up. Until then, the $3.20–$3.33 range will remain the key battleground.