- Analysts see XRP possibly reaching $15 — a 360% jump — based on a recurring three-year breakout pattern.

- Past cycles in 2022, 2023, and 2024 show similar setups that led to major price rallies.

- Market conditions and institutional interest could help fuel the next leg higher, though timing depends on broader crypto sentiment.

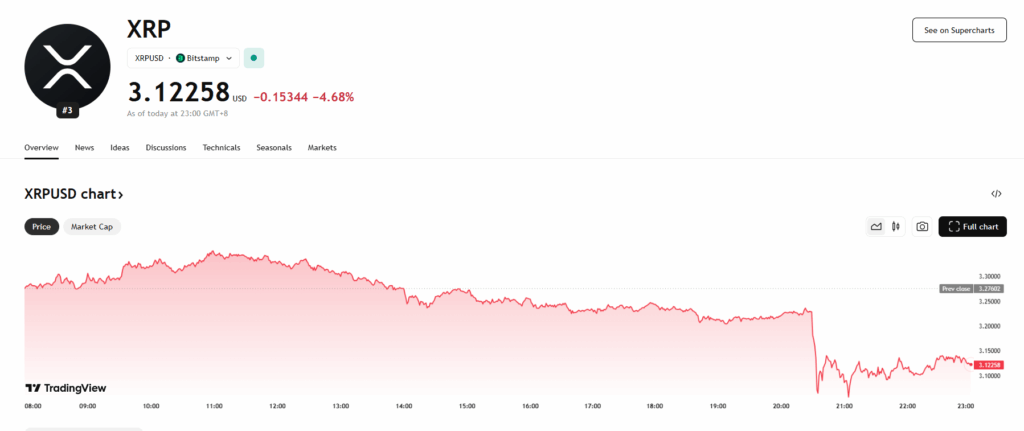

XRP bull run chatter is hitting a fever pitch right now, and the latest technical setups are painting a picture that could be the most explosive rally this token has seen yet. Analysts are tossing around projections of XRP climbing to roughly $15 — a staggering 360% jump from its current $3.28. That kind of move isn’t just pulled from thin air either; it’s based on a repeating three-year pattern that’s been oddly reliable since 2022.

A Pattern That Just Won’t Quit

Crypto analyst Steph Is Crypto has been tracking a curious setup where XRP spends months consolidating under descending resistance before blasting upward in sharp breakouts. This behavior first showed itself in 2022, then again in July 2023 right after that landmark court ruling declared XRP was not a security.

The 2024 breakout was the biggest so far in this cycle — XRP shot from $0.55 to $3.39. Now, after topping out at $3.65 in July, the token has once again cracked through another downtrend line. For chart-watchers, this is déjà vu in the best way possible.

“The Hardest Bull Run Ever”

Steph isn’t shy about their conviction here. They’ve called this stage “the hardest bull run ever” and told investors bluntly, “the best part of the cycle is about to happen.” With price structures mirroring previous explosive phases, there’s a growing sense that XRP could be on the cusp of something big.

Even with the broader market stumbling earlier in August, XRP has shown remarkable resilience. That’s adding fuel to the bullish outlook, especially for those betting on history repeating itself.

Conditions Point to More Upside

Right now, XRP’s market backdrop is looking unusually supportive. Institutional interest remains strong, regulatory clarity has improved since the SEC settlement, and trading volumes suggest big players aren’t backing off. After the July peak, the price didn’t nosedive — instead, it’s been grinding sideways, which can be a sign of hidden strength.

If the pattern holds, we might see the next surge kick off before the quarter’s over. Timing will hinge on broader crypto sentiment and any curveballs from regulators, but the setup is there. For those who’ve been waiting, the charts are hinting that the real move might be right around the corner.