- XRP is holding above $2.20 after a burst to $2.286, supported by a bullish trendline and strong upward momentum.

- The first U.S. spot XRP ETF saw nearly $25M in volume in its first 90 minutes, with XRP now trading around $3.11—15% below its July ATH.

- Multiple major firms, including Bitwise and WisdomTree, have pending XRP ETF applications as institutional interest accelerates.

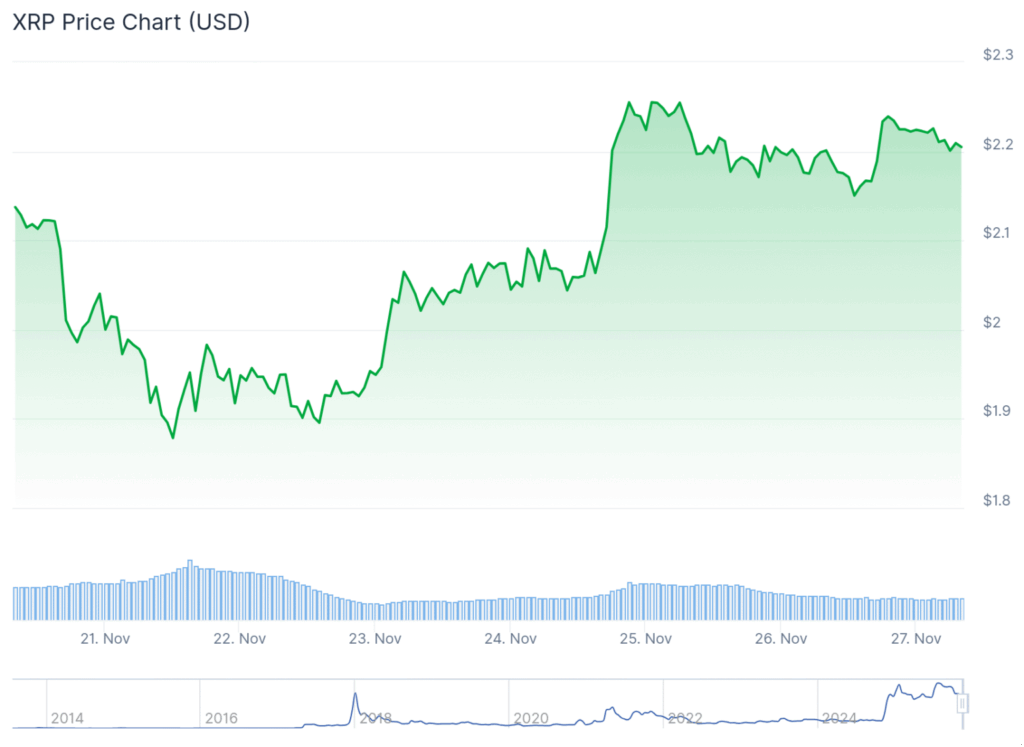

XRP kicked off the week with a burst of momentum, climbing above the $2.22 zone and tagging a high near $2.286 before slipping into a slower, more range-bound stretch. The move actually outpaced both Bitcoin and Ethereum early on, helped by a clean breakout over the $2.10–$2.12 region that had capped price for days. XRP now trades above $2.20 and the 100-hour SMA, holding a bullish trendline that sits around $2.18—basically acting as the first real safety cushion during pullbacks. Even after dipping below the 23.6% Fib level from its $1.817 swing low, price still clings to key support areas, which shows bulls haven’t stepped aside just yet.

ETF Launch Sparks Institutional Interest

Fueling the excitement, the first-ever spot XRP ETF in the U.S. made a loud entrance, pulling in nearly $25 million in trading volume within its first 90 minutes. The Rex-Osprey XRP ETF massively outperformed expectations—by about 5x compared to XRP futures ETF debuts—which took even Bloomberg analysts by surprise. XRP itself now trades around $3.11, sitting roughly 15% below its July all-time high at $3.65, leaving room for upside if demand keeps building. The structure of the ETF is a bit different, using a Cayman subsidiary under the ’40 Act rather than a traditional spot ETF setup, but clearly that didn’t scare off early buyers.

Resistance Levels and Short-Term Price Targets

If XRP starts climbing again, the next pressure zone sits around $2.2650, followed by a heavier block near $2.28. A clear breakout above that could open the door toward $2.35, and if buyers really lean in, levels like $2.45 or even $2.50 aren’t out of the question. On the flip side, losing the $2.18 trendline would weaken the structure a bit, but for now the chart still favors upward attempts—especially as ETF news continues pulling fresh attention into the market. Bulls are eyeing $2.55 as the next major hurdle if momentum returns.

More XRP ETFs Are Lined Up Behind the First

Interest isn’t stopping with Rex-Osprey. Firms like Bitwise, Canary Capital, and WisdomTree all have pending spot XRP ETF applications with the SEC, each following the more traditional Securities Act route.

Decision windows fall between October 18–25, and analysts think the SEC’s newly approved listing standards for commodity-style trusts could smooth the process. Add in Ripple’s legal clarity—where courts confirmed programmatic sales are not securities—and institutions suddenly seem more comfortable dipping into XRP exposure. With CME preparing to roll out XRP options next month, analysts say institutional confidence is hovering around 60% for a move toward $4.