- David Schwartz confirmed XRP cannot be clawed back because it has no issuer.

- The Clawback feature only applies to issued tokens like stablecoins or wrapped assets.

- XRP’s issuer-less design ensures censorship resistance, but eliminates reversal options.

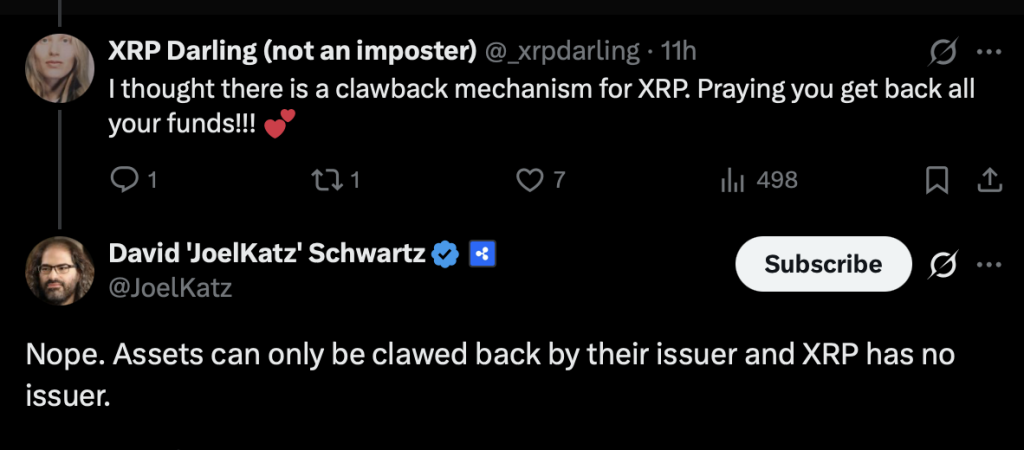

Ripple’s CTO Emeritus David Schwartz had to step in this week to clear something up — and he didn’t sugarcoat it.

After a security breach hit members of the GTF and Apex communities, some users began asking whether stolen XRP could be recovered using the XRP Ledger’s “Clawback” feature. Schwartz shut that down quickly. XRP, he reminded everyone, has no issuer. And without an issuer, there’s simply no mechanism to reverse or forcibly retrieve native XRP transactions.

The Security Breach That Sparked the Debate

The issue started when the X account for the Global Trade Finance (GTF) aggregator reported that its VC wallet had been compromised. According to the post, the attack involved a “fake NFT offer” and what was described as an “XRP Voucher Scam.” The breach reportedly impacted the project’s second-largest liquidity pool holder, which only made the situation more alarming.

In a moment of frustration, the account asked whether someone could escalate the issue directly to Schwartz, known online as @JoelKatz. That’s when the conversation shifted. A community member suggested that perhaps the XRP Ledger’s controversial Clawback amendment could offer a solution, expressing hope that the stolen funds might somehow be retrieved.

It sounded reasonable on the surface. But technically, it wasn’t.

Why the Clawback Feature Doesn’t Apply to XRP

Schwartz responded clearly: “Nope. Assets can only be clawed back by their issuer, and XRP has no issuer.”

That distinction is critical. Most tokens on the XRP Ledger — including stablecoins like RLUSD, wrapped Bitcoin representations, or even meme tokens — are issued assets. They are created and distributed by a specific wallet address. In order to hold them, users must establish what’s called a trustline with that issuer.

If the issuer enables the Clawback setting (introduced under amendment XLS-39), they retain the technical ability to retrieve those issued tokens from user wallets. This feature is primarily designed for regulated assets, like stablecoins, where compliance may require freezing or reversing funds in cases of fraud or legal orders.

But XRP doesn’t work like that. It was not issued by an account. There is no issuer wallet holding a master key. There is no centralized entity that can send a clawback command.

XRP’s Structure Is What Makes It Different

XRP is the only asset on the XRP Ledger that isn’t tied to an issuing account. That structural design is intentional. It means XRP transactions, once confirmed, cannot be reversed by any central authority.

Some see that as a strength — censorship resistance, predictability, final settlement. Others, especially in situations like this, see the downside. If funds are stolen, there’s no backdoor. No administrative override. No “undo” button.

And that’s the tradeoff.

The recent incident serves as a reminder of how crypto infrastructure actually works beneath the surface. Features like Clawback exist, yes, but only within specific parameters. They apply to issued assets, not to XRP itself. Schwartz’s clarification wasn’t controversial. It was technical.

Still, it highlights something the industry continues to wrestle with: decentralization offers protection from control, but it also removes safety nets. Once XRP moves, it moves.