- XRP surged sharply on Jan. 6 before pulling back near $2.40 resistance.

- Despite the dip, XRP is up strongly across weekly and biweekly timeframes.

- ETF inflows and improved market structure keep the medium-term outlook constructive.

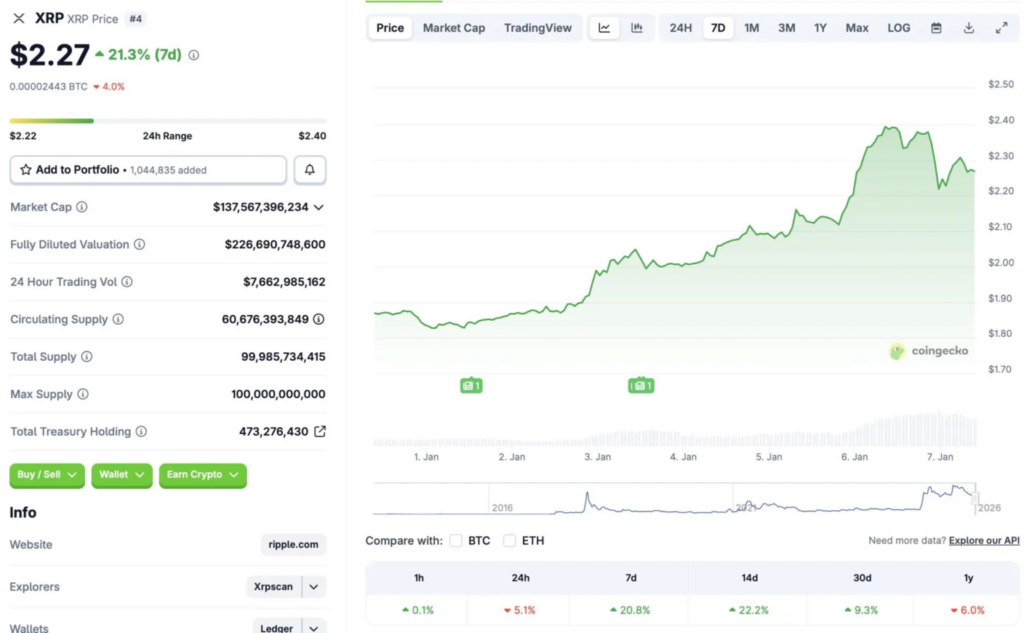

Ripple’s XRP delivered a powerful breakout on January 6, 2026, before cooling off with a sharp correction shortly after. According to CoinGecko, the token is down 5.1% over the last 24 hours and about 6% since the start of the year. Still, context matters. That single-day surge pushed XRP up more than 20% on the weekly chart, over 22% across the past 14 days, and roughly 9% on the monthly timeframe. After months of struggling below $2, XRP is now consolidating near resistance around $2.40, a level that would have felt out of reach not long ago.

Momentum Has Shifted, Even If Price Is Pausing

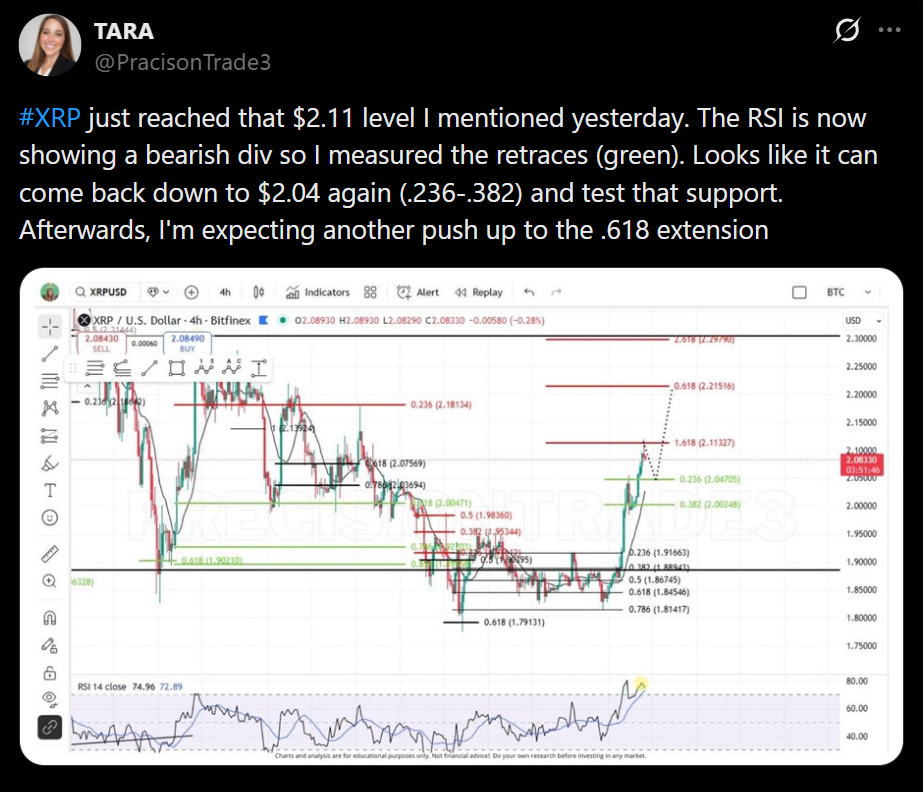

XRP’s broader setup looks very different compared to late 2025. After spending months capped near $1.90, the asset has finally reclaimed higher ground, and pullbacks at these levels look more like digestion than rejection. Short-term profit-taking following such a fast move is normal, especially after a clean breakout. What matters more is that XRP is no longer fighting to stay above $2 — it’s now testing higher zones as potential support.

ETFs and Market Structure Are Doing the Heavy Lifting

The rally didn’t happen in isolation. XRP’s move came alongside a broader crypto market resurgence, with Bitcoin pushing toward $93,000 before easing slightly. More importantly, ETF dynamics are back in focus. ETFs were a major driver of upside in 2025 for Bitcoin and Ethereum, and XRP’s growing presence in ETF products could produce similar effects in 2026. Increased inflows don’t always translate into straight-line price action, but they tend to improve the underlying structure over time.

Why the Pullback Doesn’t Invalidate the Bullish Case

The recent dip may reflect short-term profit-taking rather than fading conviction. Macroeconomic uncertainty is still pushing some capital toward traditional safe havens like gold and silver, but that doesn’t negate XRP’s improving setup. With the SEC lawsuit resolved, spot ETFs live, and momentum returning to the broader market, XRP now looks positioned for higher attempts rather than another prolonged range. A period of consolidation below $2.40 could be the base needed for the next leg higher, not a sign the move is over.