- XRP ETFs have accumulated $1.71 billion in assets under management.

- Price has lagged despite inflows, hovering near the $2 level.

- A delayed ETF-driven rally remains possible, though timing is unclear.

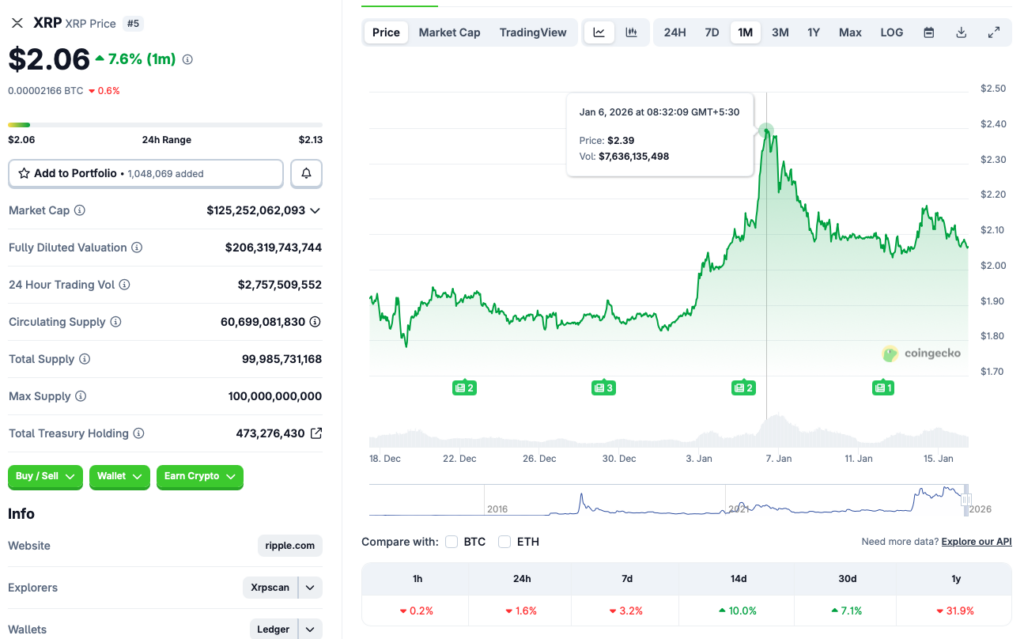

XRP-linked ETFs have quietly built up $1.71 billion in assets under management, according to data shared by XRP-Insights. On paper, that level of accumulation looks bullish. In price terms, though, XRP hasn’t followed through the way many investors expected. After briefly touching $2.39 on January 6, the token has slipped back toward the $2 range, struggling to hold upside momentum even as institutional exposure continues to grow.

Price Action Tells a Mixed Story

Recent performance highlights that tension. According to CoinGecko, XRP is down about 1.6% over the last 24 hours and 3.2% over the past week. Zooming out further, the token remains nearly 32% below its January 2025 levels. At the same time, shorter-term charts paint a slightly brighter picture, with XRP up roughly 10% over the past two weeks and 7.1% over the last month. The result is a market caught between accumulation and hesitation.

Can ETF Demand Spark a Breakout?

ETF inflows were a defining force in the 2025 crypto cycle. Both Bitcoin and Ethereum pushed to new highs as ETF demand ramped up, reshaping how institutions accessed digital assets. XRP could follow a similar path, but timing matters. The asset last traded above $3 in July 2025, when it reached an all-time high near $3.65, before entering a prolonged downtrend.

History suggests patience may be required. Ethereum’s ETF launch in 2024 didn’t immediately translate into higher prices, with meaningful upside only arriving roughly a year later. XRP’s ETFs may be following a similar pattern, where structural demand builds first and price responds later.

Why Expectations Remain Elevated

Despite near-term weakness, optimism hasn’t vanished. CNBC recently labeled XRP the “hottest crypto trade of 2026,” and several analysts expect ETF inflows to accelerate over the coming months. That backdrop helps explain why many investors remain focused on the $3 level, even as broader market sentiment stays cautious.

For now, macro headwinds and a generally risk-off environment are weighing on momentum. If economic conditions stabilize and capital flows return to growth assets, XRP’s ETF-driven foundation could become more visible in price action. Whether that happens in January remains uncertain, but the buildup suggests the story isn’t finished yet.