- XRP hit a high of $2.97 and is trending just below the $3 mark, boosted by Bitcoin’s surge to over $122K and a rise in bullish trading activity.

- For XRP to reach $5, Bitcoin must push higher and traders need to establish strong strike calls around the $4.50–$5 zone.

- Profit-taking could trigger volatility, so investors with low risk tolerance may want to hold off until the market stabilizes.

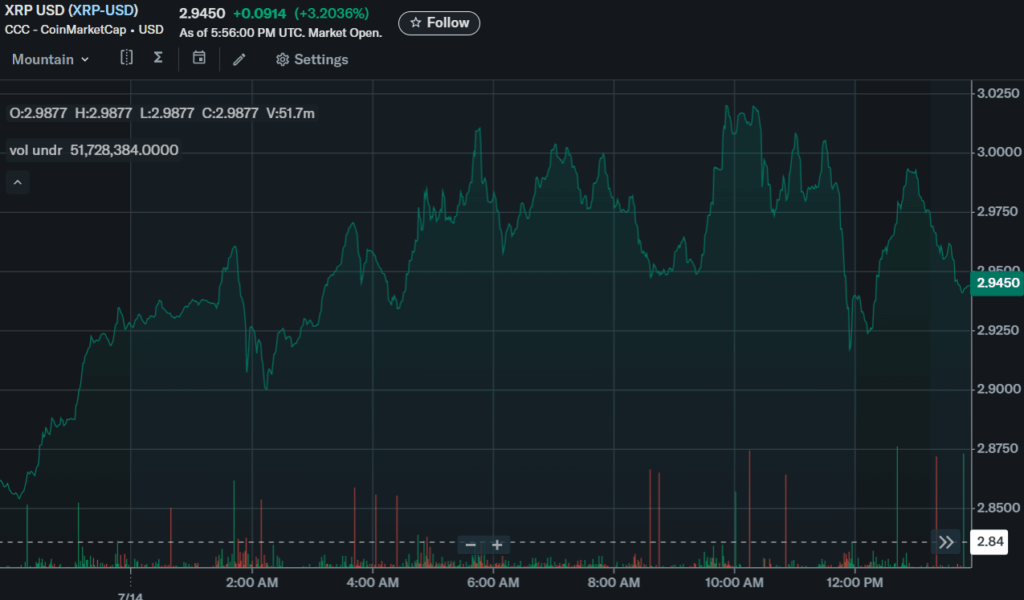

Ripple’s XRP came close to breaking the $3 barrier on Monday, reaching a daily high of $2.97 before settling around $2.94. The altcoin has surged nearly 5% in the past 24 hours, with a trading volume explosion to $8.2 billion—up from just $2.4 billion a month ago. This sharp increase signals a rising wave of bullish sentiment as traders continue to pile in.

Bitcoin’s Rally Fuels XRP Optimism

The recent breakout from Bitcoin, which hit a record high of $122,838, has lifted the broader crypto market. XRP’s surge appears to be riding this bullish wave, supported by investor interest and call strike positions centered around the $3 level. The excitement in the derivatives market suggests that traders anticipated the current pump and are betting on more upside.

Can XRP Break Through to $5?

For XRP to cross the $5 mark, Bitcoin’s bullish momentum would need to intensify, dragging the entire market higher. Analysts say further strike positions near $4.50–$5 could set the stage for XRP’s next leg up. Still, it’s a fragile balance. If Bitcoin cools off or if traders begin to lock in profits near $3, XRP might retreat, facing a potential sell-off that could cause short-term volatility.

Risk-Reward Balance: Who Should Buy XRP Now?

As it stands, XRP is in a high-stakes zone. Those with a higher risk appetite might consider an entry position if they believe the broader rally will continue. On the other hand, cautious investors may want to sit this one out until volatility eases. With XRP teetering just below a psychological milestone, the next few days will likely determine its near-term direction.